PE firms need portfolio companies with strong branding

Private Equity (PE) continues to be the preferred growth financing mechanism for most “for-profit” businesses. According to McKinsey’s 2019 Market Annual Review, “global private equity valuation has grown more than sevenfold since 2002” – more than twice the growth of publicly held equity valuation. While PE fundraising declined in 2020 to the Covid Pandemic, PE markets are experiencing a strong increase in 2021.

PE firms make most of their profits by acquiring companies, helping management increase Enterprise Value through various strategies, and then selling these companies at a much higher value. Value is quantified using metrics such as Earnings (typically EBITDA – Earnings Before Interest Taxes Debt and Amortization), Earnings Multiple (a factor applied to EBITDA to determine Enterprise Value), and valuation of Intellectual Property.

A common and highly effective growth strategy for PE portfolio companies is buying competitive or complementary companies through Mergers and Acquisitions (M&A). The brand is almost always a key component of a) the Earnings Multiple and Intellectual Property Value metrics in the valuation process and b) a successful M&A strategy. Here’s why.

Branding is so much more than a name and a logo; it’s a representation of how your company is perceived – more specifically, how your customers and the market perceive you. It’s a gut reaction, a feeling. This is why it’s critical prior to going through an M&A to create a strategic, memorable, and unique brand that provides a consistent experience across all channels, and makes sense to not just the market, but to all employees, as they become brand ambassadors themselves. PE firms have many tools and metrics to measure the value of a brand (brand loyalty, recognition, and impact) which drive a monetary valuation.

Sloppy, outdated, or inconsistent branding can make employees and the market feel uneasy and unconfident with the new company. A powerful, cohesive brand right from the gate is essential in sending the right message of being “stronger together.” In addition to looking the part, strong brands are more profitable, grow faster, and sell more frequently. You only get to go-to-market with your new brand once – make sure it counts by following our steps to a successful M&A brand launch below.

Our steps to a successful M&A brand launch

1. Develop New Positioning & Messaging

A strong brand is designed to dominate the market, which is why the first step in developing a new brand for an M&A should be to gain understanding and consensus on how you want to be (and can/should be) positioned within the market. You need to understand where you could be within the market as this new company with more talent and more vast capabilities. Determine how all the current brands’ are currently perceived, vs. how you want to be perceived. What are the brands’ value propositions and how will they be combined? If possible, involve your target audience via surveys or workshops to understand how the companies are perceived. That knowledge is a baseline on how all the companies are perceived in the market today and what needs to change in order to be perceived differently and help set expectations.

Once those baselines are understood, you’ll want to define a specific positioning strategy then base your new messaging off of that. With combined capabilities and potentially different focus areas, the positioning strategy likely will shift, so you need to identify how it should shift and define clear and compelling differentiators early on that the positioning and messaging are based on.

Market your new capabilities, but don’t become a generalist. By combining two (or frequently, more) companies together, it’s obvious there’s more diversity and broader capabilities, but if not done the right way, growing this list can make you seem too generic or disjointed. You don’t want to come across as a “jack of all trades”, but rather, a “specialist of many.” This is why considering not just the increased amount of advanced capabilities, but the outcomes of those capabilities and communicating that clearly and effectively in the new messaging is critical.

2. Create New Corporate Visual Identity

This is what most people think of when they hear “brand”. Corporate Visual Identity, CVI, is how a company visually portrays itself to the public. The logo, the color palette, typography, graphics and iconography, unique branded elements like an image masking or pattern overlay, etc. all work together to form the CVI.

Merging a brand portfolio is challenging, and there are several factors to consider before creating a new CVI. If you’re not going in the “house of brands” direction where the parent company is not associated with the products, then you’ll want to develop a unified CVI that is unique in the competitive landscape, is compelling and memorable, and visually represents the story you want to tell from the messaging. Some questions to consider include:

- How do customers/the market connect with each of the brands?

- What is the brand equity of the company or companies in consideration?

- How will you decide which assets, if any, to retain from each brand impact projected revenue?

- What story are we trying to convey and how can we visually portray that?

M&As set many new paths for success, but if the new company’s Corporate Visual Identity is not unified, meaningful, and applied in a cohesive, creative, and consistent manner, it creates a weak brand without solidarity and won’t have the impact it should.

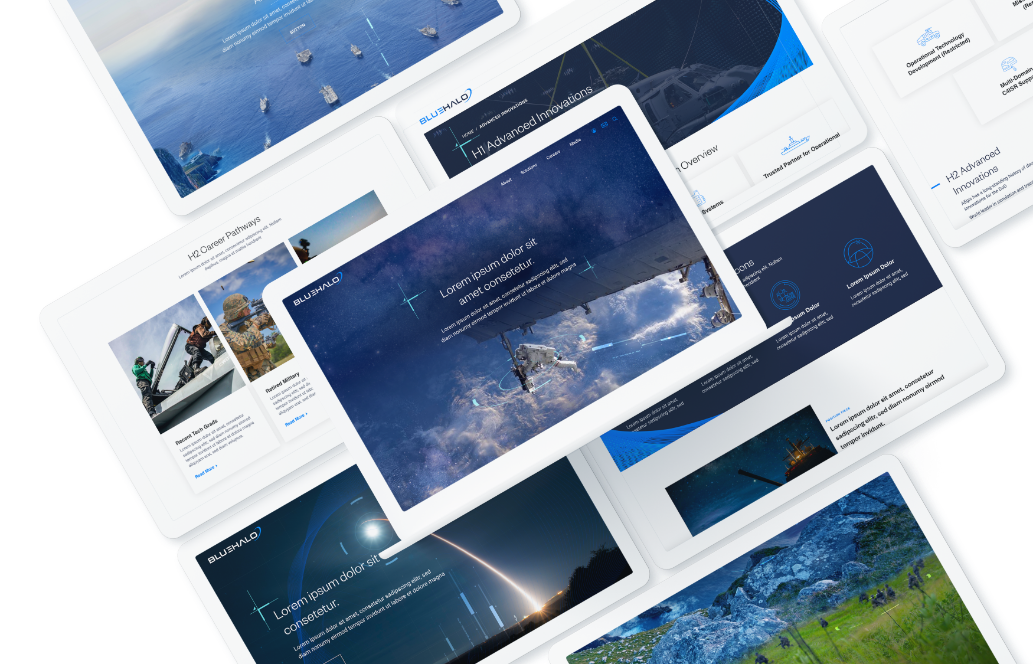

Case Study: BlueHalo

When Arlington Capital Partners acquired several top-performing companies in national security, the AEgis team looked to Bluetext to help merge multiple companies together to create one superior brand, BlueHalo. Bluetext worked closely with AEgis to develop the new name, logo, messaging and positioning, corporate visual identity brand system, website re-design and development, video work, and a go-to-market strategy and launch plan, and in record-breaking time.

Part of what made the new BlueHalo brand so strong was the powerful corporate visual identity that Bluetext created. Bluetext moved fast to create a bold new name and brand within just weeks that would make a lasting impression on the market. The name BlueHalo represents the unbroken global line that ensures the technical advantage in the most advanced battlespace. The logo embodies the name by featuring a blue swoosh shape that depicts in a clean but strong manner, a halo of protection.

The striking blue colors to accompany the name, the branded engineering vector graphics woven in the photos to create unique, branded imagery, and the blue wires to form shapes that pull from the halo in the logo all work together to create a cohesive, meaningful, and regal brand system.

To learn more about strategic branding and how M&As can succeed with it, check out part 2 of this blog. To learn more about Bluetext and our services, contact us today.