In today’s business landscape, mergers, acquisitions, and IPOs aren’t just transactions—they’re strategic leaps. Whether it’s a defense contractor expanding its mission set, a fintech firm going public to scale, or a cybersecurity company consolidating talent and tech, every move tells a story about where an industry is headed.

At Bluetext, we help organizations position themselves for these defining moments. That’s why we took a closer look at 95 notable transactions—each of which occurred within 24 months following a Bluetext engagement. From landmark deals like VMware’s acquisition by Broadcom to precision plays like CyberArk’s IPO and BlueHalo’s acquisition by AeroVironment—to understand the trends shaping the business world in 2026 and beyond.

In this comprehensive overview, we delve into 95 significant transactions that have shaped various industries. Each transaction is accompanied by a concise summary and an analysis of the strategic advantages of the merger, IPO, or acquisition.

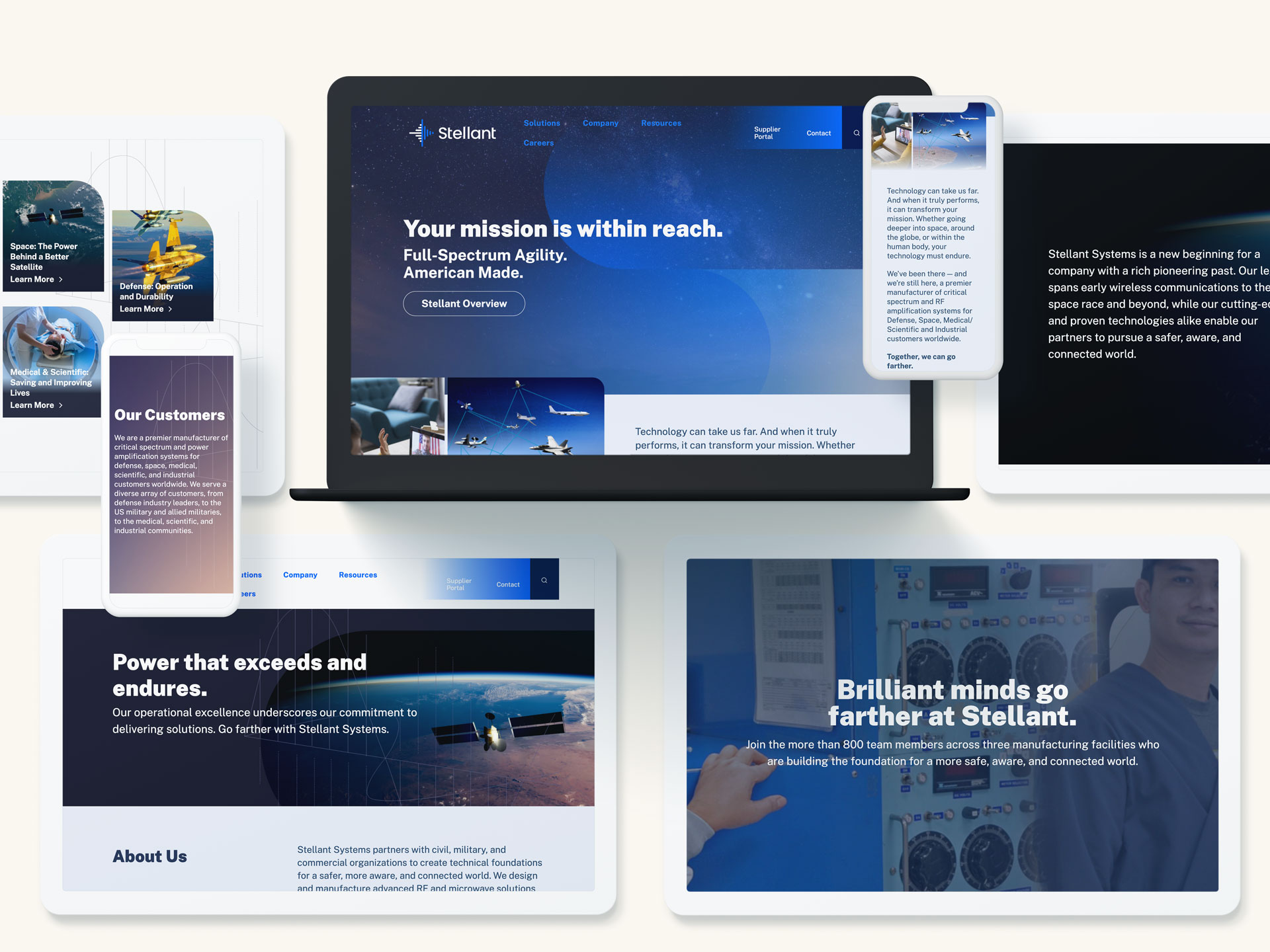

95. TransDigm Group Acquires Stellant Systems

Summary: TransDigm Group, a leading global designer, producer, and supplier of highly engineered aerospace components, has acquired Stellant Systems, a specialized provider of RF and microwave solutions supporting defense and space missions. Stellant brings deep expertise in radar, electronic warfare, communications, and satellite payload technologies, serving critical national security and aerospace programs. The acquisition strengthens TransDigm’s portfolio of proprietary, mission-critical products that support complex and highly regulated aerospace and defense platforms.

Strategic Advantages: By integrating Stellant’s advanced RF and microwave capabilities, TransDigm expands its presence in high-growth defense and space markets where performance, reliability, and technical differentiation are paramount. Stellant’s offerings complement TransDigm’s existing portfolio by adding specialized electronic subsystems that are deeply embedded in customer platforms and programs of record, reinforcing TransDigm’s position as a trusted supplier of highly engineered, value-added components.

Strategically, the acquisition underscores TransDigm’s disciplined approach to M&A, focusing on businesses with strong intellectual property, long program lifecycles, and defensible market positions. Stellant’s alignment with classified and mission-critical applications enhances TransDigm’s exposure to resilient defense and space spending while creating opportunities for long-term value creation through operational excellence, aftermarket support, and sustained customer relationships across the aerospace and defense ecosystem.

94. CACI Acquires ARKA Group

Summary: CACI, a leading provider of advanced technology and intelligence solutions for defense, federal, and commercial clients, has acquired ARKA Group, a specialized firm focused on space-based sensing, actionable intelligence, and advanced technology integration. ARKA brings expertise in sensor systems, data fusion, analytics, and mission-focused technology solutions across national security and defense operations. This acquisition strengthens CACI’s ability to deliver end-to-end, mission-centric capabilities that combine cutting-edge technology with operational insight.

Strategic Advantages: By integrating ARKA’s space and sensor capabilities, CACI enhances its position in domains where situational awareness, data-driven decision-making, and rapid response are critical. ARKA’s offerings expand CACI’s portfolio from core intelligence, cyber, and mission services into advanced space-based sensing, analytics, and technology integration—enabling defense and intelligence clients to achieve faster, more precise outcomes.

Strategically, the acquisition demonstrates CACI’s commitment to delivering innovative, mission-aligned solutions to national security customers. It creates opportunities for unified technology development across CACI’s platforms, blending sensor technology, analytics, mission systems, and actionable intelligence. The combined capabilities provide clients with a trusted partner capable of addressing complex operational challenges and emerging threats in a rapidly evolving security environment.

93. Red River Acquires Invictus

Summary: Red River, a leading provider of technology transformation, security, and managed services for government and enterprise clients, has acquired Invictus, a specialized cybersecurity and intelligence solutions firm supporting national security missions. Invictus brings deep expertise in cyber operations, intelligence analysis, secure systems engineering, and mission support services across defense, intelligence, and federal civilian agencies. The acquisition enhances Red River’s ability to deliver end-to-end, mission-focused solutions that combine advanced cybersecurity capabilities with scalable IT modernization.

Strategic Advantages: By integrating Invictus’s cyber and intelligence tradecraft, Red River significantly strengthens its position in high-security environments where resilience, protection, and operational readiness are paramount. Invictus’s capabilities expand Red River’s portfolio from core IT and cloud services into advanced cyber operations, intelligence support, and mission assurance—helping federal clients counter evolving threats with greater speed and precision.

Strategically, the acquisition underscores Red River’s commitment to supporting national security customers with secure, enterprise-grade technologies backed by deep domain expertise. It creates opportunities for unified solution development across Red River’s existing platforms, blending infrastructure modernization, cybersecurity, analytics, and managed services. The combined offering delivers greater value to defense and intelligence clients seeking trusted partners who understand both mission complexity and emerging threat landscapes.

92. BigBear.ai Acquires Ask Sage

Summary: BigBear.ai, a leader in artificial intelligence and data analytics solutions for defense and enterprise customers, has acquired Ask Sage, an AI-powered research and decision-support platform. Ask Sage leverages generative AI to accelerate access to knowledge, providing natural-language answers across secure and classified environments. The acquisition enhances BigBear.ai’s ability to deliver trusted, explainable AI solutions tailored for mission-critical applications in government, intelligence, and commercial sectors.

Strategic Advantages: By integrating Ask Sage’s generative AI technology, BigBear.ai strengthens its position at the intersection of data analytics and large language model (LLM) innovation. The acquisition enables BigBear.ai to expand its offerings beyond analytics into interactive decision-support and real-time knowledge generation, improving speed and insight for end users.

Strategically, this move underscores BigBear.ai’s commitment to advancing AI solutions that are secure, transparent, and operationally relevant—particularly in regulated and high-security domains. It also opens opportunities for product integration across BigBear.ai’s existing platforms, enhancing value for both defense and enterprise clients seeking intelligent automation.

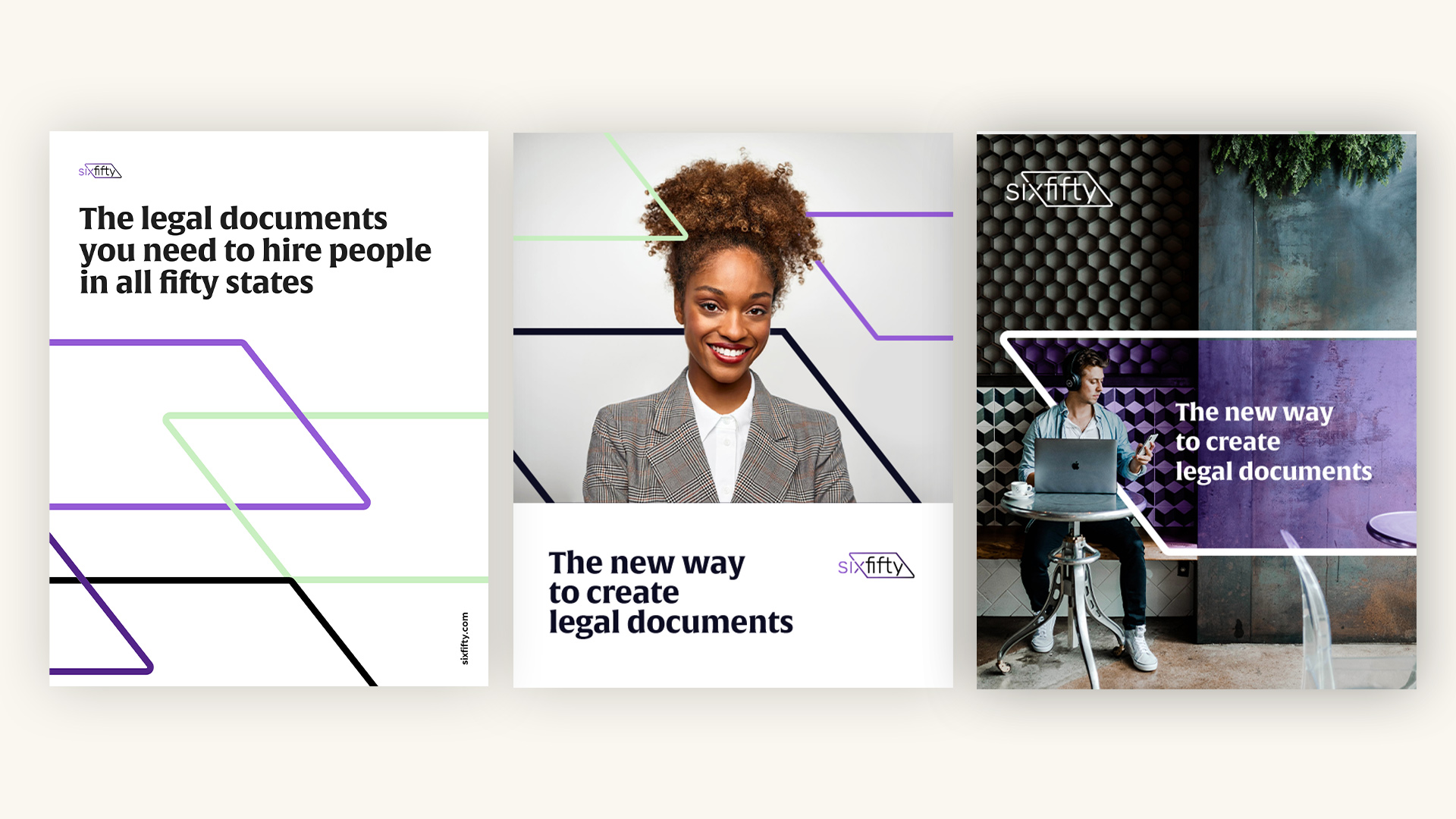

91. Paychex Acquires SixFifty

Summary: Paychex, a leading provider of human resources and payroll solutions, has acquired SixFifty, the legal technology subsidiary of Wilson Sonsini Goodrich & Rosati. SixFifty, launched in 2019, offers a platform that automates employment compliance, providing businesses with access to employment law databases and tools to generate documents such as hiring and separation agreements. The acquisition represents a major expansion of Paychex’s capabilities, adding lawyer-built legal compliance solutions to its existing suite of HR, payroll, and benefits technologies. The deal underscores Paychex’s commitment to helping businesses manage risk, maintain compliance, and streamline administrative processes through technology.

Strategic Advantages: By integrating SixFifty’s legal tech platform, Paychex strengthens its position as an end-to-end solution for business operations, combining HR, payroll, benefits, and now employment law compliance. SixFifty’s automated workflows and document-generation capabilities reduce reliance on external legal counsel for routine employment matters, allowing businesses to scale efficiently while minimizing legal risk.

The acquisition also opens opportunities for cross-selling, enabling Paychex to offer SixFifty’s compliance tools to its extensive customer base, deepening client relationships and enhancing customer retention. Strategically, this move reflects the growing trend of blending legal expertise with operational technology, positioning Paychex to provide businesses with a unified, tech-driven approach to managing both workforce and regulatory challenges.

90. Palo Alto Networks Acquires CyberArk

Summary: Palo Alto Networks acquired CyberArk, a global leader in Identity Security and privileged access management. The deal marks a significant expansion of Palo Alto’s platform strategy, adding a robust identity layer to its network, cloud, and endpoint security offerings. CyberArk’s solutions—trusted by governments and Fortune 500 companies alike—bring deep expertise in managing human and machine identities, protecting critical infrastructure from insider threats, credential theft, and unauthorized access. The acquisition reflects Palo Alto’s belief that identity is no longer a standalone concern but a foundational element of modern cybersecurity architecture, especially as AI agents and machine-to-machine workflows take on increasingly sensitive roles within the enterprise.

Strategic Advantages: The acquisition of CyberArk significantly enhances Palo Alto Networks’ platform by embedding industry-leading Identity Security capabilities into its broader cybersecurity architecture. As organizations face mounting challenges in securing not just users but also machines and autonomous AI agents, CyberArk’s technology provides the privileged access controls, secrets management, and identity governance tools required to manage this growing complexity. By integrating these capabilities into its existing suite of network, cloud, and endpoint security solutions, Palo Alto can offer customers a unified security platform that secures access across every layer of their operations.

The combination also strengthens Palo Alto’s positioning for the AI-powered enterprise, where identity becomes a cornerstone of real-time threat prevention and autonomous decision-making. CyberArk’s just-in-time and least-privilege access models are especially well suited for managing the permissions and behaviors of AI agents operating with sensitive data and systems. Strategically, the deal enables cross-selling opportunities, deepens customer relationships, and consolidates the security stack under fewer vendors—all while expanding Palo Alto’s footprint across both public and private sector identity programs. The move marks a step-change in how identity is treated: not as a point solution, but as an essential layer of enterprise cybersecurity infrastructure.

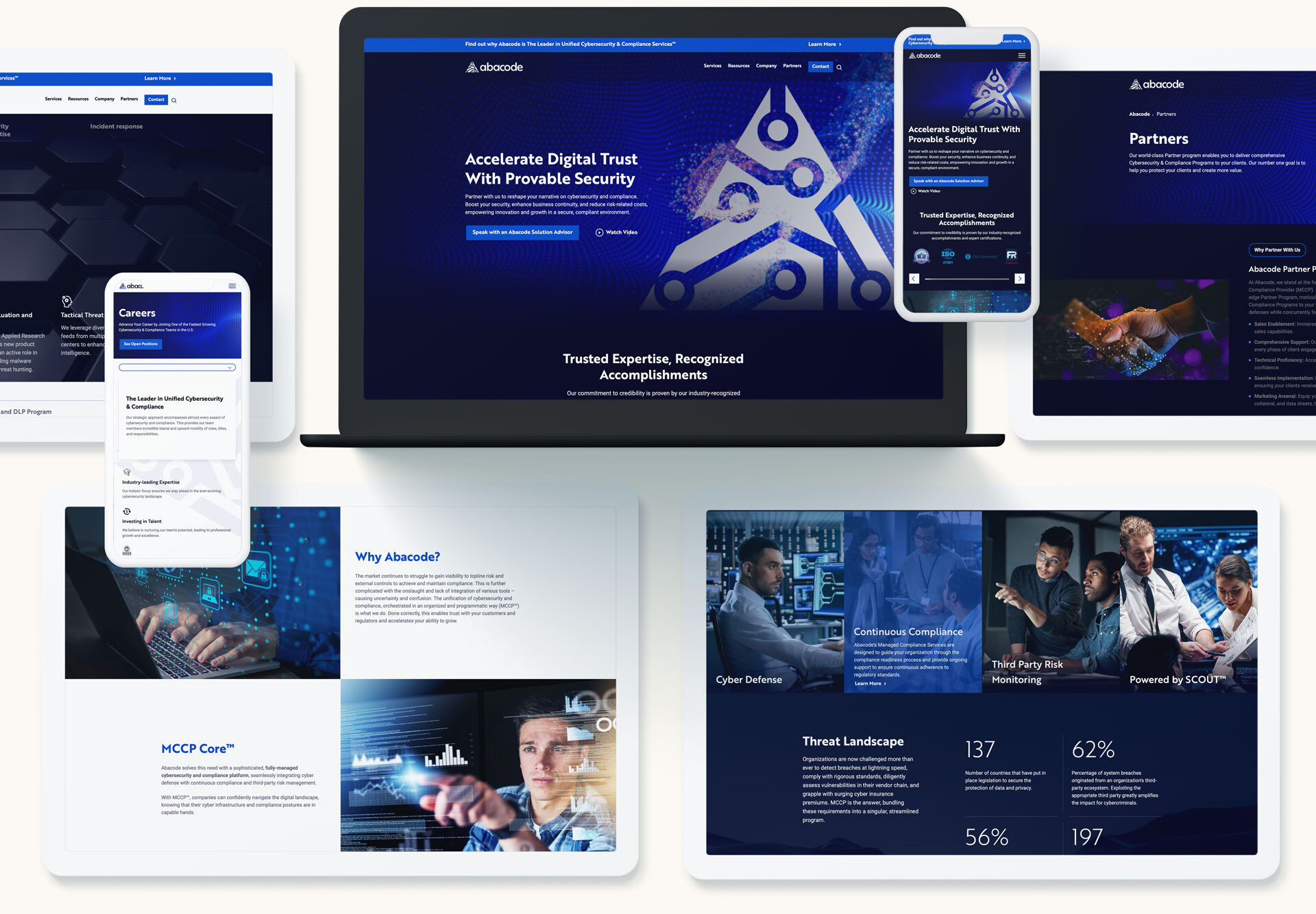

89. Thrive Acquires Abacode

Summary: Thrive, a global technology outsourcing provider specializing in cybersecurity, cloud, and managed IT services, has completed the acquisition of Abacode, a Tampa-based Managed Cybersecurity & Compliance Provider (MCCP). Abacode’s outcome-driven approach combines cybersecurity, governance, risk management, and compliance into a unified offering. By integrating Abacode’s team and capabilities, Thrive enhances its ability to help mid-market clients across healthcare, finance, government, and other regulated industries meet evolving regulatory and cyber risk requirements while turning compliance into a competitive advantage.

Strategic Advantages: The acquisition seamlessly aligns Thrive’s global, scalable infrastructure with Abacode’s proven expertise in managing compliance-intensive cybersecurity programs. Abacode’s culture of client commitment and innovation strengthens Thrive’s high-touch, advisory-led delivery model featuring vCISO, vCIO, and 24×7 SOC/NOC services. Together, they deliver a comprehensive governance, risk, and compliance platform that simplifies complexity for mid-market businesses. This union accelerates Thrive’s expansion of its compliance capabilities and presence, particularly in the Southeast US, while deepening its value proposition across industries facing stringent regulatory environments. With enhanced scale, standardized services, and integrated compliance and security advisory, the combined offering positions Thrive to drive scalable, high-touch cybersecurity outcomes for a broader range of clients.

88. Clinisys Acquires Orchard Software

Summary: Clinisys, a global provider of laboratory informatics solutions, has acquired Orchard Software from Francisco Partners. This transaction unites two leading names in the Laboratory Information System (LIS) market and reinforces Clinisys’s commitment to expanding its informatics capabilities across healthcare, life sciences, and public health. Orchard brings a deep bench in award-winning LIS solutions used across physician offices, reference labs, student health centers, veterinary clinics, and public health organizations. The combination enhances Clinisys’s ability to offer comprehensive, flexible, and scalable cloud and enterprise-level software to laboratories worldwide.

Strategic Advantages: The acquisition delivers powerful complementary strengths: Clinisys’s global footprint and cloud-native LIMS offerings merge with Orchard’s dominance in diagnostic laboratories, particularly in physician office, veterinary, and independent reference lab settings. Together, they form a unified, versatile platform capable of serving the full spectrum of laboratory customers with consistent, integrated software and analytics. Orchard’s long-standing recognition in customer satisfaction and performance metrics reinforces Clinisys’s leadership in the LIS market and accelerates innovation in workflow automation, billing enhancements, and integration with EHR systems.

87. Anduril Acquires Klas

Summary: Anduril Industries acquired KLAS, a leading provider of advanced sensor and targeting technologies for defense and intelligence applications. KLAS specializes in high-performance radar and electro-optical systems critical to situational awareness and battlefield intelligence. This acquisition strengthens Anduril’s portfolio in autonomous defense solutions by integrating KLAS’s proven capabilities in sensor fusion and target tracking. The move underscores Anduril’s commitment to delivering next-generation, end-to-end defense platforms that enhance real-time decision-making across contested environments.

Strategic Advantages: KLAS’s expertise in multi-sensor integration and scalable, ruggedized hardware complements Anduril’s autonomous systems, creating a seamless pipeline from detection to engagement. The acquisition enables accelerated development of AI-powered situational awareness tools, bolstering capabilities in drone defense, perimeter security, and battlefield monitoring. KLAS’s deep relationships with key DoD customers and classified programs provide Anduril with expanded access to mission-critical markets and classified contracts. By combining Anduril’s software-defined autonomy with KLAS’s sensor innovation, the company is positioned to lead in delivering agile, modular defense solutions optimized for rapid deployment and evolving threats.

86.Vista Equity Partners and Blackstone Acquire Assent

Summary: Vista Equity Partners, in partnership with Blackstone, has acquired a controlling stake in Assent Inc., a leading provider of supply chain sustainability and compliance software headquartered in Ottawa. The transaction involved buying out prior venture investors—namely Volition Capital, First Ascent Ventures, Warburg Pincus, and StepStone Group—under a valuation in the neighborhood of US$1.3 billion, with a reported cash payment of approximately US$400 million to exiting shareholders. Assent’s platform supports enterprise clients in highly regulated manufacturing sectors, enabling them to manage supply chain risk, regulatory compliance, and ESG data through a scalable cloud-based SaaS solution. Concurrent with the ownership shift, the company appointed a new CEO from the United States and transitioned the founder‑CEO into an executive chairman role.

Strategic Advantages: This investment strengthens Assent’s trajectory toward scaling global operations by aligning it with two of the most influential enterprise software‐focused private equity firms. Assent gains access to Vista’s deep operational playbook in scaling SaaS businesses and Blackstone’s capital scale and institutional strength. Together, the firms bring governance rigor and roadmap alignment that can accelerate Assent’s evolution from steady recurring revenue growth to broader international expansion and deeper vertical penetration across industrial sectors. With momentum driven by a history of reliable ARR growth and adoption by nearly a thousand large manufacturers, Assent is well positioned to broaden its product and partnership ecosystem in supply chain compliance, ethical sourcing, and ESG risk management. The board reconfiguration and new executive leadership are structured to support an intensified focus on growth objectives, operational scale, and customer success, building on the company’s established track record and board alignment with Vista and Blackstone principals.

85. Karman Space & Defense Files for IPO

Summary: In early 2025, Karman Space & Defense confidentially filed for an initial public offering, positioning itself as one of the first pure-play space and hypersonics manufacturers to seek a public listing. Formed through the combination of multiple heritage aerospace and defense suppliers—most notably AAE Aerospace, Systima Technologies, and Bal Seal Engineering—Karman has rapidly scaled into a vertically integrated supplier of mission-critical hardware for the space launch, missile defense, and hypersonic sectors. The IPO marks a milestone not just for Karman, but for the broader emergence of space-adjacent industrial players as viable public-market entities.

Strategic Advantages: Karman’s growth story is driven by consolidation, modernization, and smart positioning. By integrating legacy defense suppliers under one roof, it built a scalable manufacturing footprint tailored for the new space race—supporting both commercial launch providers and prime contractors. Its capabilities span nose cones, separation mechanisms, and propulsion-adjacent hardware—essential components for both reusable launch systems and advanced missile architectures. Karman’s competitive edge lies in its speed-to-market, vertically integrated facilities, and ability to deliver high-reliability components at production scale. With government investment in hypersonics and resilient space architectures rising sharply, Karman sits in the sweet spot: a defense-grade manufacturer that’s nimble enough to support new entrants like Rocket Lab or Firefly, but qualified enough for classified DoD and MDA programs.

84. Quorum Cyber Acquires Kivu Consulting

Summary: Quorum Cyber, a fast-growing cybersecurity firm specializing in managed detection and response (MDR) services, has acquired Kivu Consulting, a U.S.-based cybersecurity and digital forensics provider. Kivu is known for its expertise in ransomware response, digital investigations, and cyber risk management, serving enterprises and insurers worldwide. The acquisition significantly expands Quorum Cyber’s incident response and forensic capabilities while strengthening its North American presence. Together, the two firms will offer a full spectrum of proactive and reactive cybersecurity services, from threat monitoring to breach response and recovery.

Strategic Advantages: The addition of Kivu enhances Quorum Cyber’s ability to provide rapid, end-to-end cyber resilience solutions. Kivu’s experience handling complex incidents and insurance partnerships complements Quorum Cyber’s managed security operations, enabling a more integrated and global service offering.

The acquisition also positions Quorum Cyber to compete more aggressively with large-scale security service providers by combining operational excellence with specialized response expertise. Strategically, this move aligns with increasing enterprise demand for unified cybersecurity partners capable of managing prevention, detection, and response under a single umbrella.

83. AeroVironment Acquires BlueHalo

Summary: In early 2025, defense technology leader AeroVironment acquired BlueHalo, a rapidly growing provider of advanced defense solutions spanning space, directed energy, cyber, and AI/ML-powered C5ISR systems. BlueHalo, backed by Arlington Capital Partners, had grown aggressively through acquisitions and internal R&D, carving out a leadership position in cutting-edge national security tech. AeroVironment, traditionally known for tactical UAS (unmanned aerial systems), positions this acquisition as a strategic leap into the higher end of the defense technology spectrum.

Strategic Advantages: This acquisition gives AeroVironment access to BlueHalo’s advanced capabilities in space and directed energy—domains increasingly prioritized in the Pentagon’s modernization roadmap. BlueHalo’s portfolio also includes proprietary technologies in autonomy, AI/ML, and RF engineering, which enhance AeroVironment’s offering beyond small UAS. The combined entity now covers a broader mission set: from tactical ISR and loitering munitions to space domain awareness and counter-UAS defense systems. BlueHalo’s government customer base (including key classified programs and defense R&D agencies) complements AeroVironment’s existing DoD footprint, while BlueHalo’s East Coast presence (HQ in Arlington, VA, plus facilities in Alabama, New Mexico, and Maryland) expands AeroVironment’s geographic and programmatic reach. This scale could also improve pipeline access to large IDIQs and OTA contracts.

82. Critical Insight Acquired by Lumifi

Summary: Lumifi (formerly SilverSky), a managed detection and response (MDR) provider, acquired Critical Insight in late 2024. Critical Insight, founded by ex-CISO Mike Hamilton, offers MDR and cybersecurity-as-a-service with a strong focus on healthcare and public sector clients. This was Lumifi’s third acquisition in 13 months, following rebranding from Cygilant/SilverSky, as it aggressively consolidates the MDR market.

Strategic Advantages: The acquisition doubles down on Lumifi’s healthcare and critical infrastructure market presence. Critical Insight brings a 24/7 SOC, incident response team, and professional services that complement Lumifi’s threat monitoring and “ShieldVision” platform. Essentially, Lumifi broadens its service portfolio: adding Critical Insight’s incident response and vCISO consulting to its MDR tech stack. Geographically, Critical Insight’s West Coast roots (Seattle) and client base (hospitals, local governments) extend Lumifi’s reach. By integrating, they likely achieve some economies (shared SOC infrastructure, unified platform development) and can present a stronger value prop: full lifecycle cyber defense, from prevention to response, tailored for regulated sectors. The press release highlighted this strengthening of offerings and presence in healthcare/critical infrastructure. It’s part of Lumifi’s strategy to grow both organically and via acquisition, aiming to build enough scale to perhaps IPO or be acquired itself. Each acquisition (Infocyte, Cysiv earlier, now Critical Insight) added either technology or market share. With Critical Insight, Lumifi also gains experienced practitioners (e.g., Critical Insight’s leadership includes former government security officials) which bolsters credibility.

81. Applied Insight Acquired by CACI

Summary: Federal IT contractor CACI International acquired Applied Insight in late 2024. Applied Insight (AI LLC), backed by The Acacia Group, is a cloud and analytics firm specializing in secure cloud migration, DevSecOps, and advanced cyber for the U.S. intelligence community (IC).

Strategic Advantages: This acquisition enhanced CACI’s cloud and mission IT offerings, particularly for classified environments. Applied Insight brought its alt-cloud platform (for secure AWS/Azure in air-gapped settings) and analytics tools like SHIFT, which help simulate classified cloud setups locally – key for intel and defense clients. Integrating this, CACI can now offer full-stack enterprise IT modernization, from infrastructure to application development, with the high security the IC demands. It aligns with CACI’s strategy to invest in high-growth tech areas. Notably, Applied Insight’s work with agencies like DHS and DoD expands CACI’s customer footprint and contract vehicles. CACI’s CEO noted the combined business will “enhance cloud, cyber, and user productivity for secure networks in the IC”, indicating synergy with CACI’s existing intel support business. Financially, while terms weren’t disclosed, Applied Insight’s ~$40M+ revenue (estimate) adds to CACI’s ~$6B, so it’s a tuck-in focused on capability gains rather than scale. It also preempted competition – preventing rivals from acquiring that tech.

80. Amelia Acquired by SoundHound

Summary: SoundHound AI, Inc., known for voice AI and speech recognition, acquired Amelia (IPsoft’s Amelia) for $80M in August 2024. Amelia is a conversational AI and digital assistant platform (originally from IPsoft) used by enterprises for customer service and IT support automation.

Strategic Advantages: This acquisition significantly expanded SoundHound’s scale and product reach in the booming conversational AI market. SoundHound primarily offered voice interface tech (e.g., for automotive and restaurants) and had gone public via SPAC in 2022. By adding Amelia, a leader in enterprise AI agents, SoundHound doubled its customer count to ~200 (including Fortune 500 companies) and projected combined 2025 revenue of $150M. It allowed SoundHound to diversify from its core voice applications into the broader digital assistant space (text-based chatbots, call center AI, etc.) – a timely move as generative AI drives demand for advanced virtual agents. Financially, paying $80M (mostly cash/equity) for a company that raised ~$189M was a bargain. SoundHound also assumed Amelia’s existing enterprise contracts (with big names like BNP Paribas and Fujitsu) and deep AI tech stack. The synergy is clear: SoundHound’s voice understanding + Amelia’s conversational workflows = next-gen AI assistants across voice and text. Post-acquisition, SoundHound could offer an end-to-end voice and chat solution, enhancing upsell opportunities. The deal also improved SoundHound’s financial outlook after a rough 2023 (stock was down, layoffs happened). With Amelia’s $45M revenue on board, SoundHound inches closer to profitability while expanding markets (IT helpdesk automation, etc.)

79. Marcum’s Non-Attest Business Acquired by CBIZ

Summary: In a major accounting industry deal, CBIZ, Inc. (a national professional services firm) acquired the non-attest business of Marcum LLP in early 2025, following Marcum’s splits from its audit practice (due to regulatory rules.) This effectively merged Marcum’s tax and consulting practice into CBIZ, making CBIZ a top-10 accounting firm with 160+ offices and 10,000+ employees.

Strategic Advantages: This acquisition propelled CBIZ into the elite ranks of accounting and advisory firms. By absorbing Marcum’s advisory business, CBIZ significantly expanded its geographic reach (Marcum was strong in the Northeast and Florida) and service offerings (like capital markets advisory, specialized consulting) without conflicting with audit independence (since attest stayed separate). CBIZ can now cross-sell a broader suite of services to both client bases, e.g., offering Marcum’s consulting expertise to CBIZ’s mid-market clients and vice versa. Economies of scale in back-office functions and vendor relationships will improve margins. Importantly, the combined firm’s national presence and talent pool make it more competitive for large engagements that require depth and breadth.

78. Challenger Acquired by Richardson Sales Performance

Summary: Richardson Sales Performance, a global leader in sales training and performance improvement, has acquired Challenger, the company behind the renowned “Challenger Sale” methodology. Challenger, founded in 2011, is known for its research-driven approach that helps organizations build high-performing sales teams by teaching reps to challenge customer thinking and drive insight-led conversations. The acquisition unites two of the most influential names in sales training, combining Challenger’s proven methodologies with Richardson’s scalable digital learning and performance analytics platform. Together, the companies aim to create the most comprehensive suite of sales enablement and performance solutions in the market.

Strategic Advantages: The merger brings together Richardson’s expertise in customized training delivery and sales transformation with Challenger’s deep intellectual property and behavioral science-based frameworks. This integration allows for end-to-end sales performance programs—from methodology design to digital reinforcement and analytics—under one brand.

By leveraging Challenger’s strong brand equity and Richardson’s global footprint, the combined organization is poised to accelerate growth across enterprise clients while expanding digital offerings. Strategically, this move reflects growing demand for data-driven, behavior-based sales enablement solutions that align training with measurable business outcomes.

77. Aeyon Acquired by CGI Federal

Summary: In late 2023, CGI Federal (U.S. arm of global IT firm CGI Inc.) acquired Aeyon, a rapidly growing consultancy specialized in AI, Robotic Process Automation (RPA), and financial management for U.S. federal agencies. Aeyon, backed by Enlightenment Capital, itself was formed by merging Artlin and Sehlke in 2021, with Bluetext’s help in branding (they crafted the Aeyon name and launch messaging, per their blog with CEO Sunny Singh discussing branding through M&A).

Strategic Advantages: For CGI Federal, acquiring Aeyon expands its capabilities in emerging tech and defense support services. Aeyon brings strong past performance in DoD financial management, Army robotics process automation, and Navy data analytics, complementing CGI’s traditional IT services. This helps CGI deepen relationships in national security agencies (Aeyon’s client list included defense and intelligence agencies). It also infuses entrepreneurial talent into CGI’s rather large organization – Aeyon’s leadership is known for agility and innovation. CGI cited the move as broadening its offerings in AI and automation for federal clients, aligning with government demand for digital transformation. Aeyon’s experience with the DoD’s financial systems and the JAIC’s AI initiatives can be leveraged across CGI’s wider client base. The acquisition underscores CGI’s strategy to grow via “build and buy,” adding niche expertise to bolster its federal footprint.

76. Axient Acquired by Astrion

Summary: Astrion, a Brightstar Capital Partners portfolio company, completed the acquisition of Axient (backed by Sagewind Capital) in September 2024. Astrion is a mission support and engineering contractor for U.S. government (recently formed, possibly combining former BRG assets), while Axient is a well-known defense and aerospace solutions provider (formed from a 2021 merger of QuantiTech, Millennium, Dynamic Concepts, etc.).

Strategic Advantages: By acquiring Axient, Astrion aims to set a new industry standard through enhanced scale and capabilities. The combined company addresses critical missions across defense and civilian agencies, spanning cybersecurity, systems engineering, space operations, and digital transformation. Essentially, Astrion + Axient creates a mid-sized powerhouse with end-to-end solutions, from R&D and testing (Axient’s forte in space and missiles) to operational mission support (Astrion’s focus). This breadth means they can bid on larger contracts and deliver more integrated offerings. For Axient’s customers (Space Force, Missile Defense, etc.), Astrion’s backing brings additional resources and capital to drive innovation – fulfilling the promise of “Accelerate Possible” that Bluetext helped brand. From Astrion’s perspective, acquiring Axient injects a large, experienced workforce (Axient had thousands of employees) and key contract vehicles, accelerating Astrion’s growth trajectory by years. The press release noted “benefits of scale” and expectation of substantial growth and exceptional outcomes. Private equity sponsors (Brightstar and Sagewind) also likely realize synergies: merging back-office functions and unifying go-to-market could improve margins.

75. Courvoisier Acquired by Campari

Summary: Italian spirits company Campari Group acquired Courvoisier, the famed French cognac brand, from Beam Suntory for €1.1B (~$1.2B) in December 2023. This was Campari’s largest deal ever, bringing one of the “big four” Cognac houses into its portfolio.

Strategic Advantages: The acquisition solidifies Campari’s push into the premium brown spirits category. Courvoisier becomes Campari’s fourth pillar (after aperitifs like Aperol, bourbon, and tequila). Strategically, it gives Campari a renowned Cognac to compete with Diageo’s Hennessy partnership and Pernod Ricard’s Martell in key markets. Immediately, it boosts Campari’s sales by ~9% and brings a spirit category (cognac) that’s seeing growth in the U.S. and China. For Campari, which previously only had a smaller cognac (Bisquit) and Grand Marnier (an orange liqueur with cognac base), acquiring Courvoisier fills a portfolio gap and diversifies its revenue. It also provides scale in the supply chain for cognac (aging stocks, production in Jarnac, etc.). Campari can leverage its global distribution to expand Courvoisier’s reach, especially in Asia-Pacific where cognac demand is strong. The brand equity of Courvoisier (associated with luxury and even pop culture) adds prestige to Campari’s lineup. CEO Kunze-Concewitz, about to retire, called it a “crowning achievement”, signaling its strategic importance. Marketing-wise, Campari can now tell a richer story of being a curator of iconic brands from bitters to cognac, appealing to premiumization trends. They might invest in Courvoisier’s branding (packaging, campaigns) as they did after acquiring Grand Marnier.

74. Keyloop Acquired Automotive Transformation Group (ATG)

Summary: UK-based automotive retail software provider Keyloop acquired Automotive Transformation Group (ATG) in May 2024. Keyloop (a Francisco Partners portfolio company, formerly part of CDK Global) offers dealer management systems (DMS) and digital solutions for car dealerships, while ATG (backed by Inflexion PE) provides an omnichannel e-commerce platform for car sales (from online reservations to showroom tools).

Strategic Advantages: The deal aims to create an integrated technology portfolio connecting the entire automotive consumer journey. By combining Keyloop’s back-end dealership software with ATG’s front-end retailing tools, the merged company can offer car manufacturers and dealers a seamless solution: from customer interest and online purchase, through financing and inventory management, to after-sales service. This meets the industry’s need for “omnichannel retailing” – consumers expect to transition smoothly between online car shopping and in-store experiences. Keyloop + ATG can facilitate things like online car configuration and pricing that flow directly into the dealer’s systems for a test drive or delivery scheduling. This streamlined customer experience can help dealerships increase sales conversions and improve customer satisfaction. Additionally, the acquisition expands Keyloop’s market share in Europe by adding ATG’s clients, and potentially allows cross-selling (Keyloop’s CRM or DMS to ATG customers, and vice versa). Efficiency-wise, integrated R&D can accelerate innovations like better data analytics for dealers.

73. Intelsat Acquired by SES

Summary: In April 2024, European satellite operator SES S.A. announced plans to acquire Intelsat for $3.1 billion in cash. This merger, pending regulatory approval (expected to close by late 2024 or 2025), would combine two of the world’s largest geostationary satellite services providers, creating a multi-orbit (GEO + MEO) communications behemoth.

Strategic Advantages: The SES-Intelsat merger would yield massive scale and synergies in the satellite industry. Together they’d control ~70 satellites and a deep global customer base in video, data, and government segments. SES touted €2.4B NPV in synergies (mostly cost savings and network integration benefits) with much realized within 3 years. A combined SES-Intelsat can offer customers integrated GEO and MEO (Medium Earth Orbit) solutions – SES’s O3b mPOWER MEO constellation complemented by Intelsat’s GEO fleet – to provide more flexible and resilient connectivity. This is crucial as competition from SpaceX Starlink (LEO) and others heats up; multi-orbit capabilities are a key differentiator. Additionally, consolidation reduces overlapping expenses in launch, ground infrastructure, and R&D, allowing more investment in next-gen satellites and services (like direct-to-device communication). For Intelsat, joining SES ends years of merger speculation and adds stability via SES’s stronger balance sheet. The combined entity can also better manage C-band spectrum transitions and monetization. Communication highlights include “creating a stronger and more competitive operator with expanded network and increased revenue in growth segments”.

72. Fastpath Acquired by Delinea

Summary: Privileged access management (PAM) company Delinea acquired Fastpath Solutions, an identity governance and access control software provider, closing in April 2024. Fastpath’s products help manage user access rights and SOD (segregation of duties) across business applications like ERP systems.

Strategic Advantages: The acquisition enables Delinea to offer an end-to-end identity security platform, blending PAM with Identity Governance and Administration (IGA). With Fastpath, Delinea can dynamically control user permissions in applications (like finance or HR systems) in addition to managing privileged accounts on servers and endpoints. This means customers get a unified view of who has what access and the ability to remediate risks (like over-privileged users or toxic combinations of access) automatically. As cybersecurity moves toward zero trust and least privilege, merging these capabilities is powerful. Delinea’s CEO said it solves complex identity challenges by connecting previously siloed solutions. It also positions Delinea against giants like CyberArk or SailPoint by having both PAM and IGA in-house. For Fastpath’s part, integration into Delinea’s cloud platform means its features can reach a wider market and be enhanced by Delinea’s identity threat detection tech. Communications perspective: likely emphasized “modernizing identity security with intelligent authorization”.

71. Eqlipse Technologies Acquired by BlueHalo

Summary: In early 2024, BlueHalo – a fast-growing defense tech firm – announced it will acquire Eqlipse Technologies, a provider of cybersecurity, signals intelligence, and cyber solutions to DoD and the Intelligence Community. Both were Arlington Capital portfolio companies, effectively merging under BlueHalo’s banner.

Strategic Advantages: Combining BlueHalo and Eqlipse creates a mid-tier defense tech powerhouse nearing $1B in revenue with 2,400 employees. BlueHalo gains Eqlipse’s high-end talent and products in cyber and RF sensing, enhancing BlueHalo’s capabilities in Space, c-UAS, electronic warfare, and AI. The merged entity can bid more competitively on large DoD programs, positioned as an alternative to the biggest primes by offering innovation without bureaucracy. Eqlipse was less than a year old under that brand, and now its identity and offerings bolster BlueHalo’s portfolio (indeed, BlueHalo cited Eqlipse’s contribution to Space Force’s $1.4B SCAR program). Culturally and strategically, both companies share a focus on rapid prototyping and mission-focused R&D, which the merger amplifies.

70. ZeroFox Acquired by Haveli

Summary: In May 2024, ZeroFox – a Baltimore-based external cybersecurity firm – was acquired and taken private by Haveli Investments for $350M. Haveli, a tech-focused PE firm in Austin, paid $1.14/share, a 45% premium on the 90-day stock price, and delisted ZeroFox from the Nasdaq.

Strategic Advantages: Going private under Haveli gives ZeroFox capital and strategic support to scale without public market pressure. Haveli likely sees long-term potential in ZeroFox’s platform (which includes AI threat intelligence, digital risk protection, and recent acquisitions like LookingGlass). With Haveli’s backing, ZeroFox can invest in R&D (perhaps developing new AI-driven threat disruption tools) and pursue new go-to-market channels (like MSSP partnerships or global expansion). The infusion of resources comes at a crucial time as cybersecurity threats proliferate; ZeroFox can now expand its external threat intelligence network and automation (“Disruption”) capabilities. Also, Haveli’s network might help ZeroFox land larger enterprise deals or federal contracts. For ZeroFox’s existing customers, Haveli’s ownership was positioned as a positive: more focus on innovation and customer success rather than quarterly earnings. Messaging from the CEO echoed this, noting the partnership will help “build a safer digital world” and accelerate product innovation. In short, as a private company ZeroFox can be more agile and aggressive in a fast-moving cyber market.

69. Kontron Americas Acquires Bsquare

Summary: Kontron Americas has acquired Bsquare, a leading provider of IoT enablement software and edge intelligence solutions. Bsquare’s expertise in device management, edge computing, and data orchestration enhances Kontron’s capabilities in delivering end-to-end industrial IoT and embedded computing solutions. The acquisition strengthens Kontron’s position across key verticals such as manufacturing, energy, and transportation by enabling smarter, more connected operations with scalable and secure edge-to-cloud platforms.

Strategic Advantages: Bsquare’s software-centric approach complements Kontron’s hardware portfolio, creating a comprehensive ecosystem that accelerates digital transformation initiatives for industrial customers. With deep experience in managing heterogeneous device fleets and optimizing data workflows at the edge, Bsquare enhances Kontron’s ability to deliver flexible, reliable, and secure IoT solutions. The combined entity benefits from broadened customer relationships across critical sectors and expanded R&D capabilities to innovate in AI-powered edge analytics, predictive maintenance, and real-time operational intelligence. Together, they are well positioned to capitalize on growing demand for integrated edge computing architectures that improve efficiency, reduce downtime, and enable actionable insights across industrial environments.

68. Verve Industrial Acquired by Rockwell Automation

Summary: Industrial automation giant Rockwell Automation acquired Verve Industrial Protection (an OT/ICS cybersecurity firm) in late 2023. Verve offers a unified platform for asset discovery, vulnerability assessment, and threat monitoring in operational technology (factory and utility networks).

Strategic Advantages: Rockwell’s acquisition of Verve reflects the trend of IT-OT convergence: marrying industrial controls with robust cybersecurity. By embedding Verve’s vendor-neutral OT security platform into its offerings, Rockwell can now deliver a turnkey solution to its manufacturing and energy customers – not just automating processes but also securing them. This is a critical differentiator as cyber threats to critical infrastructure rise. The move expands Rockwell’s suite in its software & services segment, likely offering Verve’s solution alongside Rockwell’s FactoryTalk software. Rockwell gains Verve’s domain expertise and its established client base in industries like oil & gas and utilities. Moreover, Verve’s capability to secure multi-vendor environments appeals to customers who run mixed control systems. Financially, at an estimated $190M price, it’s a relatively small acquisition for Rockwell with potentially big returns via new service contracts and recurring revenue (cyber monitoring subscriptions). In terms of marketing, Rockwell can now message a “secure automation” story: “We not only optimize your operations, we protect them.” That alignment of mission likely guided the communications around the deal, emphasizing enhanced reliability and safety for clients.

67. Ardent Acquired by Mission1st Group

Summary: Government IT contractor Mission1st Group acquired Ardent Management Consulting (Ardent MC) in mid-2024. Ardent is a 17-year-old digital transformation and geospatial analytics provider for federal agencies, and Mission1st (a veteran-owned firm) focuses on defense IT and engineering.

Strategic Advantages: This acquisition combines Mission1st’s defense market success with Ardent’s deep civilian agency expertise. Mission1st can now offer a broader slate of services – from military communications support to civilian agency cloud and data analytics – under one roof. For Ardent, joining Mission1st brings scale and access to Mission1st’s defense contracts, potentially opening new revenue streams (e.g., applying Ardent’s geospatial tech to DoD needs). The two companies’ capabilities are complementary, allowing cross-pollination of solutions (like Ardent’s location intelligence for Mission1st’s Army clients, or Mission1st’s cyber skills for Ardent’s DHS clients). Leadership quoted in the announcement highlighted leveraging “collective strengths” to enhance delivery for all customers. Strategically, the deal creates a mid-sized GovCon competitor with both DoD and civilian past performance – making them more competitive for large multi-agency IT contracts. Communications wise, the integration likely rebranded Ardent as “Ardent, a Mission1st company,” focusing on continuity of services.

66. RiskLens Acquired by Safe Security

Summary: Safe Security, a Palo Alto-based cyber risk management firm, acquired RiskLens in mid-2023. RiskLens is the pioneer of cyber risk quantification using the FAIR model (Factor Analysis of Information Risk). By joining forces, Safe Security aimed to create the undisputed leader in Cyber Risk Quantification (CRQ) and management.

Strategic Advantages: The combination marries RiskLens’ quantitative risk modeling with Safe’s real-time risk scoring platform, yielding a comprehensive view of cyber risk in financial terms. Customers benefit from automated, data-driven risk assessments that align with business impact – essentially, a “single pane of glass” for CISOs to prioritize security investments. Safe Security can now answer Board-level questions (“How much risk in dollars are we carrying?”) by leveraging RiskLens’ FAIR-standard calculations, something competitors may lack. This move differentiates Safe in the $4B CRQ market as a one-stop leader. Culturally, both companies focus on translating cyber metrics into business language, so integration is smoother. The strategic messaging is about transformation: “Together, we transform cyber risk management from guesswork into science.” This resonates with enterprise clients and was indeed the pitch – empowering customers with a real-time, standard model to manage risk proactively. In sum, Safe + RiskLens gives enterprises a powerful tool to make smarter, financially grounded security decisions, reinforcing Safe’s vision of holistic, AI-driven cyber risk management.

65. Imageware Systems Acquired by TECH5

Summary: Swiss-based biometrics company TECH5 acquired the assets of Imageware Systems (a U.S. biometric authentication firm) in early 2023. The deal included all software, patents, and key staff of Imageware, known for biometric identity management solutions for law enforcement and enterprise.

Strategic Advantages: This acquisition strengthened TECH5’s presence in North America and broadened its biometric product suite. TECH5, which provides fingerprint, face, and iris recognition tech, can integrate Imageware’s user-friendly biometric software (including its multimodal biometric management platform) to offer more complete solutions. Gaining Imageware’s patents accelerates TECH5’s innovation pipeline and possibly opens new verticals (Imageware had government and law enforcement clients). Importantly, TECH5 can reassure Imageware’s existing customers by continuing support and improving the acquired products with TECH5’s AI algorithms. The combination promises “the best UI and AI-driven authentication software” under one roof. Marketing wise, TECH5 pitched this as combining TECH5’s biometrics engines with Imageware’s proven front-end solutions, delivering more accurate and user-friendly ID systems.

64. VMware Acquired by Broadcom

Summary: Broadcom Inc. – known for semiconductors and enterprise software – acquired VMware for approximately $69 billion in a cash-and-stock deal. Finalized in late 2023 after regulatory delays, this landmark merger combined Broadcom’s infra and security software (CA, Symantec enterprise) with VMware’s cloud and virtualization suite.

Strategic Advantages: Broadcom aims to build “the world’s leading infrastructure technology company”. With VMware, Broadcom gains a dominant position in multi-cloud services used by enterprises globally. The strategic logic: pair Broadcom’s existing mainframe and security software with VMware’s cloud offerings to sell an integrated stack to large customers. The deal also nearly doubles Broadcom’s software revenue, diversifying beyond semiconductors. Broadcom touts significant synergies – both cost (via efficiencies, unfortunately including layoffs) and revenue (by cross-selling VMware to its clients). There are innovation benefits too: Broadcom’s resources can help VMware accelerate R&D in cloud networking, AI integration, and edge computing. For VMware users, Broadcom has pledged to continue support and investment (though some customers have warily watched pricing). Communication strategy would stress continuity and enhanced support: “VMware’s innovation + Broadcom’s scale = better solutions for your multi-cloud future”.

63. LookingGlass Acquired by ZeroFox

Summary: External cybersecurity firm ZeroFox (focused on digital risk protection) acquired LookingGlass Cyber Solutions for about $26 million in 2023. LookingGlass brought expertise in external attack surface management (EASM) and threat intelligence, complementing ZeroFox’s social media and digital threat hunting platform.

Strategic Advantages: The acquisition allowed ZeroFox to offer a full-spectrum external cyber risk platform. By folding in LookingGlass, ZeroFox added capabilities to monitor clients’ entire internet-facing footprint (domains, IPs, infra) and not just social/digital channels. This broadens ZeroFox’s value proposition to CISO customers: one vendor for brand protection, dark web monitoring, and attack surface reduction. Financially, acquiring at $26M (primarily in stock) was relatively inexpensive, leveraging ZeroFox’s then-public stock currency. Post-IPO, ZeroFox likely sought growth via acquisitions to meet shareholder expectations. With LookingGlass, ZeroFox could upsell new services to its base and attract larger enterprise deals with a more comprehensive suite.

62. Cvent Acquired by Blackstone

Summary: Event-management software leader Cvent was taken private by Blackstone in a $4.6 billion deal, completed mid-2023. Blackstone, a global PE firm, bought Cvent’s outstanding shares (at $8.50/share) and delisted the company from Nasdaq.

Strategic Advantages: As a private entity under Blackstone, Cvent can pursue long-term growth strategies away from public market pressures. Blackstone’s investment provides capital and industry connections (especially in hospitality) to help Cvent innovate its SaaS for meetings and events. The deal came as tech valuations dipped, giving Blackstone a bargain for a firm once valued higher. Blackstone can streamline Cvent’s operations (they reportedly planned cost cuts and workforce optimization) and potentially merge Cvent with other portfolio companies to expand its reach (e.g., combining with venue or travel tech assets). For Cvent, the infusion of resources and strategic guidance means accelerated development of its event marketing platform and possibly acquisitions of complementary tech (indeed, after going private, Cvent quickly acquired other software like Jifflenow.)

61. Paya Acquired by Nuvei

Summary: Nuvei, a Canadian fintech, acquired Paya (a U.S. integrated payments processor) for $1.3 billion in an all-cash deal, completed in February 2023. Paya specializes in payments embedded in software for sectors like non-profits, utilities, and B2B – complementing Nuvei’s global e-commerce payment platform.

Strategic Advantages: The acquisition created a payments powerhouse spanning global e-commerce and high-growth integrated payments. Nuvei gains Paya’s 300+ software integrations and strong foothold in U.S. B2B and government/utility payments. This diversifies Nuvei’s revenue streams, adding counter-cyclical stability (B2B and bill-pay tend to be less volatile than consumer retail). Technologically, plugging Paya into Nuvei’s platform enhances Nuvei’s offering with ACH processing, invoicing, and other capabilities Paya excels in. Nuvei’s CEO noted it speeds Nuvei’s growth into new verticals and allows them to offer a more comprehensive, “revenue-driving” payment solution to merchants.

60. Micro Focus Acquired by OpenText

Summary: In a mega-software deal, Canada’s OpenText acquired UK-based Micro Focus for roughly $6 billion. The acquisition (closed in early 2023) combined OpenText’s enterprise information management cloud software with Micro Focus’s legacy IT operations, security, and DevOps tools, nearly doubling OpenText’s revenue.

Strategic Advantages: OpenText’s goal is to become one of the world’s largest software and cloud businesses. By absorbing Micro Focus, OpenText instantly added a “tremendous marquee customer base” and expanded its product portfolio into mainframe software, cybersecurity, and IT management. There’s significant cross-sell opportunity: OpenText can offer its cloud-based information management to Micro Focus’s customers, while modernizing Micro Focus’s offerings with cloud and AI capabilities. The deal also promised ~$400M in cost synergies via consolidation, though it involved workforce reductions. This scale and breadth better positions OpenText against competitors like IBM.

59. CertainPath Merged with Mojio

Summary: CertainPath (formerly Success Group International), a provider of software and training for home service contractors, partnered/merged with Mojio to integrate Mojio’s connected fleet management platform (“Force by Mojio”) into CertainPath’s offering. This tie-up was described as joining forces rather than a full acquisition, but it effectively merges Mojio’s telematics services with CertainPath’s contractor management systems.

Strategic Advantages: The integrated solution provides home service businesses a seamless way to manage both operations and vehicles. CertainPath’s members (plumbers, HVAC, electricians, etc.) can access real-time van/truck tracking, driver safety scores, and maintenance alerts within the same platform they use for job scheduling and invoicing. This enhances operational efficiency: contractors reduce fuel costs and improve on-time service by routing and dispatching smarter. Mojio gains distribution to CertainPath’s nationwide member base, expanding its reach in the $650B home services market. By merging software and telematics, the partnership delivers an end-to-end solution competitors will find hard to match.

58. Revegy Acquired by Dura Software

Summary: Revegy, a sales optimization and revenue enablement software provider, was acquired by Dura Software in November 2022. Dura, known for buying “hyper-niche” software companies, made Revegy its 11th acquisition. Revegy’s platform helps enterprise sales teams manage complex accounts and relationships, functioning as a CRM-agnostic solution with 30,000 global users.

Strategic Advantages: With Revegy, Dura expanded its portfolio into sales enablement software, complementing existing holdings like 6Connex and Moki. The acquisition allows cross-pollination of technology and customers: Dura can infuse operational expertise and capital to grow Revegy’s product suite and market reach. For Revegy, joining Dura provides resources to innovate features (like AI-driven account insights) and enter new verticals under the umbrella of a company committed to “best-in-class” software solutions. Dura’s hyper-niche strategy means Revegy will receive focused attention to remain a leader in its segment. Bluetext’s emphasis on clear value storytelling in M&A would help communicate to Revegy’s clients that the acquisition strengthens long-term product support and innovation, reassuring them during the transition.

57. Dynamyx (Inspirata) Acquired by Fujifilm

Summary: Fujifilm Healthcare acquired the Dynamyx digital pathology business from Inspirata, integrating Inspirata’s FDA-cleared digital pathology platform into Fujifilm’s medical imaging portfolio. The deal included Dynamyx software, employees, and IP, giving Fujifilm a foothold in pathology informatics.

Strategic Advantages: For Fujifilm, acquiring Dynamyx accelerates its push into digital healthcare solutions. Fujifilm established a new digital pathology division to combine Dynamyx with its Synapse® Enterprise Imaging suite, aiming to integrate pathology images into hospital EHR systems. This creates a one-stop solution for radiology and pathology imaging, streamlining cancer diagnostics for care teams. Fujifilm can now leverage Dynamyx’s open architecture and multi-scanner support to challenge other industry players (like Philips). For Inspirata, the acquisition validated its technology and allowed its pathology innovations to scale globally under Fujifilm’s umbrella. BlueText’s earlier efforts in building Inspirata’s brand narrative around patient impact likely contributed to its credibility and appeal, showcasing the power of strategic branding in M&A outcomes.

56. SpaceIQ Merged with iOffice to Form Eptura

Summary: SpaceIQ and iOffice, key players in workplace management software, merged to form Eptura, a unified “worktech” powerhouse. This consolidation, backed by private equity firms Thoma Bravo and JMI Equity, pooled together SpaceIQ’s integrated workplace solutions (including legacy brands Archibus and Serraview) with iOffice’s asset management tools. The merger coincided with Condeco’s integration, as all three converged to create a comprehensive workplace experience platform.

Strategic Advantages: By forming Eptura, the companies expanded their market reach and product breadth. Eptura offers end-to-end workplace and asset management, addressing hybrid work challenges with solutions for space planning, resource scheduling, and asset tracking. The combined entity leverages shared R&D to accelerate innovation and respond to the evolving “future of work” demands. With Thoma Bravo and JMI’s backing, Eptura gains financial heft to invest in technology like AI-driven workspace analytics, plus cross-selling opportunities to a broad customer base. BlueText’s branding of SpaceIQ ensured the new venture launched with a strong digital presence, clearly communicating the benefits of the merger to customers and investors.

55. Illusive Acquired by Proofpoint

Summary: Proofpoint, a cybersecurity and compliance company, acquired Illusive, a leader in Identity Threat Detection and Response (ITDR).

Strategic Advantage: The acquisition strengthened Proofpoint’s threat and information protection platforms, providing customers with a unified solution to address identity-based threats.

54. E. Cohen & Company Merged into Marcum

Summary: Marcum LLP, a national accounting and advisory services firm, merged with E. Cohen & Company, CPAs, a Rockville, Maryland-based accounting firm.

Strategic Advantage: The merger expanded Marcum’s presence in the Mid-Atlantic region and enhanced its service offerings to clients in the area.

53. Octo Acquired by IBM

Summary: IBM announced the acquisition of Octo, a U.S.-based IT modernization and digital transformation services provider serving the federal government.

Strategic Advantage: The acquisition aimed to establish one of the largest digital transformation partners for the federal government, enhancing IBM’s consulting capabilities in the public sector.

52. Cybeats Technologies Listed on the Canadian Securities Exchange

Summary: Cybeats Technologies Corp., a cybersecurity company specializing in Software Bill of Materials (SBOM) management and software supply chain intelligence, commenced trading on the Canadian Securities Exchange under the symbol “CYBT.”

Strategic Advantage: The listing provided Cybeats with access to public capital markets, enabling it to expand its cybersecurity solutions and address the growing demand for software supply chain security.

51. Level Access Merged with eSSENTIAL Accessibility

Summary: Level Access, a provider of enterprise digital accessibility solutions, merged with eSSENTIAL Accessibility, a pioneer of Accessibility-as-a-Service, to create a comprehensive digital accessibility solutions provider.

Strategic Advantage: The merger combined complementary technologies and expertise, accelerating the mainstream adoption of digital accessibility and offering end-to-end solutions for clients.

50. GCP Applied Technologies Acquired by Saint-Gobain

Summary: French construction materials leader Saint-Gobain acquired GCP Applied Technologies, a U.S.-based provider of specialty construction chemicals, for approximately $2.3 billion. GCP, known for its cement additives, concrete admixtures, and other high-performance building solutions, brought an established global footprint and complementary technologies to Saint-Gobain. This acquisition strengthens Saint-Gobain’s position in the construction chemicals sector and enhances its portfolio across high-performance and specialty building materials.

Strategic Advantage: The acquisition provides Saint-Gobain with an expanded product portfolio, incorporating GCP’s expertise in cement additives, concrete admixtures, and specialty construction chemicals, which complements the company’s existing CertainTeed and Chryso brands. GCP’s North American presence and international operations extend Saint-Gobain’s reach into key markets, while its proprietary technologies in high-performance building solutions strengthen Saint-Gobain’s innovation pipeline. Integrating GCP with Saint-Gobain’s CertainTeed and Chryso divisions is expected to improve operational efficiency and create new cross-selling opportunities. Overall, the combined entity positions Saint-Gobain as a global leader in construction chemicals, enabling growth in high-margin, specialized segments and reinforcing its competitive advantage in the industry.

49. ManTech Acquired by Carlyle Group

Summary: Global investment firm Carlyle Group acquired ManTech International, a cyber and technology contractor for defense, intelligence, and civilian agencies, in an all-cash transaction valued at approximately $4.2 billion.

Strategic Advantage: The acquisition aimed to leverage ManTech’s expertise in cybersecurity and technology solutions to enhance Carlyle’s portfolio in the government services sector.

48. Citrix Acquired by Vista Equity Partners and Evergreen Coast Capital

Summary: Affiliates of Vista Equity Partners and Evergreen Coast Capital completed the acquisition of Citrix Systems, a leader in cloud computing and virtualization technology, in an all-cash transaction valued at $16.5 billion.

Strategic Advantage: The acquisition aimed to take Citrix private, allowing the company to accelerate its SaaS transformation and expand its platform for secure hybrid work solutions.

47. ID Technologies Acquired by CACI

Summary: CACI International acquired ID Technologies, an enterprise IT and network modernization provider with NSA-compliant Commercial Solutions for Classified (CSfC) technology.

Strategic Advantage: The acquisition expanded CACI’s secure network modernization capabilities, enhancing its offerings for U.S. government clients requiring classified communication solutions.

46. Cvent Goes Public via SPAC Merger with Dragoneer Growth Opportunities Corp. II

Summary: Cvent, a meetings, events, and hospitality technology provider, completed its merger with Dragoneer Growth Opportunities Corp. II, a special purpose acquisition company, and began trading on the Nasdaq as “CVT.”

Strategic Advantage: The merger provided Cvent with capital to accelerate product innovation and expand its market presence in the event technology sector.

45. Quest Acquired by Clearlake Capital

Summary: Clearlake Capital Group completed the acquisition of Quest Software, a global cybersecurity, data intelligence, and IT operations management software provider.

Strategic Advantage: The acquisition aimed to accelerate Quest’s growth and drive momentum in its cybersecurity and data intelligence solutions, leveraging Clearlake’s resources and expertise.

44. Narrative Science Acquired by Salesforce

Summary: Salesforce acquired Narrative Science, a data storytelling company, integrating its capabilities into Salesforce’s Tableau Software.

Strategic Advantage: This acquisition enhanced Tableau’s analytics platform by adding automated data storytelling features, enabling users to better understand and communicate data insights.

43. ResMan Acquired by Inhabit IQ

Summary: Inhabit IQ, a collective of tech-forward products serving the property management industry, acquired ResMan, a leading property management SaaS platform provider.

Strategic Advantage: This acquisition allowed Inhabit IQ to enhance its suite of solutions for multifamily and commercial property management, offering more comprehensive and integrated services to its clients.

42. BigBear.ai Goes Public via SPAC Merger with GigCapital4

Summary: BigBear.ai, an AI-powered analytics company, merged with GigCapital4, a special purpose acquisition company, to become a publicly traded entity.

Strategic Advantage: The merger provided BigBear.ai with capital to accelerate growth and expand its AI analytics offerings across various sectors.

41. Perspecta Acquired by Peraton

Summary: Peraton acquired Perspecta, a government services provider, to create a leading government technology solutions contractor.

Strategic Advantage: The acquisition combined complementary capabilities, enhancing Peraton’s ability to deliver comprehensive solutions to federal agencies.

40. Abaco Systems Acquired by Ametek

Summary: Ametek acquired Abaco Systems, a provider of embedded computing solutions, to expand its electronic instruments and electromechanical devices portfolio.

Strategic Advantage: The acquisition strengthened Ametek’s position in the defense and industrial markets, leveraging Abaco’s embedded computing expertise.

39. MuseDev Acquired by Sonatype

Summary: Sonatype acquired MuseDev, a software quality automation company, to enhance its software supply chain management platform.

Strategic Advantage: This acquisition allowed Sonatype to offer integrated code quality and security solutions, helping organizations manage and secure their software development processes.

38. Blue Yonder Acquired by Panasonic

Summary: Panasonic acquired Blue Yonder, a supply chain management software company, to enhance its autonomous supply chain capabilities.

Strategic Advantage: The acquisition enabled Panasonic to integrate Blue Yonder’s AI-driven supply chain solutions with its hardware offerings, providing comprehensive solutions for logistics and manufacturing clients.

37. Clarabridge Acquired by Qualtrics

Summary: Qualtrics acquired Clarabridge, a customer experience management platform, to enhance its experience management capabilities.

Strategic Advantage: This acquisition allowed Qualtrics to offer more robust customer insights and analytics solutions, strengthening its position in the experience management market.

36. Cloudera Acquired by KKR and CD&R

Summary: Investment firms KKR and Clayton, Dubilier & Rice (CD&R) acquired Cloudera, a data management and analytics company, to take it private and drive its next phase of growth.

Strategic Advantage: The acquisition provided Cloudera with resources and strategic guidance to enhance its product offerings and expand its market presence in the data analytics sector.

35. Alfresco Acquired by Hyland

Summary: Hyland acquired Alfresco, an open-source content services provider, to expand its content management capabilities.

Strategic Advantage: This acquisition allowed Hyland to offer a more comprehensive suite of content services solutions, catering to a broader range of industries and use cases.

34. PacStar Acquired by Curtiss-Wright

Summary: Curtiss-Wright acquired PacStar, a provider of tactical communications solutions, to enhance its defense electronics portfolio.

Strategic Advantage: The acquisition strengthened Curtiss-Wright’s offerings in battlefield communications, providing integrated solutions for military applications.

33. Centauri Acquired by KBR

Summary: KBR acquired Centauri, a provider of engineering and technology solutions for national security, to expand its defense and intelligence capabilities.

Strategic Advantage: This acquisition enhanced KBR’s position in the government solutions sector, allowing it to offer a broader range of services to defense and intelligence clients.

32. Paya Goes Public via SPAC Merger with FinTech Acquisition Corp III

Summary: Paya, a leading integrated payments and commerce solutions provider, went public through a merger with FinTech Acquisition Corp III, a special purpose acquisition company (SPAC), in late 2020. The transaction positioned Paya on the NASDAQ under the ticker symbol “PAYA,” enabling it to access public capital markets while continuing its strategic expansion across high-growth verticals such as healthcare, education, non-profit, and field services.

Strategic Advantage: The SPAC merger offered Paya both financial and strategic runway to scale its operations in a competitive and rapidly evolving fintech landscape. Paya’s move exemplifies how verticalized fintech platforms can leverage public markets—not just for liquidity, but as a catalyst for category leadership and innovation.

31. LGS Innovations Acquired by CACI

Summary: CACI International acquired LGS Innovations, a provider of C4ISR and cybersecurity solutions, to strengthen its offerings for defense and intelligence clients.

Strategic Advantage: The acquisition bolstered CACI’s capabilities in communications and cybersecurity, enhancing its ability to serve national security missions.

30. Bronfman Rothschild Acquired by NFP

Summary: NFP acquired Bronfman Rothschild, a wealth management firm, to expand its investment advisory services.

Strategic Advantage: This acquisition allowed NFP to enhance its wealth management capabilities, offering clients a broader range of financial planning and investment services.

29. KnightPoint Acquired by Perspecta

Summary: Perspecta acquired KnightPoint Systems, a cybersecurity and IT services firm, to bolster its cybersecurity offerings for government clients.

Strategic Advantage: The acquisition enhanced Perspecta’s ability to provide comprehensive cybersecurity solutions, addressing the critical needs of federal agencies.

28. GoCanvas Acquired by K1

Summary: K1 Investment Management acquired GoCanvas, a mobile platform for businesses to automate workflows, to accelerate its growth and product development.

Strategic Advantage: This acquisition provided GoCanvas with resources to enhance its platform and expand its market reach, strengthening its position in the mobile workflow automation sector.

27. Cority Acquired by Thoma Bravo

Summary: Thoma Bravo acquired Cority, a provider of environmental, health, and safety (EHS) software, to expand its investment in the EHS sector.

Strategic Advantage: The acquisition allowed Thoma Bravo to leverage Cority’s market position and technology to drive growth in the EHS software market.

26. Endgame Acquired by Elastic

Summary: Elastic acquired Endgame, a security company specializing in endpoint protection, to integrate security capabilities into its search and analytics platform.

Strategic Advantage: This acquisition enabled Elastic to offer users integrated security solutions, enhancing its platform’s appeal to organizations seeking comprehensive data analysis and protection.

25. Earth Networks Acquired by Union Park Capital

Summary: Union Park Capital acquired Earth Networks, a provider of weather intelligence solutions, to enhance its environmental monitoring portfolio.

Strategic Advantage: The acquisition allowed Union Park Capital to expand its offerings in the environmental data sector, leveraging Earth Networks’ technology and expertise.

24. Mindtree Acquired by L&T

Summary: Larsen & Toubro (L&T) acquired Mindtree, an IT services and consulting company, to expand its digital services capabilities.

Strategic Advantage: This acquisition strengthened L&T’s position in the IT services sector, allowing it to offer a broader range of digital transformation solutions to clients.

23. CQ Roll Call Acquired by FiscalNote

Summary: FiscalNote acquired CQ Roll Call, a provider of congressional news and legislative tracking, to expand its policy and analysis offerings.

Strategic Advantage: The acquisition enabled FiscalNote to provide clients with a more robust set of tools for policy monitoring and analysis, enhancing its value proposition in the legislative intelligence market.

22. BroadSoft Acquired by Cisco

Summary: Cisco acquired BroadSoft, a global leader in cloud-based communications, to enhance its cloud collaboration portfolio.

Strategic Advantage: This acquisition allowed Cisco to offer a comprehensive suite of unified communications solutions, strengthening its position in the cloud communications market.

21. PlanetRisk Federal Acquired by Culmen Technologies

Summary: In a move that deepens its national security and risk intelligence capabilities, Culmen Technologies acquired the federal business unit of PlanetRisk in early 2025. PlanetRisk Federal, known for delivering advanced geospatial, threat intelligence, and predictive analytics solutions to U.S. government agencies, strengthens Culmen’s footprint across the defense, intelligence, and homeland security markets. The acquisition aligns with Culmen’s strategy to expand its mission-critical support across the full threat lifecycle—combining operational expertise with enhanced data-driven insights.

Strategic Advantages: This acquisition brings immediate scale and capability lift to Culmen’s national security offerings. PlanetRisk Federal’s strengths in real-time situational awareness, data fusion, and predictive modeling directly complement Culmen’s existing programs in international security, logistics, and threat reduction.

20. PlanetRisk Acquired by Everbridge

Summary: Everbridge acquired PlanetRisk, a risk analytics company, to enhance its critical event management capabilities.

Strategic Advantage: This acquisition allowed Everbridge to provide more robust risk assessment and management solutions, strengthening its position in the critical event management sector.

19. Lithium Merged with Khoros

Summary: Lithium Technologies merged with Spredfast to form Khoros, a customer engagement platform.

Strategic Advantage: The merger combined complementary technologies, enabling Khoros to offer integrated solutions for customer engagement across multiple channels.

18. ThreatTrack (Vipre) Acquired by J2 Global

Summary: J2 Global acquired Vipre, a cybersecurity company, to expand its portfolio of internet security solutions.

Strategic Advantage: The acquisition allowed J2 Global to offer a more comprehensive suite of security products, enhancing its competitiveness in the cybersecurity market.

17. Endgame Acquired by Accenture Federal Services

Summary: Accenture Federal Services acquired Endgame, a cybersecurity firm specializing in endpoint protection, to bolster its security offerings for government clients.

Strategic Advantage: This acquisition enhanced Accenture’s ability to provide advanced cybersecurity solutions, addressing the critical needs of federal agencies in protecting against evolving cyber threats.

16. XO Communications Acquired by Verizon

Summary: Verizon acquired XO Communications, expanding its fiber-optic network and enhancing its enterprise service capabilities.

Strategic Advantage: The acquisition strengthened Verizon’s infrastructure, enabling it to offer improved services to enterprise customers and support the growing demand for high-speed connectivity.

15. NetWatcher Acquired by Qualys

Summary: Qualys acquired NetWatcher, a provider of network security solutions, to enhance its cloud-based security and compliance offerings.

Strategic Advantage: Integrating NetWatcher’s capabilities allowed Qualys to offer more robust and comprehensive security solutions, addressing the increasing demand for cloud security.

14. Sage Acquired by GTCR

Summary: Private equity firm GTCR acquired Sage Payment Solutions, aiming to expand its presence in the payment processing industry.

Strategic Advantage: The acquisition provided GTCR with a platform to capitalize on the growing electronic payments market, leveraging Sage’s technology and customer base.

13. CB&I Acquired by Veritas Capital