Preparing your brand for a buyout or acquisition isn’t just a nice-to-have—it’s essential for maximizing valuation, attracting the right buyers, and ensuring a smooth post-acquisition integration. Companies with strong, clear, and consistent branding are more likely to stand out during due diligence, command higher valuations, and retain customers and employees during the transition. By taking strategic steps to strengthen your brand, you set your company up for both financial and operational success.

Understand the Role of Brand in Acquisitions

Buyers don’t just acquire products, services, or market share—they acquire your brand. A strong brand signals credibility, reliability, and market differentiation, which are key factors in valuation. Tangible assets like logos, websites, and collateral matter, but intangible assets—like reputation, thought leadership, and customer trust—often carry even more weight.

Key Takeaways:

- A well-positioned brand can increase perceived company value.

- Strong branding reduces risk perception for buyers.

- Intangible assets are often as critical as tangible ones in valuation.

Audit Your Current Brand Positioning

A comprehensive brand audit is the first step in preparing for a sale. Evaluate your visual identity, messaging, digital presence, and market perception. Use analytics, surveys, and competitor benchmarking to uncover strengths and gaps. The goal is to ensure your brand communicates value clearly and resonates with potential buyers.

Action Steps:

- Review logos, color schemes, and visual design for modern appeal.

- Analyze messaging consistency across website, social media, and collateral.

- Benchmark against competitors to identify opportunities for differentiation.

Strengthen Brand Messaging and Identity

Clear, consistent messaging and a modern visual identity are crucial for attracting suitors. Define your value proposition and differentiate your company from competitors. Ensure messaging is consistent across websites, social media, presentations, and sales collateral. A strong, cohesive brand identity helps potential buyers quickly understand your company’s strengths, vision, and market potential.

Tips for Messaging Success:

- Highlight what makes your company unique.

- Use language that resonates with target buyers.

- Maintain consistency across all brand touchpoints.

Enhance Digital Presence and Visibility

Digital credibility is a major factor in acquisition decisions. Optimize your website and social channels to reflect professionalism and thought leadership. Highlight customer success stories, industry recognition, and relevant content that demonstrates market authority. Maintaining an active, SEO-optimized digital presence increases your brand’s visibility and perceived value to prospective buyers.

Digital Strategies:

- Update and optimize website content for clarity and SEO.

- Promote thought leadership through blogs, articles, and social media.

- Showcase client success stories and industry recognition.

Prepare Brand for Integration Post-Acquisition

Post-acquisition integration is smoother when your brand aligns with the acquiring company’s culture and strategy. Maintain clear messaging and visual consistency to retain customer and employee trust. Provide guidance for stakeholders to understand brand evolution, ensuring a seamless transition while protecting the equity you’ve built.

Integration Considerations:

- Develop unified messaging for internal and external audiences.

- Align visual identity with the acquiring company where appropriate.

- Communicate changes clearly to employees and customers.

Case Examples & Best Practices

BlueHalo (formerly AEgis Technologies)

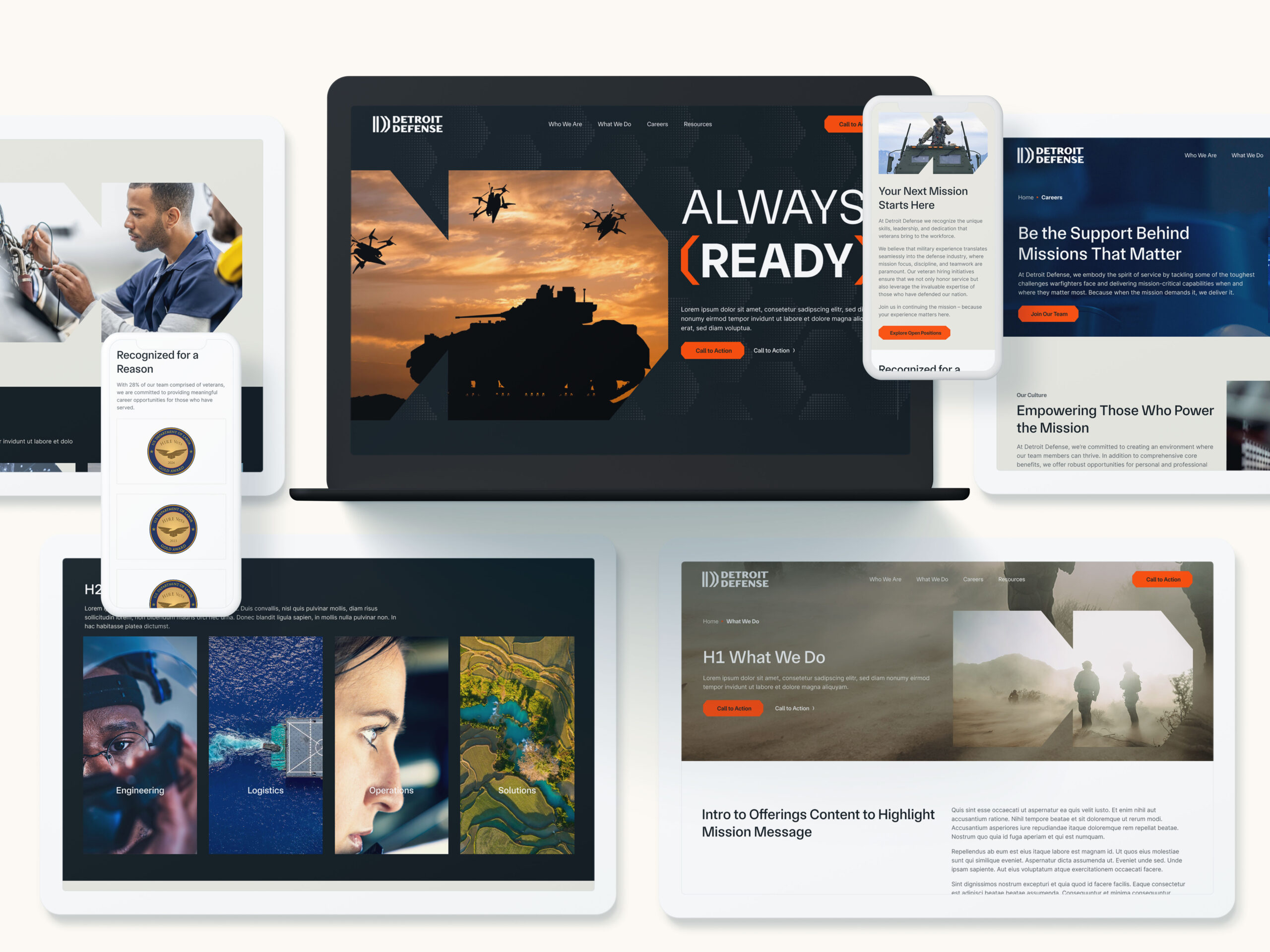

Bluetext partnered with AEgis Technologies to rebrand the company as BlueHalo, positioning it as a leader in defense and aerospace. The rebrand included a refreshed visual identity, modern messaging, and a polished digital presence that clearly communicated market differentiation. This strategic transformation played a critical role in attracting suitors and ultimately supported BlueHalo’s acquisition by AeroVironment for $4.1 billion.

Quest Software

For Quest Software, Bluetext helped refine branding to emphasize product strengths, customer value, and market leadership. Through cohesive messaging, an updated visual identity, and enhanced digital assets, Quest presented itself as a compelling acquisition target. In November 2021, private‑equity firm Clearlake Capital acquired Quest from Francisco Partners in a deal reportedly worth $5.4 billion. The strengthened brand helped facilitate a successful sale and set the stage for smoother integration after acquisition.

Next Steps for Your Brand

Preparing your brand for a buyout or acquisition is about maximizing value, attracting the right buyers, and protecting your company’s legacy during transition. Conduct audits, refine messaging, optimize digital presence, and plan for post-acquisition alignment to strengthen your market position. Contact Bluetext to ensure your brand is fully prepared for a successful buyout or acquisition.

In today’s attention economy, brands don’t have minutes—or even seconds—to make a first impression. Studies show that people form an opinion about a brand in as little as seven seconds. In the fast scroll of digital content, those moments are everything. Whether it’s a homepage hero animation, a LinkedIn video, or a product teaser, your audience is deciding almost instantly if your story is worth their time.

For B2B marketers, that might sound like a challenge built for consumer brands. But the truth is, short-form storytelling isn’t just for B2C anymore. It’s a powerful tool for any brand trying to connect quickly, authentically, and memorably.

Why Seven Seconds Defines Modern Storytelling

The “seven-second rule” has its roots in psychology: humans are wired to make snap judgments based on limited information. Online, that instinct translates into how quickly we process design, tone, and motion. Research from Microsoft found that average attention spans have dropped to around eight seconds—and that number continues to shrink as content becomes denser and more competitive.

For B2B audiences, the challenge is no different. Executives, engineers, and decision-makers scroll through the same feeds as everyone else. The first few seconds of your message determine whether your brand earns their curiosity—or disappears into the noise.

The Psychology of First Impressions

In marketing, first impressions are rarely rational. They’re emotional. Psychologists refer to this phenomenon as “thin-slicing”—our ability to infer meaning or intent from very brief experiences. That means your audience is forming opinions based on visual language, color, typography, motion, and tone before they even process your words.

Emotion plays a defining role. A confident, clear intro evokes trust. A cluttered or ambiguous message signals confusion. Effective storytelling doesn’t overwhelm—it distills your essence into something instantly relatable. That’s why brands like Salesforce, HubSpot, and AWS build consistency across their visual and verbal identities—so even a fleeting encounter leaves a lasting imprint.

The Anatomy of a 7-Second Story

A great seven-second story has three simple components:

- The Hook (1–2 seconds):

Capture attention immediately. This could be a bold visual, a powerful statement, or an emotional cue. Think of the opening frame as the first handshake. - The Message (3–4 seconds):

Clearly communicate what your brand does—or more importantly, what it stands for. Focus on outcomes, not features. For example, “Transforming secure communication for government agencies” tells a clearer story than “Leading provider of encrypted software solutions.” - The Emotion (final 1–2 seconds):

Leave your audience with a feeling—confidence, curiosity, inspiration. This emotional residue is what drives recall and future engagement.

The best intros work like visual haikus: compact, evocative, and unmistakably yours.

Why Short-Form Isn’t Just for B2C

Short-form content once belonged to consumer marketing—fashion, entertainment, lifestyle. But as digital behaviors converge, B2B brands have realized that storytelling fundamentals are universal. A CIO watching a 15-second explainer or a 7-second brand teaser is still responding to the same cues as a consumer: authenticity, clarity, and emotion.

LinkedIn has become a showcase for this shift. Brands like Adobe, Deloitte, and Accenture use short-form storytelling to communicate complex ideas in digestible bursts. Even government-focused organizations are using microvideo and motion design to explain big ideas—like modernization, cybersecurity, or innovation—without losing their audience halfway through a paragraph.

Short-form storytelling doesn’t replace thought leadership or long-form content. It amplifies it. Those seven seconds open the door to deeper engagement down the funnel.

Crafting Impactful Short-Form Brand Stories

So how do you actually tell a brand story in seven seconds or less? Start by zooming out before you zoom in.

- Lead with your core narrative, not your product. What do you stand for? What problem do you exist to solve? Those answers drive emotion far better than a feature list.

- Translate your brand pillars into micro-moments. Identify visual or verbal cues that instantly signal who you are—whether it’s a tagline, tone, or recurring motif.

- Design for silence. Many short-form videos autoplay without sound, so ensure your story works visually. Captions, motion, and typography should all do the heavy lifting.

- Script for attention. Every frame should earn its place. Use visual pacing and rhythm to maintain energy without overwhelming.

- End with action. Even a subtle CTA—like “Learn how” or “Discover what’s next”—can turn a passing glance into measurable engagement.

At Bluetext, we often say: great stories don’t start big, they start clearly. When you can express your value in seven seconds, everything after becomes easier.

Measuring the Impact of Fast Storytelling

In short-form storytelling, every second counts—and so does every data point. The most telling metrics aren’t just views, but view-through rates, retention curves, and engagement quality.

If your audience consistently drops off after three seconds, the hook may need refinement. If your completion rates are high but conversions lag, your CTA might be misaligned.

Use A/B testing to experiment with visuals, copy, and structure. Even small adjustments—a color shift, a headline tweak, a new voiceover—can yield dramatic differences in audience retention. Over time, data reveals not just what works, but why it works.

From Seven Seconds to Lasting Impressions

Seven seconds might define the beginning of your brand story—but the goal is to make that story last. Every short-form asset should connect seamlessly to the larger narrative: your website, your campaigns, your brand voice. When those micro-moments align, they build recognition, trust, and ultimately conversion.

Short-form storytelling isn’t a trend—it’s the new language of brand communication. For organizations that embrace it, seven seconds isn’t a limit. It’s an opportunity.

Ready to Capture Attention in Seconds?

At Bluetext, we help brands turn fleeting moments into powerful connections. From short-form video and motion design to integrated storytelling campaigns, we craft strategies that resonate instantly—and endure long after the scroll.

Contact Bluetext to see how your brand can make every second count.

Generative AI is transforming content marketing. From blog posts to email campaigns, AI tools can help marketers create copy faster and more efficiently. But there’s a catch: the quality of your AI output depends almost entirely on the prompts you provide. A vague or poorly structured prompt can lead to inconsistent, off-brand content that wastes time instead of saving it.

This guide will teach you the fundamentals of prompt engineering, helping you craft effective prompts that consistently produce on-brand content, whether you’re writing social media posts, website copy, or email campaigns.

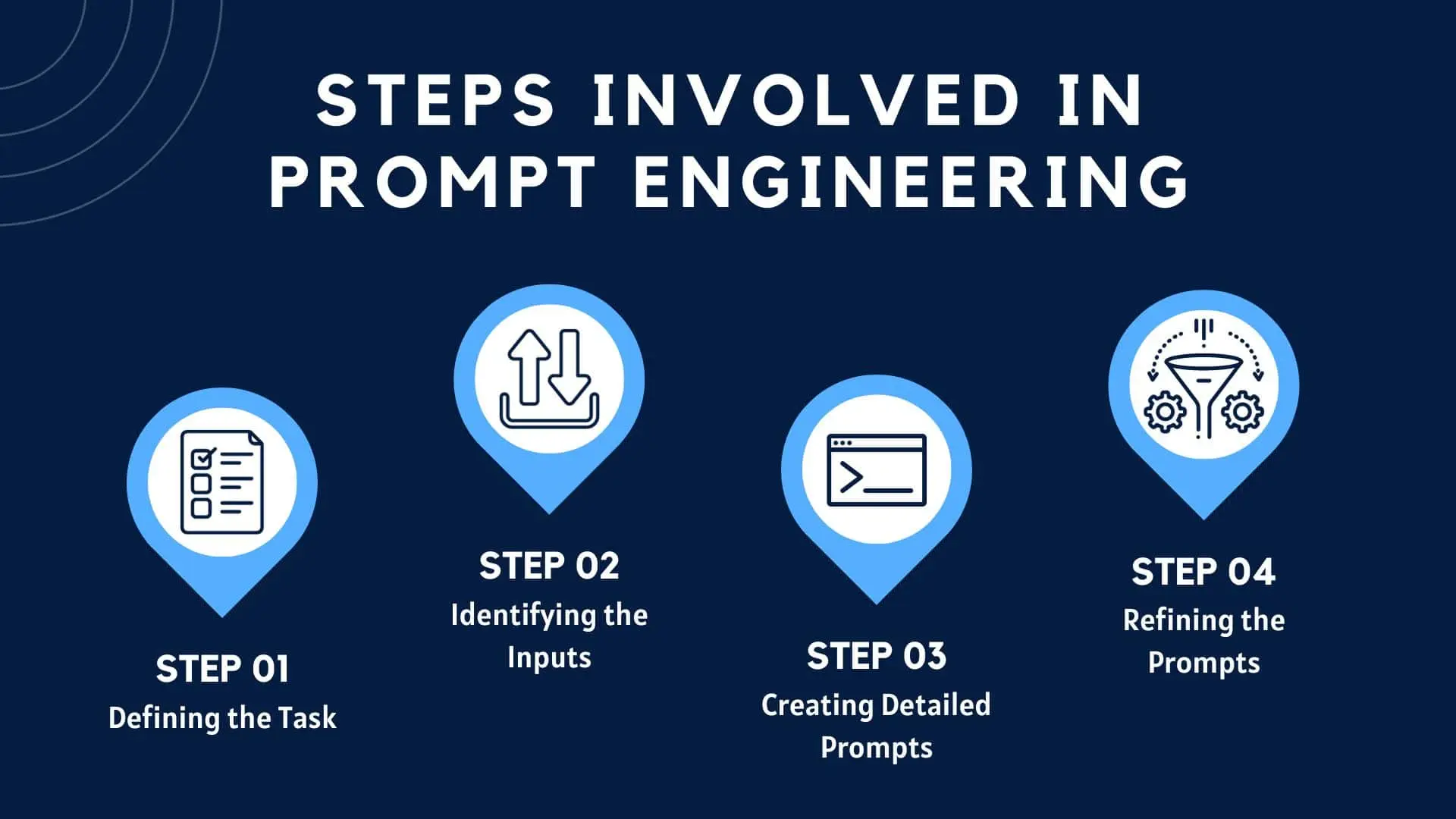

What is Prompt Engineering?

Prompt engineering is the practice of designing inputs—or prompts—for AI tools to generate precise, useful outputs. For marketers, it’s less about coding and more about clear communication: giving AI enough context and direction to produce content that aligns with your brand voice, tone, and objectives.

For example:

- Vague prompt: “Write a blog about email marketing.”

- Well-engineered prompt: “Write a 600-word blog post on email marketing for B2B SaaS companies, focusing on personalization strategies. Use a professional, approachable tone and include at least three actionable tips.”

The difference is night and day. The second prompt gives context, audience details, desired length, tone, and structure, which helps the AI generate content you can use with minimal editing.

Why marketers need prompt engineering:

- Ensures content aligns with brand voice

- Reduces time spent editing AI outputs

- Increases content consistency across channels

- Improves ROI on AI content tools

Key Principles of Effective Prompt Engineering

To get the most out of AI tools, marketers should follow these core principles:

- Clarity – Be explicit about what you want, including tone, style, audience, and format.

- Context – Provide background information or examples to guide the AI.

- Constraints – Define limits such as word count, structure, or style to keep outputs consistent.

- Iterative Refinement – Test, tweak, and improve prompts based on results.

By following these principles, you can significantly reduce wasted effort and ensure AI-generated content is aligned with your marketing goals.

Prompt Engineering Strategies for Content Marketers

Here are actionable strategies you can start using today:

1. Start With a Goal

Define the objective of your content before writing your prompt. Are you creating a blog post, a LinkedIn update, an email, or a product description? Your prompt should clearly state the intended output.

2. Audience-Centric Prompts

Include audience persona details, pain points, and preferences. For example:

“Write a LinkedIn post targeting marketing managers at mid-sized SaaS companies, highlighting the benefits of AI-powered analytics in campaign optimization.”

3. Specify Tone and Style

Your brand voice matters. Whether your tone is professional, friendly, witty, or authoritative, make it clear in your prompt to avoid generic outputs.

4. Provide Examples

Give the AI examples of successful content. For instance, link to or describe previous posts or blogs that represent the style you want.

5. Use Templates

Create reusable prompt templates for recurring content types. Examples:

- Blog posts: Include word count, section headers, key points, CTA.

- Social media: Specify character limit, hashtags, emojis, tone.

- Emails: Define subject line, body length, personalization cues.

Sample Prompt Template:

“Write a 500-word blog post for [audience] on [topic]. Include three actionable tips and a call-to-action. Use a [tone] tone and [style] formatting.”

Common Prompt Mistakes to Avoid

Even experienced marketers can make mistakes with AI prompts. Avoid these pitfalls:

- Using vague language or assuming the AI will infer context

- Overloading prompts with too many instructions

- Ignoring iterative testing and refinement

- Failing to align output with brand voice

By addressing these common errors, you’ll save time and improve the consistency of your AI-generated content.

Measuring Prompt Success

Effective prompt engineering doesn’t stop at writing. You need to measure success:

- Content alignment: Does the output match your brand voice and style?

- Engagement metrics: How well does the content perform with your audience?

- Efficiency gains: Are you spending less time editing AI outputs?

Iterate on your prompts using these metrics. Small adjustments can dramatically improve output quality over time.

Tools and Resources

Several AI writing tools are well-suited for marketers:

- ChatGPT – Versatile tool for blogs, emails, social posts

- Jasper – AI content generation with templates and workflows

- Writesonic – Great for social media, ads, and web content

- Copy.ai – Fast generation for marketing copy and product descriptions

Learning Resources:

- Blogs and guides on AI content creation

- Online courses focused on AI writing tools

- Community forums and workshops on prompt engineering

Conclusion & Takeaways

Prompt engineering is a skill every modern marketer should master. By crafting clear, context-rich, and iterative prompts, you can consistently generate on-brand content, reduce editing time, and maximize the ROI of AI tools.

Actionable steps:

- Start small and iterate on your prompts

- Document successful prompts for repeat use

- Always measure outputs against your brand standards

Ready to supercharge your content marketing with AI? Contact Bluetext to learn how our team can help you implement AI-driven content strategies, including expert prompt engineering support.

In the B2B world, engineers and analysts aren’t influenced by flashy campaigns or celebrity endorsements—they respond to credible voices that understand their challenges and speak their language. That’s where micro-influencers come in. These trusted voices can elevate your brand, drive engagement, and build trust with technical decision-makers.

This blog explores how to identify and activate B2B micro-influencers who resonate with engineers, analysts, and other technical audiences, helping your marketing campaigns achieve measurable impact.

What is B2B Influencer Marketing for Technical Audiences?

B2B influencer marketing involves collaborating with individuals who have credibility and authority in your target industry. Unlike B2C campaigns, B2B influencers are valued for their expertise, insights, and practical experience.

For engineers and analysts, a successful influencer is someone who:

- Has deep knowledge of their technical domain

- Shares insights in forums, publications, or social platforms engineers frequent

- Can communicate complex ideas clearly and credibly

Why it matters:

- Engineers and analysts often drive or influence purchasing decisions for technical solutions

- Peer recommendations carry far more weight than traditional advertising

- Micro-influencers help brands reach niche technical audiences authentically

Why Micro-Influencers Work in Technical B2B Marketing

Micro-influencers typically have smaller but highly engaged followings (1,000–50,000 followers) within a specialized niche. For technical audiences:

- Authenticity matters more than reach: Engineers value detailed, accurate, and unbiased insights.

- Engagement is higher: Smaller communities tend to interact more, ask questions, and share content.

- Cost-effective partnerships: Working with multiple micro-influencers can be more impactful than a single large influencer campaign.

Tips for Identifying B2B Micro-Influencers

- Search Niche Communities

- LinkedIn groups, GitHub projects, Stack Overflow, Reddit communities, or technical forums

- Look for individuals who consistently share expertise, answer questions, or provide valuable insights

- Analyze Content Quality and Engagement

- Evaluate how informative, accurate, and clear their posts are

- Check comments and interactions to see if their audience trusts their opinions

- Look for Alignment With Your Brand

- Ensure their technical expertise aligns with your product or solution

- Check tone, values, and communication style for compatibility

- Use Influencer Discovery Tools

- Tools like Traackr, Klear, LinkedIn Sales Navigator, or BuzzSumo can help identify technical influencers by keywords, industry, and engagement metrics

Activating Micro-Influencers for Technical Campaigns

Once you’ve identified the right influencers, consider these activation strategies:

- Collaborative Content

- Co-create technical blog posts, case studies, webinars, or podcasts

- Ensure the content is educational and adds value to their audience

- Product Trials and Reviews

- Offer access to products or solutions for hands-on testing

- Encourage honest reviews that showcase features relevant to engineers and analysts

- Event Participation

- Invite influencers to speak at webinars, panels, or technical conferences

- Leverage their credibility to amplify your brand messaging

- Long-Term Partnerships

- Build ongoing relationships instead of one-off campaigns

- Consistent collaboration strengthens trust and brand recognition within technical communities

Measuring Success in Technical Influencer Campaigns

Unlike consumer campaigns, technical influencer campaigns focus on engagement quality and influence, not just impressions:

- Lead generation: Track inquiries or downloads from content shared by influencers

- Engagement: Evaluate comments, questions, and discussions generated by the content

- Brand authority: Monitor mentions in forums, technical communities, or LinkedIn conversations

- Conversion impact: Assess whether influencer-driven leads move through the decision-making funnel

Iterate based on metrics to refine influencer selection, content strategy, and engagement methods.

Tools and Resources for B2B Influencer Marketing

- Influencer platforms: Traackr, Klear, BuzzSumo, Onalytica

- Social and professional networks: LinkedIn, GitHub, Stack Overflow

- Analytics tools: Google Analytics, HubSpot, LinkedIn Campaign Manager

Use these tools to discover, manage, and track influencer campaigns for maximum impact.

Conclusion & Takeaways

Influencer marketing for engineers and analysts isn’t about flashy campaigns—it’s about credibility, authenticity, and relevance. By identifying the right micro-influencers, activating them thoughtfully, and measuring engagement strategically, you can:

- Build trust with technical decision-makers

- Amplify your brand’s authority in niche technical markets

- Drive measurable business results through B2B influencer partnerships

Start small, prioritize alignment over reach, and focus on building long-term relationships with influencers. Contact Bluetext to develop a tailored influencer marketing strategy that resonates with technical audiences.

In industries where compliance is non-negotiable—government contracting, defense, and other regulated spaces—marketing can feel like coloring inside the lines with a dull pencil. But while rules and regulations define what you can’t do, they don’t have to limit your ability to stand out. Striking, compliant creative is possible—and it’s often the difference between blending in and breaking through.

The Compliance-Creativity Dilemma

For many government contractors and businesses in regulated industries, creative execution defaults to “safe.” Campaigns rely on muted palettes, stock-heavy imagery, and conservative messaging designed to avoid compliance risk.

But there’s a cost to playing it too safely. When every competitor’s materials look nearly identical, brands struggle to stand out, build recognition, and win mindshare with government buyers.

The challenge: balancing creativity and compliance without letting the latter completely suppress the former.

Why Standing Out Matters in Conservative Spaces

Even in highly conservative industries, audiences are still people. They’re inundated with information and marketing messages daily, which makes capturing attention harder than ever. Safe, predictable creative may not raise compliance flags—but it rarely sparks engagement or builds emotional connection.

Bold but compliant creative can:

- Differentiate your brand in crowded markets.

- Signal innovation and forward-thinking without straying from the rules.

- Build credibility by showing you understand both the mission and the market.

When executed thoughtfully, compliance doesn’t have to be the enemy of creativity. It can serve as the framework that ensures strong ideas are delivered responsibly.

Strategies for Compliant but Striking Creative

Start with a Strong Brand Foundation

The most successful campaigns are built on a brand strategy that aligns with your mission, values, and audience expectations. Before diving into design, ensure your messaging framework is crystal clear—this creates a guardrail for compliance while giving creative teams room to innovate.

Use Color and Typography Thoughtfully

Color is one of the simplest ways to bring energy into conservative marketing. Bright, modern palettes can make visuals pop while still feeling professional. Typography can also signal sophistication and innovation—sans serif fonts, for example, can look contemporary without being risky.

The key is balance: pair bold accents with grounded neutrals to avoid overwhelming the audience.

Visual Storytelling Without the Risk

Imagery is a common compliance minefield, especially for defense or B2G campaigns. Instead of overused stock photos or restricted military imagery, lean on custom iconography, data visualizations, or abstract patterns that represent innovation. Infographics and illustrations can convey complex concepts without crossing sensitive lines.

Language That Resonates and Complies

Words carry just as much weight as visuals. Avoid restricted claims (e.g., “the only solution” or unverifiable superlatives), but don’t settle for lifeless copy. Use persuasive language that emphasizes mission alignment, reliability, and innovation. Active voice and customer-focused phrasing can make messaging both powerful and safe.

Real-World Applications in B2G Marketing

Consider two campaign directions for a defense contractor:

- Safe approach: muted blue-gray palette, stock photos of people in suits, copy that says “trusted solutions for mission success.”

- Striking but compliant approach: bold accent colors layered over technical schematics, clean iconography, copy that emphasizes “advancing mission outcomes with innovation and integrity.”

Both approaches check the compliance box—but only one truly stands out.

Best Practices for Teams in Regulated Industries

Breaking the mold without breaking the rules requires process as much as creativity. A few best practices include:

- Engage compliance teams early. Make them partners in the creative process rather than last-stage reviewers.

- Build checkpoints into your workflow. This prevents wasted time revising ideas that may not pass final review.

- Leverage external expertise. Outside partners can bring fresh creative ideas informed by compliance considerations, giving you the best of both worlds.

Bringing Creativity Into Compliance

In conservative spaces, too many brands let compliance clip their creative wings. But with the right strategy, process, and design choices, it’s possible to build campaign assets that are both visually striking and fully compliant.

Now is the time to embrace bold ideas—because in a market where sameness is the norm, the brands that stand out will be the ones remembered.

Ready to take your creative beyond the basics—without crossing compliance lines?

Connect with Bluetext to explore how bold ideas can work for your brand.

In today’s marketing landscape, brands are under constant pressure to produce more content, faster. Audiences expect fresh insights across blogs, social channels, email campaigns, and multimedia platforms. But scaling content production sustainably—without diluting quality—remains one of the biggest challenges for marketing teams.

That’s where content atomization comes in. At its core, content atomization is the process of transforming one “big idea”—like a whitepaper, webinar, or research report—into dozens of derivative deliverables. It’s not about recycling or copy-pasting. It’s about strategically repurposing content into formats tailored for different channels, audiences, and stages of the buyer journey.

In this playbook, we’ll break down how to turn a single asset into a full campaign ecosystem, outline best practices to follow, and highlight common pitfalls to avoid.

What Is Content Atomization and Why It Matters

Content atomization is the practice of breaking down a larger piece of content into smaller, more focused assets. For example, a 20-page research report might become a three-part blog series, a webinar, a handful of infographics, a podcast episode, and a set of social media posts.

The benefits are clear:

- Scalability – One idea can fuel a month or more of campaigns.

- Efficiency – Reduce the time and resources needed to create net-new content.

- Message consistency – Ensure a unified brand narrative across platforms.

- ROI – Extend the lifespan and impact of flagship content investments.

In a world where marketing teams face increasing pressure to be “always on,” content atomization provides a framework for digital marketing efficiency without sacrificing quality.

The Content Atomization Framework

Think of content atomization as a hub-and-spoke model. At the hub sits your core asset—a whitepaper, webinar, keynote, or research report. From there, spokes radiate outward into derivative assets that extend the core message into different channels and formats.

Core Asset (The Big Idea)

Your atomization strategy begins with one substantial piece of content. This could be:

- A research-driven whitepaper

- A recorded webinar or virtual panel

- A keynote presentation

- A case study or success story

This core asset is your intellectual “pillar” that everything else builds from.

Derivative Assets

Here’s how a single core asset can splinter into dozens of deliverables:

- Blogs & Articles – Break down sections into topic-specific posts optimized for search.

- Social Content – Extract key quotes, statistics, and visuals for LinkedIn, X, and Instagram.

- Thought Leadership – Draft contributed articles or op-eds drawing from core themes.

- Email Campaigns – Create nurture sequences that tease insights and drive downloads.

- Infographics & Visuals – Translate data-heavy sections into shareable graphics.

- Video & Audio – Clip webinar highlights into short-form videos or podcast segments.

- Interactive Assets – Turn research into calculators, quizzes, or gated interactive tools.

The beauty of this model is that one initial investment produces a multi-channel marketing ecosystem—meeting audiences where they are with content that feels purpose-built.

Real-World Examples of Content Atomization in Action

To illustrate, let’s look at two scenarios where brands can apply this approach:

Example 1: Whitepaper Atomization

- A cybersecurity company develops a whitepaper on emerging threats.

- The whitepaper becomes:

- Three blog posts on specific threat categories

- An infographic visualizing attack trends

- A webinar with subject matter experts

- A LinkedIn carousel highlighting key statistics

- A nurture email sequence linking to each derivative piece

Example 2: Webinar Atomization

- A SaaS brand hosts a webinar on customer experience trends.

- From the recording, the marketing team creates:

- A recap blog post with takeaways

- Short video clips optimized for LinkedIn

- A thought leadership article by the webinar host

- A podcast episode edited from the Q&A session

- A set of sales enablement slides for the field team

In both cases, the original asset fuels an entire campaign ecosystem—maximizing reach while reducing the demand for net-new production.

Best Practices for Scaling Your Content Atomization Strategy

While the concept is straightforward, executing content atomization effectively requires discipline. Here are best practices to guide your approach:

- Start with a strong “pillar” asset. Choose an idea that is broad enough to support multiple derivatives and relevant enough to resonate across buyer stages.

- Map assets to the buyer journey. Ensure derivative content addresses awareness, consideration, and decision-making phases.

- Adapt to each channel. Don’t simply repost—customize tone, format, and length for blogs, social, and video.

- Leverage analytics. Use engagement metrics to prioritize which derivative formats perform best with your audience.

- Maintain consistency. Keep design, voice, and key messages aligned across all pieces to reinforce the campaign.

- Use AI wisely. Artificial Intelligence tools can accelerate drafting and formatting but should be guided by brand voice and editorial oversight.

When done right, atomization amplifies your reach without sacrificing quality or cohesion.

Common Mistakes to Avoid

Content atomization can be powerful, but there are traps to watch for:

- Republishing instead of repurposing. Copying text from one channel to another rarely works. Content must be reshaped for its audience and format.

- Lack of channel-specific optimization. A LinkedIn carousel should look and feel different from a blog post or nurture email.

- Ignoring SEO. Each derivative piece should be optimized with keywords, metadata, and internal links to strengthen discoverability.

- Overproduction without strategy. Don’t create derivative assets for the sake of volume—prioritize formats your audience values most.

Avoiding these pitfalls ensures that your atomization efforts drive real results rather than just more content.

Building Your Own Content Atomization Playbook

So how can your team put this into practice? Start by developing a repeatable playbook:

- Identify the core asset. Whitepaper, webinar, or report.

- Audit potential derivatives. Map out blogs, social, emails, and visuals.

- Align with the buyer journey. Match content to awareness, consideration, and decision stages.

- Develop a rollout plan. Stagger content releases to sustain engagement over time.

- Measure and refine. Track performance to see which atomized pieces resonate most.

By creating a systematic process, you can ensure that every major content investment continues to pay dividends long after launch.

Maximizing the Value of Every Idea

Marketing teams don’t always need to chase the next “big idea.” Often, the smartest move is to extract more value from the ideas you already have. Content atomization offers a roadmap for doing exactly that—fueling multi-channel campaigns, ensuring message consistency, and maximizing ROI.

At Bluetext, we help brands design and execute content marketing frameworks that scale. From developing high-impact core assets to rolling out full atomization ecosystems, our team ensures that one idea becomes dozens of deliverables—without sacrificing quality or creativity.

Looking to maximize the value of your content? Bluetext helps brands transform big ideas into multi-channel campaigns that drive results. Contact us today.

In the high-stakes world of defense contracting, great capabilities often go unnoticed—not because they underperform, but because they aren’t on the right radar. Winning business inside the Department of Defense (DoD) doesn’t start with a contract vehicle or an RFP. It starts with a strategy. To get your tech, tools, or team in front of DoD decision-makers, you must first understand the unique buyer journey within the Pentagon and the creative marketing tactics that cut through complexity, compliance, and competition.

Here’s how to win the mission—before it’s even assigned.

Understanding the DoD Buyer Journey

Marketing to the Department of Defense means navigating a buyer journey unlike any in the commercial world. Instead of a centralized decision-maker, you’re targeting an ecosystem of stakeholders, including:

- Program managers seeking mission alignment

- Contracting officers focused on compliance and pricing

- Technical evaluators assessing performance and security

- End users who may shape requirements

- Innovation arms like DIU, AFWERX, and NavalX

This journey can be broken down into three high-level phases:

1. Awareness: Identifying the Mission Need

The DoD doesn’t buy software or satellites for the sake of modernization—they buy capabilities that close mission gaps. Your first marketing challenge is making potential customers aware that your solution aligns with their pain points. That starts with translating your commercial value proposition into national security outcomes.

2. Consideration: Evaluating Potential Capabilities

Once a mission need is validated, decision-makers assess technical fit, risk, and readiness. This is where white papers, demos, and small pilot contracts (like SBIRs) can elevate your profile—if you’re already on their radar.

3. Procurement: Navigating the Acquisition Pathway

Even when you’re the right fit, getting funded depends on being in the right place at the right time with the right contract vehicle. Marketing must support your business development team’s efforts to align with OTAs, BAAs, or IDIQs early.

Why Marketing to the DoD Is Different

The Department of Defense is not just another vertical—it’s a culture with a complex procurement architecture, specialized language, and risk-averse mindsets. Common marketing missteps include:

- Using the wrong language. Civilian tech jargon often doesn’t resonate. Using terms like “zero trust,” “kill chain,” or “interoperability” (where appropriate) can make a difference.

- Leading with features, not mission relevance. DoD buyers need to see how your solution enhances warfighter readiness, improves situational awareness, or reduces lifecycle costs.

- Assuming access. Traditional digital channels don’t always reach .mil audiences due to firewall restrictions.

- Ignoring the influence network. Many decisions are made before a formal solicitation appears. If you’re not part of the early-stage conversation, you’re likely too late.

Creative Strategies to Break Through Bureaucracy

Marketing to the Pentagon requires more than brochures and trade show booths. Here are six tactics to earn attention where it counts:

1. Lead with Mission Impact Messaging

Replace “faster, better, cheaper” with language that speaks to capability gaps and operational outcomes. Emphasize how your solution supports Joint All-Domain Command and Control (JADC2), resilience, cybersecurity, or domain superiority.

2. Create Dual-Purpose Campaigns

Develop content that serves both education and enablement—think explainer videos that work on LinkedIn and in BD meetings, or solution briefs that double as handouts at AUSA or WEST.

3. Activate Trusted Voices

Nothing resonates like a peer or former insider. Partner with former flag officers, cleared consultants, or respected integrators who can validate your offering through blogs, speaking engagements, or earned media.

4. Deploy Account-Based Marketing (ABM)

DoD outreach isn’t one-size-fits-all. Create hyper-targeted campaigns focused on specific branches, program offices, or commands. Combine this with IP targeting or LinkedIn filters to reach the right desks.

5. Modernize the Demo Experience

Move beyond PowerPoints. Use immersive media—AR, VR, or 3D simulations—to bring your product to life. Even a digital twin or 3D walkthrough can help abstract capabilities click.

6. Map to Acquisition On-Ramps

Time your marketing to coincide with pre-RFI periods, BAA cycles, or SBIR solicitations. Educating stakeholders before the paperwork starts gives you an edge over competitors who wait for the RFP.

Where Bluetext Comes In

At Bluetext, we’ve helped some of the fastest-growing names in national security—like ManTech, BlueHalo, and Axient—cut through the noise with branding, campaigns, and digital experiences that get noticed and get funded. Following our strategic marketing efforts, these companies have seen increased visibility, improved stakeholder engagement, and in several cases, successful acquisition outcomes.

We’ve also partnered closely with Arlington Capital Partners and Sagewind Capital, helping portfolio companies position themselves effectively within the government ecosystem—from visuals and messaging to launch strategy and campaign execution.

We understand what it takes to make an impression inside the wire—and we deliver it.

Position Your Brand to Win the Next Mission

The most successful defense marketers know it’s not about selling—it’s about aligning. By mapping your message to mission needs, understanding the nuances of the federal buyer journey, and deploying creative strategies that cut through red tape, your brand can become not just known—but trusted.

Looking to elevate your marketing strategy for the defense space? Let’s talk about how Bluetext can help you win inside the DoD.

In a marketing world driven by personalization, relevance, and precision, a one-size-fits-all approach no longer cuts it. As markets mature and buyers demand deeper expertise, more global CMOs are turning to a proven strategy to break through the noise: verticalization.

Rather than positioning their products or services in broad horizontal terms (e.g., “project management software” or “cloud security”), top SaaS and services brands are embracing industry-specific go-to-market strategies that speak directly to the pain points, regulations, and nuances of distinct verticals like healthcare, government, financial services, or manufacturing.

And the results? Higher win rates, stronger brand affinity, and shorter sales cycles.

What Is Verticalization—and Why Now?

Verticalization means tailoring your entire marketing and sales motion—messaging, content, campaigns, and even product features—to the needs of a specific industry.

It’s more than just inserting an industry name into a landing page. It’s about showing buyers that you understand their world—their compliance requirements, their legacy systems, their KPIs—and that your solution was built with their unique context in mind.

With B2B decision-makers increasingly tuning out generic messaging, brands that go deep rather than wide are standing out.

Why CMOs Are Leaning In

Global marketing leaders are investing in verticalization because it delivers measurable, strategic advantages:

1. Relevance that drives resonance

Generic messaging may sound safe, but it rarely inspires action. Tailored industry messaging helps buyers see themselves in your story—and moves them further down the funnel.

2. Faster sales cycles

Industry-aligned sales enablement tools (e.g., vertical case studies, ROI calculators) help reps build trust faster and reduce time spent educating prospects on fit.

3. Better content performance

Industry-specific thought leadership and gated content drive higher engagement and conversion rates, especially in ABM or outbound campaigns.

4. Stronger differentiation

In crowded categories, vertical fluency sets you apart. Buyers don’t just want software—they want solutions built for them.

What Verticalized Marketing Looks Like in Practice

To make verticalization work, brands need to operationalize it across the marketing ecosystem:

1. Dedicated industry teams or pods

Many global CMOs are standing up “vertical marketing managers” or small pods that own campaign development, content calendars, and sales enablement for a given sector.

2. Industry-tailored buyer journeys

From awareness to conversion, each touchpoint should reflect the language, needs, and challenges of that specific industry—whether it’s a white paper for healthcare CIOs or a nurture flow for state-level procurement teams.

3. Customized web experiences

Landing pages, homepage segments, or entire microsites built for individual industries can dramatically improve engagement and conversion.

4. Sales and marketing alignment

Ensure that industry-specific marketing efforts are tightly integrated with sales motions. The messaging used in campaigns should map directly to the conversations happening in the field.

Deep Messaging, Not Just Different

Verticalization isn’t a find-and-replace exercise. Buyers can smell inauthenticity. To be effective, your marketing must show true domain expertise.

That means:

- Speaking to regulatory realities (e.g., HIPAA, FedRAMP, PCI-DSS)

- Referencing industry-specific workflows or pain points

- Using metrics that matter to the sector—whether it’s uptime, throughput, cost per bed, or citizen satisfaction

Collaborating with subject matter experts, leveraging customer testimonials, and co-creating with vertical influencers can help you avoid surface-level messaging.

How to Scale Without Losing Focus

A common concern with verticalization is that it can become complex and resource-intensive. The key is building systems that allow for scale and specificity:

- Create modular campaign assets (e.g., hero videos, pitch decks, email sequences) that can be easily adapted per vertical.

- Develop a flexible brand framework that preserves consistency while enabling regional or industry customization.

- Use a centralized DAM and CMS to manage, update, and distribute vertical-specific content across global teams.

- Define a rollout roadmap—you don’t need to verticalize for every industry at once. Start with your top-performing or highest-potential sectors.

Why It Works

At its core, verticalized marketing works because it meets buyers where they are. It builds credibility, confidence, and conversion power—three things every marketing leader is after.

And in competitive categories where every brand sounds the same, speaking your buyer’s language is no longer a nice-to-have—it’s a strategic imperative.

Want to Build an Industry-Specific Growth Strategy?

Bluetext helps brands reframe their messaging, campaigns, and go-to-market strategies around the industries that matter most. Whether you’re launching into new sectors or scaling vertical programs globally, we build frameworks that drive results. Contact us to start verticalizing your marketing—and winning where it counts.

In government contracting, clarity is currency. When every word, capability, and differentiator is under scrutiny, the companies that rise to the top aren’t necessarily the largest or loudest—they’re the ones that speak with precision. In a world of acronyms, mandates, and mission alignment, the ability to articulate your value in a hyper-targeted way is what separates contenders from winners.

Let’s explore why hyper-niche messaging isn’t just a branding preference—it’s a business-winning strategy for B2G organizations.

The Problem with Generic Positioning in GovCon

Generic messaging is a liability in government contracting. Agencies don’t award multi-million-dollar contracts to companies that merely “support innovation” or “deliver secure solutions.” They want partners who understand their mission, speak their language, and solve their specific pain points.

Contracting officers and evaluation boards are inundated with vendors claiming to “do it all.” If your message isn’t directly aligned with the program goals, agency priorities, and procurement language, you’re likely to be filtered out long before the final downselect.

What Precision Branding Looks Like in B2G

Precision branding is more than buzzwords—it’s about showing a deep understanding of the agency, mission, and problem set you’re trying to support. It’s branding that reflects:

- Mission fluency: Messaging that maps to agency-specific goals, such as modernization, zero trust, or resilient logistics.

- Procurement awareness: A tone and structure that mirrors how contracts are framed and awarded.

- Technical confidence: Specificity around your capabilities, differentiators, and how they align to contract requirements.

This kind of messaging signals you’re not just capable—you’re credible.

Segmentation Strategies for Government Audiences

In the public sector, your audience isn’t “the government”—it’s a web of stakeholders, each with different concerns. Hyper-niche messaging starts with segmentation. Effective B2G segmentation can include:

- By agency or department: Tailoring messages for DHS, VA, DoD, or HHS based on their unique missions and tech stacks.

- By mission area: Whether it’s cybersecurity, digital transformation, healthcare delivery, or ISR, speak to the problem, not just the platform.

- By role: Program managers want operational outcomes; contracting officers want clarity and compliance.

This approach enables your BD, capture, and marketing teams to deliver the right message at the right time—every time.

Building Trust Through Tailored Messaging

In government contracting, trust drives procurement decisions. Precision branding helps build that trust by showing that you’ve done your homework. Tailored messaging demonstrates:

- Understanding of agency challenges

- Familiarity with prior contract awards and initiatives

- Ability to integrate with existing systems and workflows

Messaging that speaks directly to a program’s needs helps pre-sell your value well before the RFP drops—and can be the deciding factor in whether you get on the bidder’s shortlist.

Supporting Pursuits Through Smart Brand Architecture

When every pursuit is unique, your brand needs to be flexible without losing cohesion. Precision branding allows you to:

- Deploy microsites or campaign pages for specific agencies or programs.

- Align visuals and language across BD collateral, white papers, and proposal materials.

- Build modular messaging systems that scale from digital campaigns to in-person orals.

This kind of architecture supports faster spin-ups, more aligned capture efforts, and consistent storytelling across the entire business development funnel.

Why It All Matters for Winning Contracts

At the end of the day, precision branding is about outcomes. Tailored messaging can:

- Accelerate procurement cycles by removing confusion and building confidence.

- Improve proposal win rates by resonating more clearly with evaluators.

- Differentiate your solution in a crowded field of government vendors.

In the complex, competitive world of GovCon, vague promises won’t win big contracts. Specificity, strategy, and segmentation will.

Let’s Talk Precision

Looking to refine your message and win with more intention? Bluetext helps government contractors position with purpose—through hyper-targeted messaging, modular brand systems, and smart creative built for the B2G space.

Contact us to learn how we can help you speak the language of your next big win.

When a private equity firm acquires a company, the clock starts ticking. Growth targets accelerate, performance metrics tighten, and marketing teams—often lean and under-resourced—are expected to deliver results fast. But unlike traditional businesses, private equity portfolio companies (portcos) face a distinct set of marketing challenges that require a strategic and scalable approach.

From legacy tech stacks to murky messaging, portcos must overcome foundational hurdles to build a modern marketing engine. Here’s a look at the most common challenges—and how to solve them.

High Expectations, Limited Time

Private equity ownership often brings a new level of pressure. Marketing teams must balance long-term brand strategy with short-term performance goals, all while navigating new reporting structures and operational expectations. Unlike a typical company with a 3–5 year brand horizon, portcos are often judged on quarterly metrics, driving a need for speed that can compromise strategy.

This urgency makes prioritization critical. Portcos must identify high-impact marketing opportunities—whether that’s clarifying their messaging, launching a new website, or streamlining their digital campaigns—to make measurable progress, fast.

Brand Confusion Post-Acquisition

Many portcos are acquired mid-transformation. They may have undergone leadership changes, shifted target markets, or expanded their offerings—yet their brand still reflects the company they used to be. This disconnect can confuse customers, dilute differentiation, and weaken marketing ROI.

Compounding the issue, some portcos are the product of roll-ups or mergers, with multiple brands, cultures, and customer expectations colliding under one roof. Without a clear brand architecture and narrative, marketing efforts struggle to gain traction.

Strategic rebranding, messaging workshops, and go-to-market alignment can bring clarity to the chaos and position the business for accelerated growth.

A Patchwork Tech Stack

One of the most overlooked challenges portcos face is their fragmented marketing infrastructure. Often, companies enter PE ownership with outdated or disconnected systems—multiple CRMs, legacy websites, spreadsheets in place of automation platforms, and inconsistent analytics tracking.

This patchwork approach stalls scalability. It makes personalization difficult, breaks campaign attribution, and undermines confidence in reporting. Worse, it creates operational drag when every minute counts.

An early-stage digital audit—assessing martech tools, CRM integrations, analytics setup, and automation workflows—can lay the groundwork for a performance-ready marketing engine.

Unclear or Undifferentiated Value Propositions

It’s common for portcos to lack a well-defined or updated value proposition, especially after acquisition. The business may be expanding into new markets, offering new services, or pursuing new customers—yet their messaging hasn’t caught up.

This gap often shows up on the homepage. If a prospective customer or investor can’t understand what the company does and why it matters within five seconds, they move on.

To avoid that drop-off, portcos need messaging that resonates with buyers and aligns with business strategy. Positioning exercises, persona development, and competitive messaging frameworks help clarify the value prop and give marketing a strong foundation to build from.

Resource-Constrained Marketing Teams

In many portcos, the marketing function is a small team—or a single individual—expected to manage everything from lead generation to website updates to investor presentations. While agile, these teams often lack the bandwidth or specialized expertise to execute complex campaigns at scale.

This creates risk. Without a strong partner or internal support, critical gaps in strategy, design, data, or digital performance can hold back growth.

Building a hybrid model—where internal teams focus on strategy and oversight, while external partners handle execution—can be a force multiplier that enables marketing to move faster and smarter.

Internal Misalignment and Change Management

Even the best marketing strategy will fall flat if it’s not aligned across the organization. Many portcos face internal tension between legacy leadership and new PE-backed direction. Sales may resist marketing changes. Product teams may pursue different priorities. Leadership may hesitate to invest in brand-building.

Change management is key. Marketing leaders must build internal consensus, align stakeholders, and ensure everyone is marching to the same strategic beat. Transparent communication, cross-functional workshops, and shared KPIs can help unify vision and accelerate progress.

Turning Challenges Into Competitive Advantage

While the hurdles are real, so is the opportunity. With the right strategy, tools, and support, private equity portcos can build modern marketing engines that not only meet short-term growth goals, but also create lasting enterprise value.

At Bluetext, we’ve partnered with PE-backed companies across industries to streamline operations, sharpen positioning, modernize digital presence, and generate measurable results—fast. Whether you’re a PE firm looking to elevate your portfolio or a portco ready to modernize your marketing, Bluetext can help. Let’s talk about how we can accelerate your growth.