Preparing your brand for a buyout or acquisition isn’t just a nice-to-have—it’s essential for maximizing valuation, attracting the right buyers, and ensuring a smooth post-acquisition integration. Companies with strong, clear, and consistent branding are more likely to stand out during due diligence, command higher valuations, and retain customers and employees during the transition. By taking strategic steps to strengthen your brand, you set your company up for both financial and operational success.

Understand the Role of Brand in Acquisitions

Buyers don’t just acquire products, services, or market share—they acquire your brand. A strong brand signals credibility, reliability, and market differentiation, which are key factors in valuation. Tangible assets like logos, websites, and collateral matter, but intangible assets—like reputation, thought leadership, and customer trust—often carry even more weight.

Key Takeaways:

- A well-positioned brand can increase perceived company value.

- Strong branding reduces risk perception for buyers.

- Intangible assets are often as critical as tangible ones in valuation.

Audit Your Current Brand Positioning

A comprehensive brand audit is the first step in preparing for a sale. Evaluate your visual identity, messaging, digital presence, and market perception. Use analytics, surveys, and competitor benchmarking to uncover strengths and gaps. The goal is to ensure your brand communicates value clearly and resonates with potential buyers.

Action Steps:

- Review logos, color schemes, and visual design for modern appeal.

- Analyze messaging consistency across website, social media, and collateral.

- Benchmark against competitors to identify opportunities for differentiation.

Strengthen Brand Messaging and Identity

Clear, consistent messaging and a modern visual identity are crucial for attracting suitors. Define your value proposition and differentiate your company from competitors. Ensure messaging is consistent across websites, social media, presentations, and sales collateral. A strong, cohesive brand identity helps potential buyers quickly understand your company’s strengths, vision, and market potential.

Tips for Messaging Success:

- Highlight what makes your company unique.

- Use language that resonates with target buyers.

- Maintain consistency across all brand touchpoints.

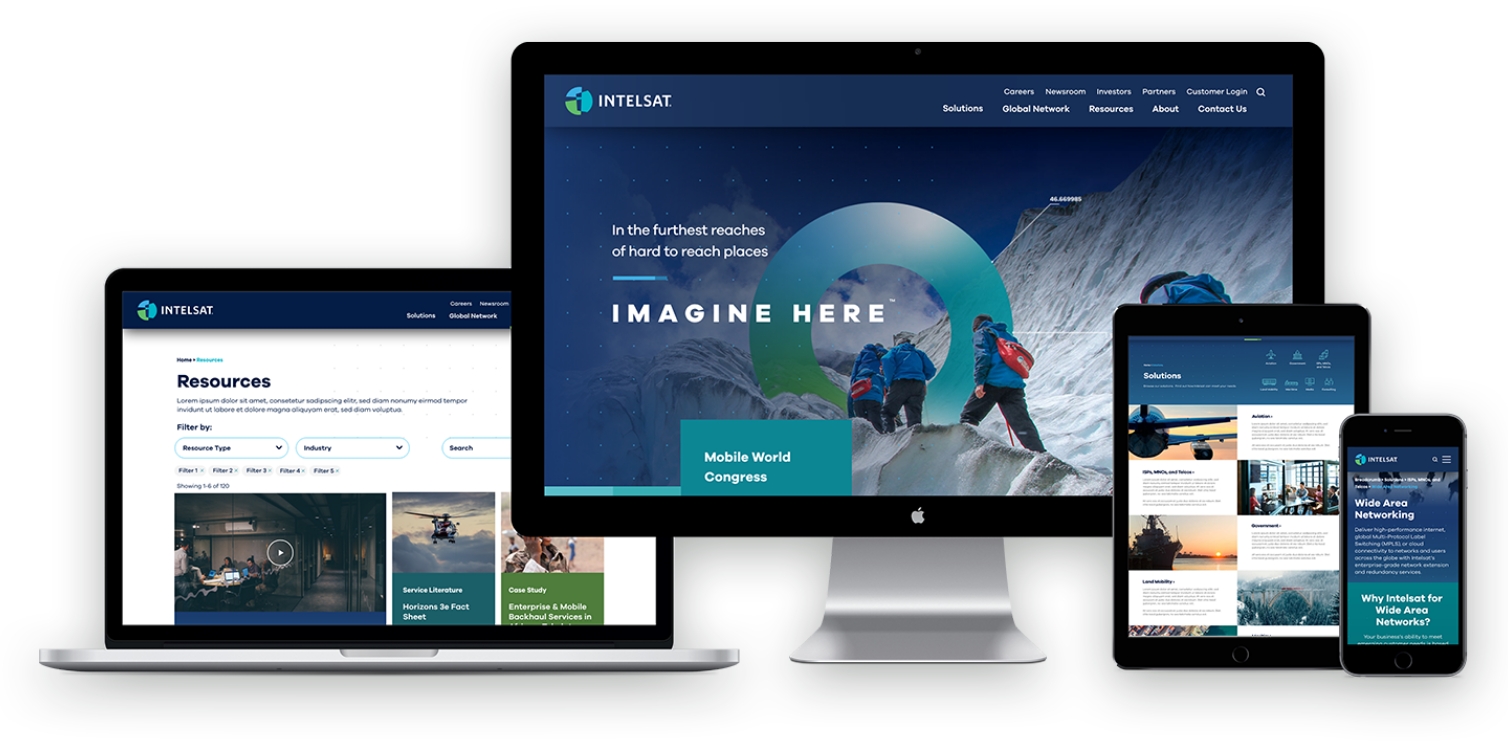

Enhance Digital Presence and Visibility

Digital credibility is a major factor in acquisition decisions. Optimize your website and social channels to reflect professionalism and thought leadership. Highlight customer success stories, industry recognition, and relevant content that demonstrates market authority. Maintaining an active, SEO-optimized digital presence increases your brand’s visibility and perceived value to prospective buyers.

Digital Strategies:

- Update and optimize website content for clarity and SEO.

- Promote thought leadership through blogs, articles, and social media.

- Showcase client success stories and industry recognition.

Prepare Brand for Integration Post-Acquisition

Post-acquisition integration is smoother when your brand aligns with the acquiring company’s culture and strategy. Maintain clear messaging and visual consistency to retain customer and employee trust. Provide guidance for stakeholders to understand brand evolution, ensuring a seamless transition while protecting the equity you’ve built.

Integration Considerations:

- Develop unified messaging for internal and external audiences.

- Align visual identity with the acquiring company where appropriate.

- Communicate changes clearly to employees and customers.

Case Examples & Best Practices

BlueHalo (formerly AEgis Technologies)

Bluetext partnered with AEgis Technologies to rebrand the company as BlueHalo, positioning it as a leader in defense and aerospace. The rebrand included a refreshed visual identity, modern messaging, and a polished digital presence that clearly communicated market differentiation. This strategic transformation played a critical role in attracting suitors and ultimately supported BlueHalo’s acquisition by AeroVironment for $4.1 billion.

Quest Software

For Quest Software, Bluetext helped refine branding to emphasize product strengths, customer value, and market leadership. Through cohesive messaging, an updated visual identity, and enhanced digital assets, Quest presented itself as a compelling acquisition target. In November 2021, private‑equity firm Clearlake Capital acquired Quest from Francisco Partners in a deal reportedly worth $5.4 billion. The strengthened brand helped facilitate a successful sale and set the stage for smoother integration after acquisition.

Next Steps for Your Brand

Preparing your brand for a buyout or acquisition is about maximizing value, attracting the right buyers, and protecting your company’s legacy during transition. Conduct audits, refine messaging, optimize digital presence, and plan for post-acquisition alignment to strengthen your market position. Contact Bluetext to ensure your brand is fully prepared for a successful buyout or acquisition.