Government efforts to engage PE and VC-backed startups puts federal marketing and messaging in the spotlight

Venture Capital-backed companies accounted for less than 1% of the $411 billion DoD contracts awarded last year. Analyzing that figure probably comes down to whether you are a glass half-empty or half-full kind of person. There are clear opportunities for startups to secure more contracts from DoD and US Public Sector, but there are also undeniable reasons why this number remains so low.

Perhaps that is why DoD and the VC and Private Equity communities are increasingly focused on making it easier for both sides to communicate effectively with one another. Entrenched government contractors know the language of Washington and what messages will resonate with stakeholders. They also know which processes and vehicles offer the best chances for success in securing contract wins.

Notable and encouraging is that the ecosystem of defense tech brands the DoD can tap is more diverse than ever before – with capabilities stretching across every conceivable market need and pain point. Bessemer Venture Partners charted this diversity in a defense tech startup map across five leading marketing opportunities: AI/ML, autonomous systems, cyber, advanced manufacturing, and communications/intelligence/edge

VC firms and their portfolio companies are still adapting to the language of Washington, but there are encouraging initiatives underway and proven strategies to help defense tech startups win more government business.

Cross-pollination from DoD to VC

National Security and DoD personnel hopping over to government contractor jobs is as predictable as Congress waiting until the 23rd hour to avoid government shutdowns. But late last year, The New York Times reported on the growing number of senior Pentagon officials leaving for positions at B2G-focused venture capital and private equity firms that invest in defense tech startups.

The article “identified at least two dozen venture capital, government contractor financing or private equity firms that are run by or have hired former Pentagon officials or retired military officers, with most of the hires having taken place in the last five years.” The author added that there are at least 50 people who have shifted from government roles to VC firms backing defense-oriented startups, including:

- Red Cell Partners: Mark Esper, former secretary of defense (2020)

- Scout Ventures: Ryan McCarthy, formerArmy secretary (2021)

- Shield Capital: Raj Shah, formermanaging partner, Defense Innovation Unit, Air Force F-16 pilot (2018)

- US Innovative Technology Fund: Ryan McCarthy,former secretary of the Army (2021)

- Lux Capital: Raymond Anthony Thomas III, retired general,S. Special Operations Command (2019)

- General Catalyst: Scott Howell, retiredAir Force lieutenant general, former Joint Special Operations Command (2021).

- AE Industrial Partners: James McConville,retired general, chief of staff of the U.S. Army (2023).

- Pallas Advisors/Pallas Ventures/Pallas Foundation:Richard Spencer, former secretary of the Navy (2019)

- Snowpoint Ventures: Doug Philippone, former Army Ranger (2008)

- J2 Ventures: Patricia D. Horoho,former Army surgeon general

- Insight Partners: Nick Sinai, former White House deputy chief technology officer (2014).

- Chertoff Group/MC2Security Fund: Michael Chertoff, former homeland security secretary (2009)

- Point72 Ventures: Daniel Gwak, formermember, In-Q-Tel

The National Security and DoD firepower now being put to work across B2G VC and B2G PE firms is immensely valuable for tapping more deeply into the government market. Some of the hottest defense tech brands can be found at these investment firms, including: Shield AI (A.I. pilot), HawkEye 360 (satellite data), Virtru (encrypted email), Rebellion Defense (mission management software), HawkEye 360 (satellites), Shift5 (data-driven equipment maintenance), BigBear.AI (intel and defense A.I.), Anduril (defense software/autonomous vehicles), Palantir (A.I. software), and Applied Intuition (autonomous vehicle software).

VC and PE firms educating acquisition community

And while these former officials are helping VCs and startups better speak the language of Washington, there are parallel efforts underway to educate government leaders and contracting officers on how to better identify and engage with startups. Earlier this year, Federal News Network wrote on a Potomac Officers Club Defense R&D Summit to bridge the communications gap. At the event, Melissa A. Johnson, U.S. Special Operations Command acquisition executive, acknowledged that “We definitely have a communication gap right now. We speak one language on the DoD side, the [Defense Industrial Base] pretty much understands it, but the startup culture — not so much. There’s a lot of just talking past each other.”

Johnson went on affirm that her focus is on closing that communications gap through investment in relationship building and assembling venture capitalists with the acquisition community so contracting officers can ask the right questions. These efforts complement tools that exist for defense tech startups to submit for and win DoD contracts, including Federal Acquisition Regulations (FAR) and Defense Federal Acquisition Regulation Supplements (DFAR) contracting, as well as Other Transaction Agreements (OTAs) that allow DoD to accelerate emerging technology adoption.

Defense tech startups also recognize resources such as Defense Innovation Unit (DIU), the only DoD organization focused on accelerating the adoption of commercial and dual-use technology to solve operational challenges at speed and scale.

Messaging to ‘Government’ doesn’t work

The DoD isn’t one customer; it’s hundreds. Messaging and targeting must reflect that. Unlike the commercial market where vendors and service providers can conceivable message to a “financial services firm” and replicate that across the industry, trying to create a message that will universally resonate across DoD is far more perilous. Branches, units and individuals are driven by specific objectives, and your ability to build branding, messaging and go-to-market campaigns aligned to that reality is critical.

My colleague and public sector messaging veteran Ray Holloman wrote on the importance and challenges of federal marketing and messaging in a blog post last year. He talked about how even the savviest, largest government contractors still get federal marketing wrong. Everyone is innovative, everybody is a great partner and everybody solves the most complex B2G challenges. The marketing too often speaks to what the contractor thinks the government wants to hear, and that also applies to defense tech startups that will feel even greater pressure to follow “check the concern box” messaging than spend time on what makes the startup uniquely capable. Ray reminds B2G brands to “market to stand out, not to fit in.”

That starts with speaking directly to an audience of one, or few, rather than attempting a bland, cookie-cutter message built for mass appeal.

Message nimble, not small

Punching above your brand weight is a phrase we hear often from B2G marketing clients and prospects. It is important to note that when we develop campaigns with this objective in mind, the goal is not to create an impression that the brand can deliver beyond its capabilities. It simply means that the brand is trailing the business.

That said, there are startup attributes to message that will resonate with DoD decision makers. Startups have more flexibility and less bureaucracy to innovate, and can more easily pivot around client needs. Startups must be highly efficient in developing products and services, which translates to potential cost savings and accelerated delivery to government clients. At the end of the day, DoD is less interested in the “smallness” of a vendor, but very interested in scalability and agility to support demand peaks and valleys.

Message to convey enterprise value

It is not an accident that, to date, 68 of Bluetext clients have been acquired in the 24 months following a Bluetext engagement – which is why firms targeting public sector/defense decision makers turn to Bluetext to deliver powerful creative, branding, websites, campaigns and digital experiences that raise enterprise value.

Whether the client goal is to get acquired, make acquisitions, go public or simply accelerate organic growth, shining a spotlight on all the core assets and differentiators of the business – technologies, services, people, culture, leadership, market position – lifts enterprise value and, in turn, creates growth opportunities. This message resonates with government decision makers who want to see strength across your enterprise, as well as current and prospective investors.

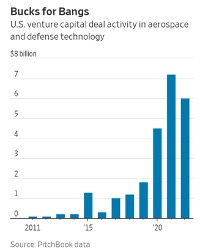

Growing startup contract share is not an overnight process. The Wall Street Journal highlighted some reasons that DoD dollars are not yet gushing to startups, including an ecosystem that was challenging for startups to crack, expected culture and bureaucracy hurdles, and the fact that adjusting buying habits around startups is a work in progress. But there are signs of a more positive outlook; VC investment in defense tech startups surpassed $30 billion a year for the past few years (5x investment levels in 2016), and the WSJ article estimates roughly 100 new defense-tech startups have been founded in the U.S. during that time period.

With more investment dollars flowing, marketing and messaging becomes critical to convert funding into DoD revenues. If you are a defense tech brand, B2G Venture Capital or B2G Private Equity firm interested in learning more about why Bluetext is the right partner to grow public sector opportunities and business, reach out to us at https://bluetext.com/contact-us/.