The financial services industry is undergoing rapid digital transformation, reshaping how firms engage with customers, deliver services, and remain competitive. To thrive in this evolving landscape, financial services firms must position themselves as leaders in innovation through strategic marketing initiatives.

The Importance of Digital Transformation in Financial Services

Digital transformation has become a cornerstone of success for financial services organizations. Key drivers include:

- Evolving Customer Expectations: Today’s consumers demand seamless, personalized digital experiences.

- Technological Advancements: Innovations like artificial intelligence (AI), blockchain, and data analytics are revolutionizing the sector.

- Competitive Pressure: Fintech disruptors are challenging traditional financial institutions, pushing them to innovate or risk obsolescence.

- Regulatory Changes: Firms must navigate an increasingly complex compliance landscape while embracing digital tools to streamline processes.

Strategic Marketing to Lead the Transformation

To position as leaders in digital transformation, financial services firms need to communicate their vision and demonstrate their capabilities effectively. Below are key marketing strategies to drive this effort:

- Showcase Digital Innovation

Highlighting investments in technology and innovation builds trust with customers and stakeholders.

How to Execute:

- Create case studies and success stories that demonstrate the tangible benefits of your digital initiatives.

- Develop video content that showcases innovative solutions, such as mobile banking apps or AI-driven financial planning tools.

- Use storytelling to connect technological advancements with customer benefits, emphasizing security, efficiency, and personalization.

- Position as Thought Leaders

Becoming a trusted source of insights and trends in digital transformation can elevate your brand and build credibility.

How to Execute:

- Publish white papers, eBooks, and research reports on topics like blockchain, AI in finance, or digital customer experience.

- Host webinars and participate in industry conferences to discuss digital transformation trends.

- Maintain an active blog with insights from your leadership team and industry experts.

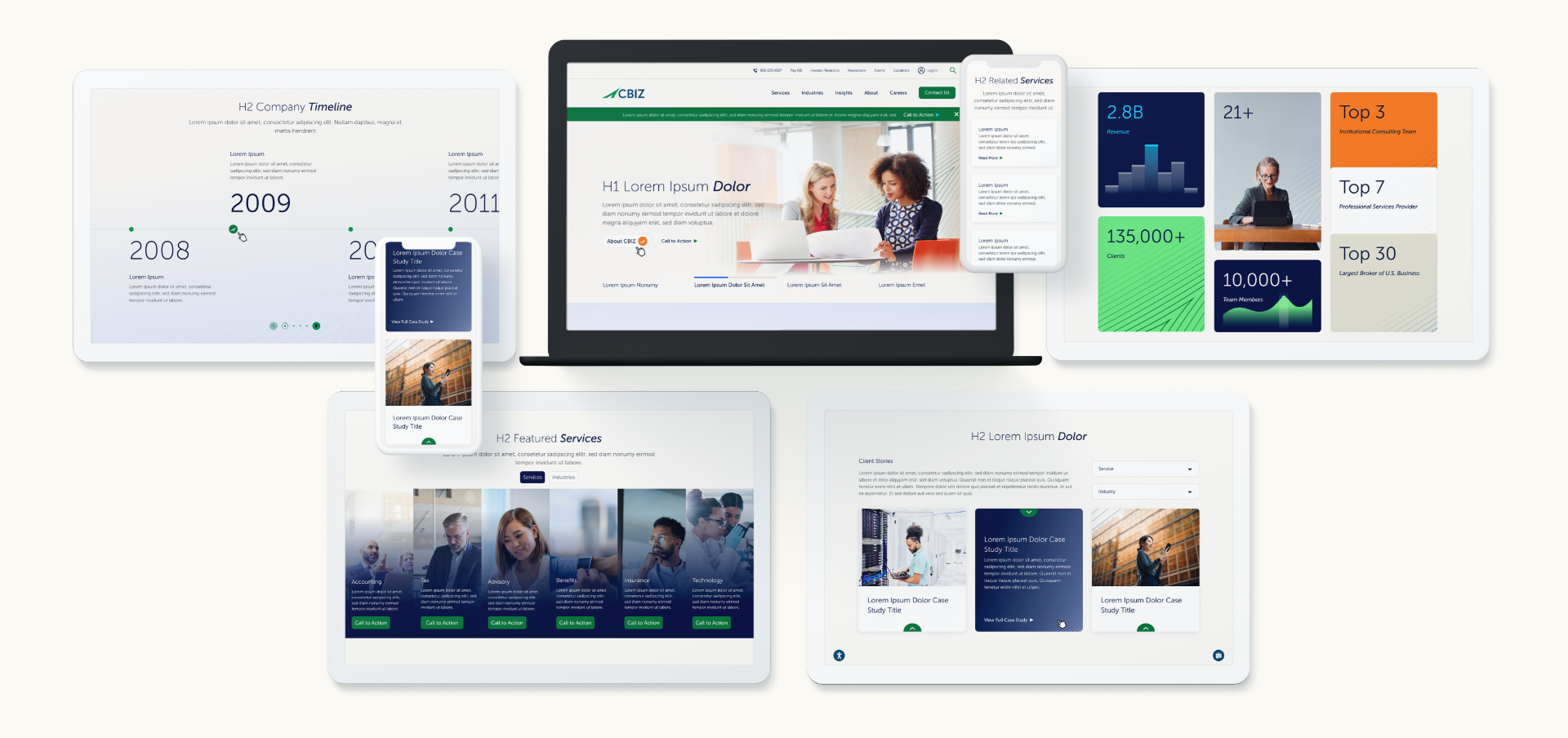

- Deliver a Seamless Omnichannel Experience

Modern financial services customers interact with brands across multiple touchpoints. A consistent and seamless experience across these channels is essential.

How to Execute:

- Use data analytics to personalize customer experiences across email, social media, mobile apps, and websites.

- Implement a unified brand voice across all platforms, from digital ads to in-branch experiences.

- Optimize user experience (UX) design for mobile-first interactions, reflecting the shift toward mobile banking.

- Address Concerns About Security and Compliance

Digital transformation raises questions about data security and regulatory compliance. Addressing these concerns proactively is critical to building trust.

How to Execute:

- Highlight your firm’s commitment to cybersecurity through content like blog posts, videos, and infographics.

- Share how you ensure compliance with evolving regulations, such as GDPR or financial-specific frameworks like SOX.

- Publish third-party certifications or endorsements to reinforce trust in your digital platforms.

- Engage with Data-Driven Marketing

Harnessing the power of data is integral to effective marketing in the digital era.

How to Execute:

- Use predictive analytics to identify emerging customer needs and tailor offerings accordingly.

- Segment audiences based on behavior, preferences, and demographics to deliver hyper-personalized campaigns.

- Continuously measure and optimize campaign performance using advanced analytics tools.

Preparing for the Future of Financial Services

Marketing efforts must align with emerging trends to future-proof your business. Key areas of focus include:

- Sustainability Messaging: Highlight efforts in green finance and ESG (Environmental, Social, and Governance) initiatives.

- AI-Driven Personalization: Emphasize how AI enhances customer experiences and streamlines operations.

- Partnerships with Fintechs: Showcase collaborations with fintech innovators to reinforce your firm’s commitment to staying ahead of the curve.

Final Thoughts: Leading the Charge in Digital Transformation

Digital transformation is not just a technological shift but a strategic opportunity for financial services firms to redefine their market position. By leveraging marketing strategies that highlight innovation, thought leadership, and customer-centricity, your firm can build a future-proof brand that thrives in an increasingly digital landscape.

Partner with Bluetext for Digital Transformation Marketing

At Bluetext, we specialize in crafting strategic marketing campaigns that position financial services firms as leaders in digital innovation. Whether it’s creating compelling content, executing data-driven campaigns, or designing seamless digital experiences, we can help you navigate the complexities of digital transformation. Contact us today to learn how we can elevate your marketing efforts.