In government contracting, the RFP isn’t the starting line—it’s the midpoint. By the time a request for proposal (RFP) hits SAM.gov or an agency portal, the most successful vendors have already been shaping the conversation. Their messaging is familiar. The solutions feel tailored. Their names are top of mind.

Welcome to pre-RFP marketing—the strategic art of influencing the buy before the bid.

Why Waiting for the RFP Is Too Late

Government buyers aren’t making decisions in a vacuum. Long before an RFP is released, agencies are:

- Conducting market research

- Reviewing past performance

- Following industry thought leaders

- Listening to the players shaping public discourse

If your brand only shows up once the formal procurement starts, you’re already behind. Agencies tend to favor vendors they know, trust, and associate with mission fluency. Pre-RFP marketing ensures that you’re in the conversation before requirements are locked in.

What Pre-RFP Marketing Looks Like

This isn’t traditional lead-gen marketing—it’s highly strategic, often narrowcasted, and deeply aligned with procurement timelines. Pre-RFP marketing may include:

- Agency-specific messaging that speaks to mission goals and challenges

- Content marketing aligned to strategic priorities (e.g., zero trust, AI integration, climate resilience)

- Awareness-building campaigns that elevate your expertise in relevant domains

- Executive thought leadership that frames your brand as a solutions partner, not just a vendor

The goal isn’t volume—it’s influence.

Marketing + Capture: The Dream Team

In the B2G space, marketing should work hand-in-hand with business development and capture teams to create pre-RFP momentum. That collaboration looks like:

- Message alignment based on capture insights, agency intel, and pain points

- Strategic content creation that reinforces key capabilities tied to upcoming procurements

- Campaign timing that builds awareness months—or even years—before the bid drops

- Visual storytelling that mirrors future proposal themes and evaluation priorities

Pre-RFP marketing isn’t a siloed activity. It’s an integral part of shaping opportunity strategy.

Tactical Ways to Influence Before the RFP

Smart pre-RFP marketing combines digital precision with reputational lift. Tactics might include:

- Agency-targeted landing pages or microsites: Showcase case studies, credentials, and capabilities specific to the agency’s needs.

- Mission-aligned white papers, videos, or articles: These signal thought leadership and policy fluency—and can be shared by internal champions.

- LinkedIn targeting and paid campaigns: Reach key agency decision-makers and influencers with tailored content.

- Conference presence and speaking opportunities: Position SMEs and executives at industry events where agency staff are present.

- PR placements in federal media: Establish credibility through earned media on platforms read by procurement leaders.

These assets don’t just inform—they shape perception.

How Pre-RFP Marketing Pays Off

This level of positioning isn’t just about awareness—it influences outcomes. Done right, pre-RFP marketing:

- Establishes name recognition that builds evaluator confidence

- Increases your “trusted partner” status well before proposal submission

- Shapes the RFP itself by aligning with the narratives and needs already in motion

- Sets the stage for better win themes when the proposal does come around

It’s a long game—but it’s a proven one.

Don’t Just Bid. Influence.

Winning in the public sector isn’t about reacting quickly—it’s about planning smartly. The most successful GovCon brands don’t just respond to RFPs. They shape the buying environment before the paperwork even begins.

Want to Lead Before You Bid?

Bluetext helps government contractors develop strategic, pre-RFP marketing campaigns that position them as mission-aligned, agency-ready partners. From messaging architecture to campaign execution, we work alongside your capture and BD teams to create early influence that pays off at award time.

Contact us to get ahead of the next opportunity—and make sure you’re on the shortlist before the RFP even drops.

In government contracting, clarity is currency. When every word, capability, and differentiator is under scrutiny, the companies that rise to the top aren’t necessarily the largest or loudest—they’re the ones that speak with precision. In a world of acronyms, mandates, and mission alignment, the ability to articulate your value in a hyper-targeted way is what separates contenders from winners.

Let’s explore why hyper-niche messaging isn’t just a branding preference—it’s a business-winning strategy for B2G organizations.

The Problem with Generic Positioning in GovCon

Generic messaging is a liability in government contracting. Agencies don’t award multi-million-dollar contracts to companies that merely “support innovation” or “deliver secure solutions.” They want partners who understand their mission, speak their language, and solve their specific pain points.

Contracting officers and evaluation boards are inundated with vendors claiming to “do it all.” If your message isn’t directly aligned with the program goals, agency priorities, and procurement language, you’re likely to be filtered out long before the final downselect.

What Precision Branding Looks Like in B2G

Precision branding is more than buzzwords—it’s about showing a deep understanding of the agency, mission, and problem set you’re trying to support. It’s branding that reflects:

- Mission fluency: Messaging that maps to agency-specific goals, such as modernization, zero trust, or resilient logistics.

- Procurement awareness: A tone and structure that mirrors how contracts are framed and awarded.

- Technical confidence: Specificity around your capabilities, differentiators, and how they align to contract requirements.

This kind of messaging signals you’re not just capable—you’re credible.

Segmentation Strategies for Government Audiences

In the public sector, your audience isn’t “the government”—it’s a web of stakeholders, each with different concerns. Hyper-niche messaging starts with segmentation. Effective B2G segmentation can include:

- By agency or department: Tailoring messages for DHS, VA, DoD, or HHS based on their unique missions and tech stacks.

- By mission area: Whether it’s cybersecurity, digital transformation, healthcare delivery, or ISR, speak to the problem, not just the platform.

- By role: Program managers want operational outcomes; contracting officers want clarity and compliance.

This approach enables your BD, capture, and marketing teams to deliver the right message at the right time—every time.

Building Trust Through Tailored Messaging

In government contracting, trust drives procurement decisions. Precision branding helps build that trust by showing that you’ve done your homework. Tailored messaging demonstrates:

- Understanding of agency challenges

- Familiarity with prior contract awards and initiatives

- Ability to integrate with existing systems and workflows

Messaging that speaks directly to a program’s needs helps pre-sell your value well before the RFP drops—and can be the deciding factor in whether you get on the bidder’s shortlist.

Supporting Pursuits Through Smart Brand Architecture

When every pursuit is unique, your brand needs to be flexible without losing cohesion. Precision branding allows you to:

- Deploy microsites or campaign pages for specific agencies or programs.

- Align visuals and language across BD collateral, white papers, and proposal materials.

- Build modular messaging systems that scale from digital campaigns to in-person orals.

This kind of architecture supports faster spin-ups, more aligned capture efforts, and consistent storytelling across the entire business development funnel.

Why It All Matters for Winning Contracts

At the end of the day, precision branding is about outcomes. Tailored messaging can:

- Accelerate procurement cycles by removing confusion and building confidence.

- Improve proposal win rates by resonating more clearly with evaluators.

- Differentiate your solution in a crowded field of government vendors.

In the complex, competitive world of GovCon, vague promises won’t win big contracts. Specificity, strategy, and segmentation will.

Let’s Talk Precision

Looking to refine your message and win with more intention? Bluetext helps government contractors position with purpose—through hyper-targeted messaging, modular brand systems, and smart creative built for the B2G space.

Contact us to learn how we can help you speak the language of your next big win.

Why getting B2G branding right in today’s contracting climate may dictate success or failure for years to come.

The beat of federal marketers has been a tad arrhythmic the past few months, as we seek to digest dramatic shifts in agency budgets, procurement and contracting, as well as reduced manpower. The old adage “nobody ever gets fired for buying IBM” has evolved in the current contracting climate to “explain why you bought IBM in the first place.”

And while the public face of DOGE may be moving on, its mandate endures through the Trump administration FYI 2026 budget proposal – which calls for expanding DOGE staffing by roughly two-thirds and more than doubling its budget. There are also few signs that hyper analysis of contracts with top revenue industry partners will ease. After targeting the top 10 consulting firms for contract cuts, GSA is now requesting justifications for services and pricing structures from 10 leading tech Value Added Resellers (VARs). Already this year, more than 11,000 contracts across 60 agencies have been nixed, totaling $33 billion.

All of these narratives were swirling on June 6th at FedPulse 2025: Turning Brand & Market Data into Competitive Advantage.

FedPulse is GovExec’s new brand and market intelligence platform designed to empower public sector marketers, business development, and sales leaders with real-time data and insights to drive smarter strategies and win market share.

Through a series of panels, CXOs, public sector unit leads and marketing executives from Intel, Dell, Carahsoft, SolarWinds, and GDIT discussed this tectonic shift in workforce dynamics – driven by an unprecedented shift in the public sector / administration “decision maker class” when it comes to contracting, procurement, and go-to-market strategies. The discussions were buoyed by new FedPulse data on Fed IT brand perception and what B2G marketing strategies resonate with agency customers AD (After DOGE) vs. BD (Before DOGE).

Props to GovExec for structuring one of the more insightful government marketing events I’ve attended when it comes to valuable market intelligence and panelists who were not just dispensing cookie-cutter insights and commentary, but instead offering blunt assessments on what it will take to succeed in the current environment.

Below are some data-driven takeaways from the event that public sector marketers and executives can consider as they navigate the contract landscape in 2025:

1. B2G Brands Must Re-Introduce Themselves To Decision Makers

FedPulse data shared by GovExec at the event affirms what government marketers already knew to be anecdotally true: Significant turnover amongst agency decision makers to those with fewer years of public sector experience and exposure to B2G brands. 44% of those surveyed have 10 years of experience or less as a government employee, down from 34% last year. This helps explain a four percentage point drop in those surveyed being “very familiar” with some of the top B2G brands included in FedPulse.

What does this mean for government marketers? As panelist Oliver Nutt, Vice President, Marketing and External Communications (U.S.) at GDIT shared, it becomes critical to re-introduce your brand to these new decision makers. They may know the name, but not fully grasp what you do and what you enable. Agencies are under massive pressure and they need to be able to communicate outcomes delivered, not just services you provide.

This is particularly urgent for these top consulting and services providers whose contracts are now under the microscope. Firms are being bucketed into general categories, and saying you do everything may not be the best path to preserve existing contracts and win new ones. Prioritization and differentiation must be communicated through clear branding, messaging, go-to-market and PR strategies.

Some prioritization opportunities are already emerging. During his 1×1 interview at the event, Craig Abod, President and Founder, Carahsoft, spoke of a “re-invigorated CMMC,” as DoD elevates security requirements for contractors and subcontractors – requirements such as CMMC compliance that may find their way into more contracts sooner rather than later.

2. Brands Must Re-Think How They Educate

Every B2G brand is now fully aware that decisions are being heavily driven by your ability to deliver operational efficiencies and cost reduction. These are now longer differentiator messages, but table stakes.

Abod outlined the stakes in even starker terms: Decision makers need to understand what would happen if the agency didn’t use your product or service. It’s not just re-introducing the brand, but you need to re-sell every deal. Because the question being asked isn’t “why should we buy your product/service” but “why did the agency buy it in the first place.”

How B2G brands must educate has changed. As referenced, agencies are buying outcomes so that impacts market messaging. Nutt added in later panel comments that it may not resonate to brand yourself as “the AI company” or “the digital transformation company.” If you are talking about digital transformation, connect it to specific use cases such as logistics to justify why these technologies matter.

For marketers, content assets such as case studies to show a track record of outcomes remain highly relevant, but it’s not an AI case study, or DT case study. The storytelling has to be outcome based with supporting data and compelling visuals.

The bottom line, as panelist Greg Clifton, General Manager – Defense & National Security Group, Intel added, is that you can’t assume agency decision makers know what you do. Educate yes, but there is a need to re-invent how you talk to customers. We make chips, great, but what emerging applications does this enable?

3. Non-Traditional Events & Networking Will Drive Deals

Relying exclusively on traditional marketing and branding channels will not get it done. This reality is a byproduct of where the new class of decision makers is consuming information and building relationships. Agency and industry events still hold value, but at the event GovExec CEO Tim Hartman discusses the fact that this is a relationship-driven Administration. B2G brands will need to engage in more advocacy and political events, and across all channels communicate how your solutions enable the agency – and political – mission.

4. Industry Collaboration

We spoke of a new contingent of agency decision makers; they are younger and many hail from silicon valley. Their worldview on technology development, adoption and implementation is driving a changing acquisition strategy. They don’t just want to acquire products and innovate piecemeal. More holistically, they want to build new technology stacks.

The Administration / DOGE message to vendors and contractors is clear, as Clifton detailed in his panel: You own a piece of our IT environment, but it is not in our best interests to try and go vendor by vendor in a siloed fashion. Instead, get together with other relevant vendors up and down the stack and give us an integrated strategy.

5. Your B2G Brand Must Stand Out, Not Fit In

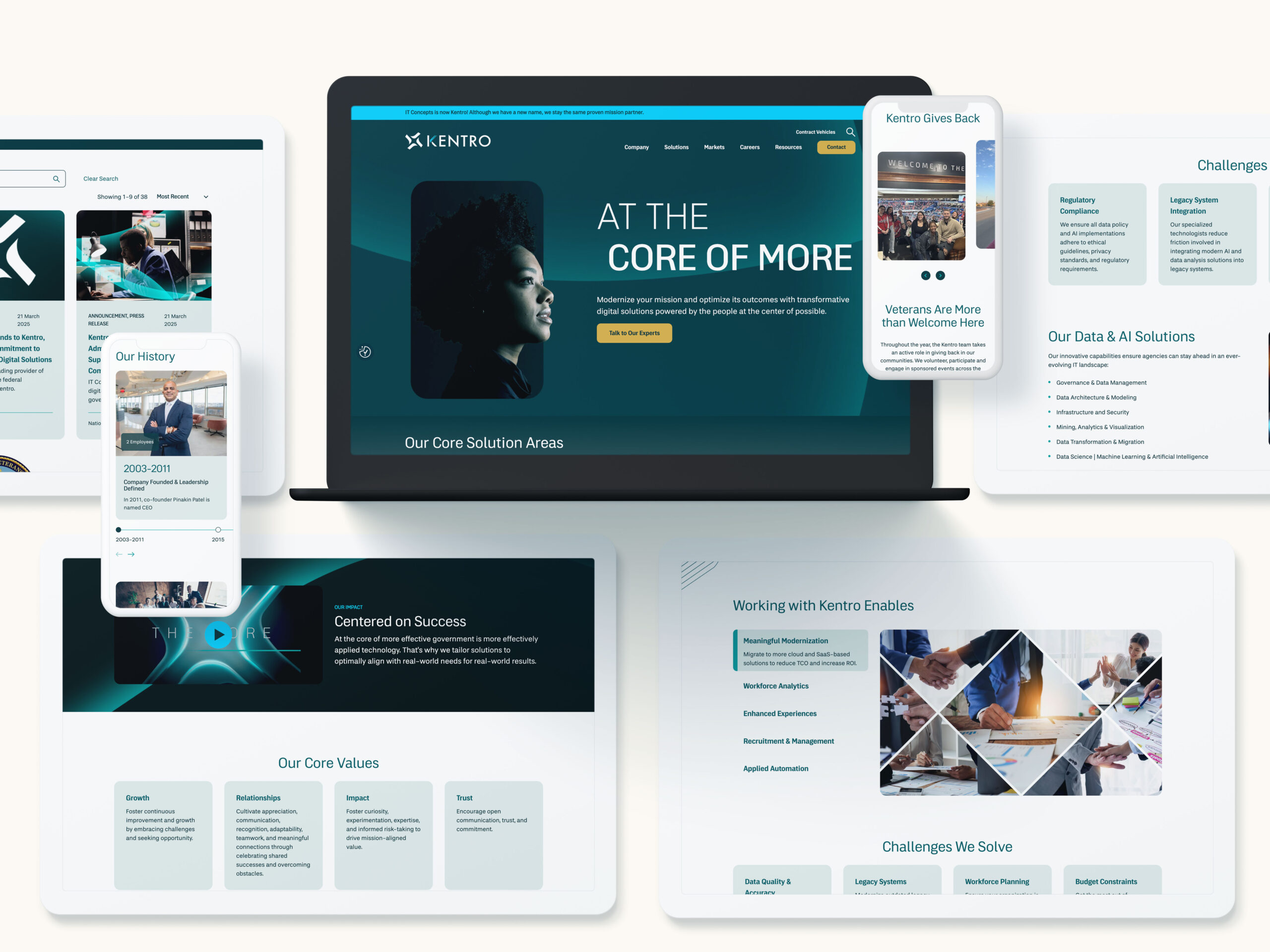

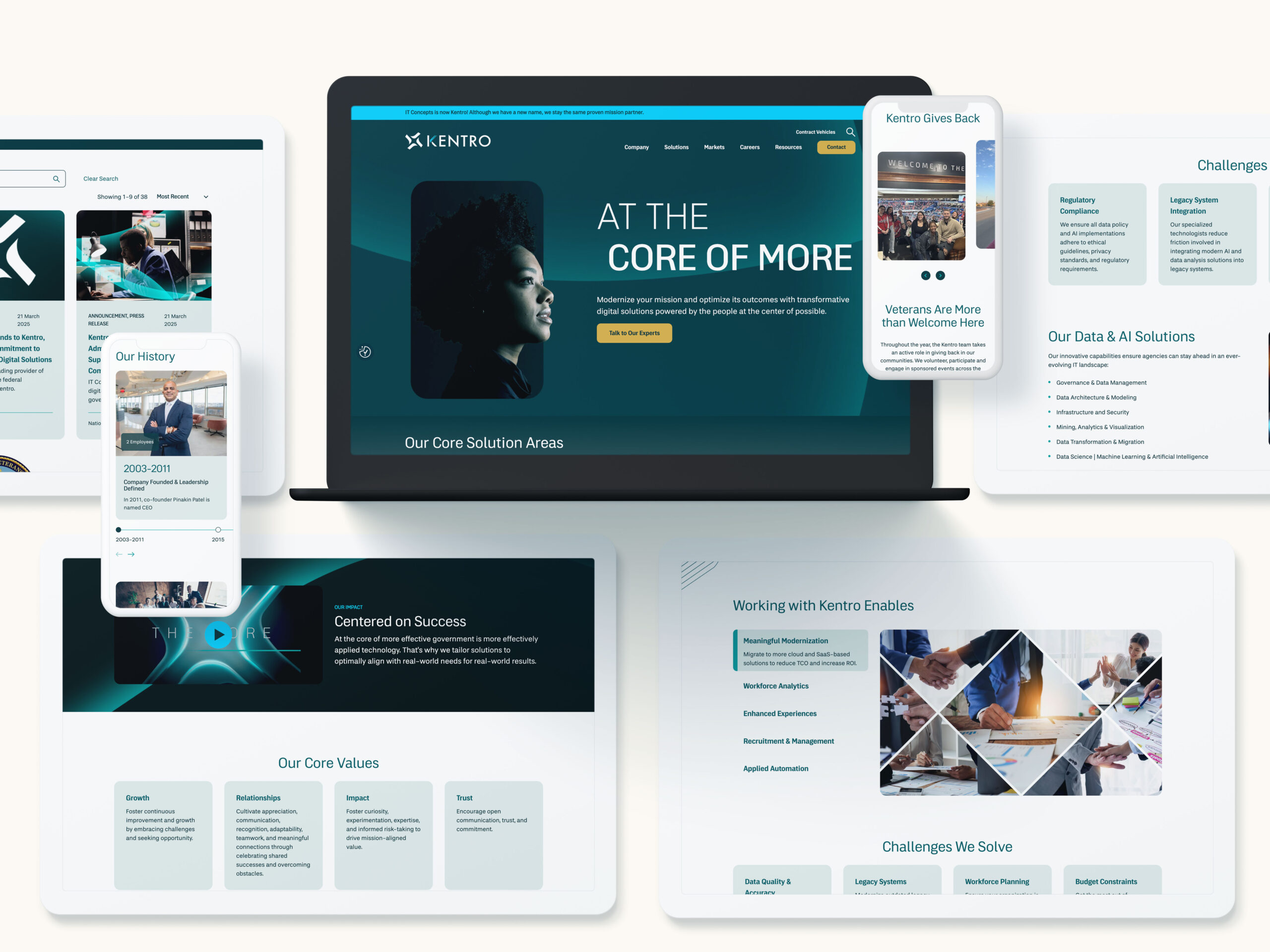

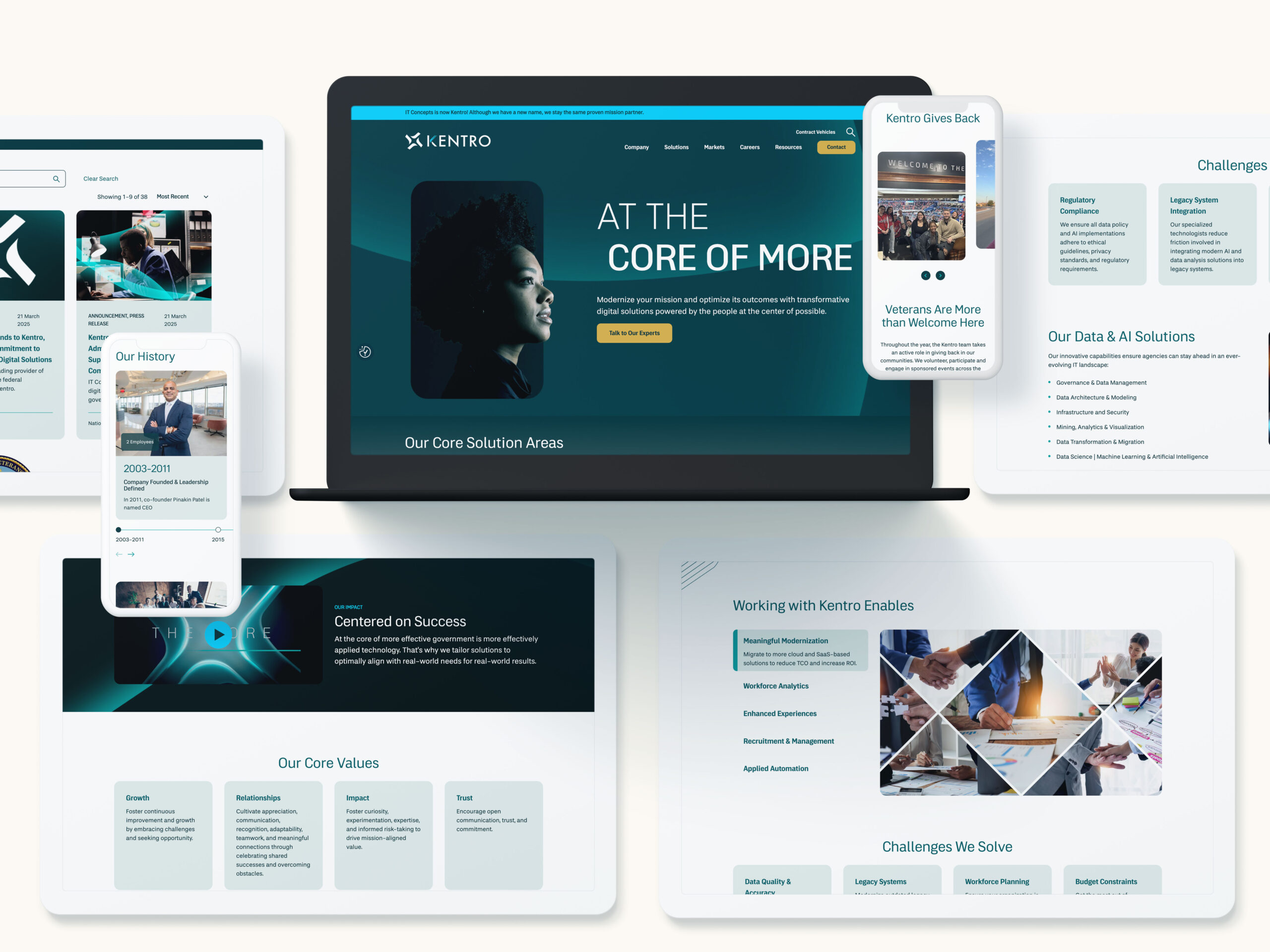

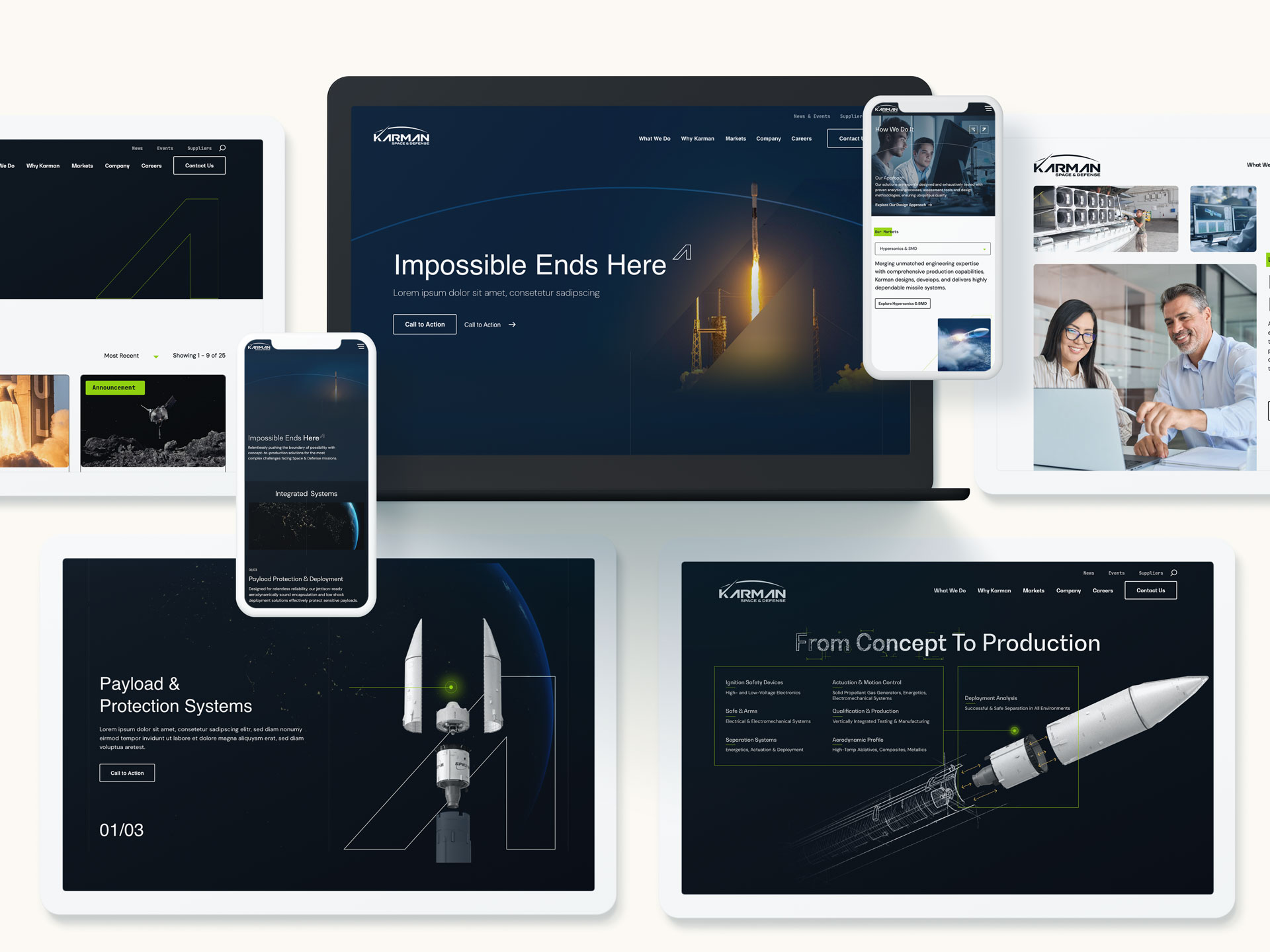

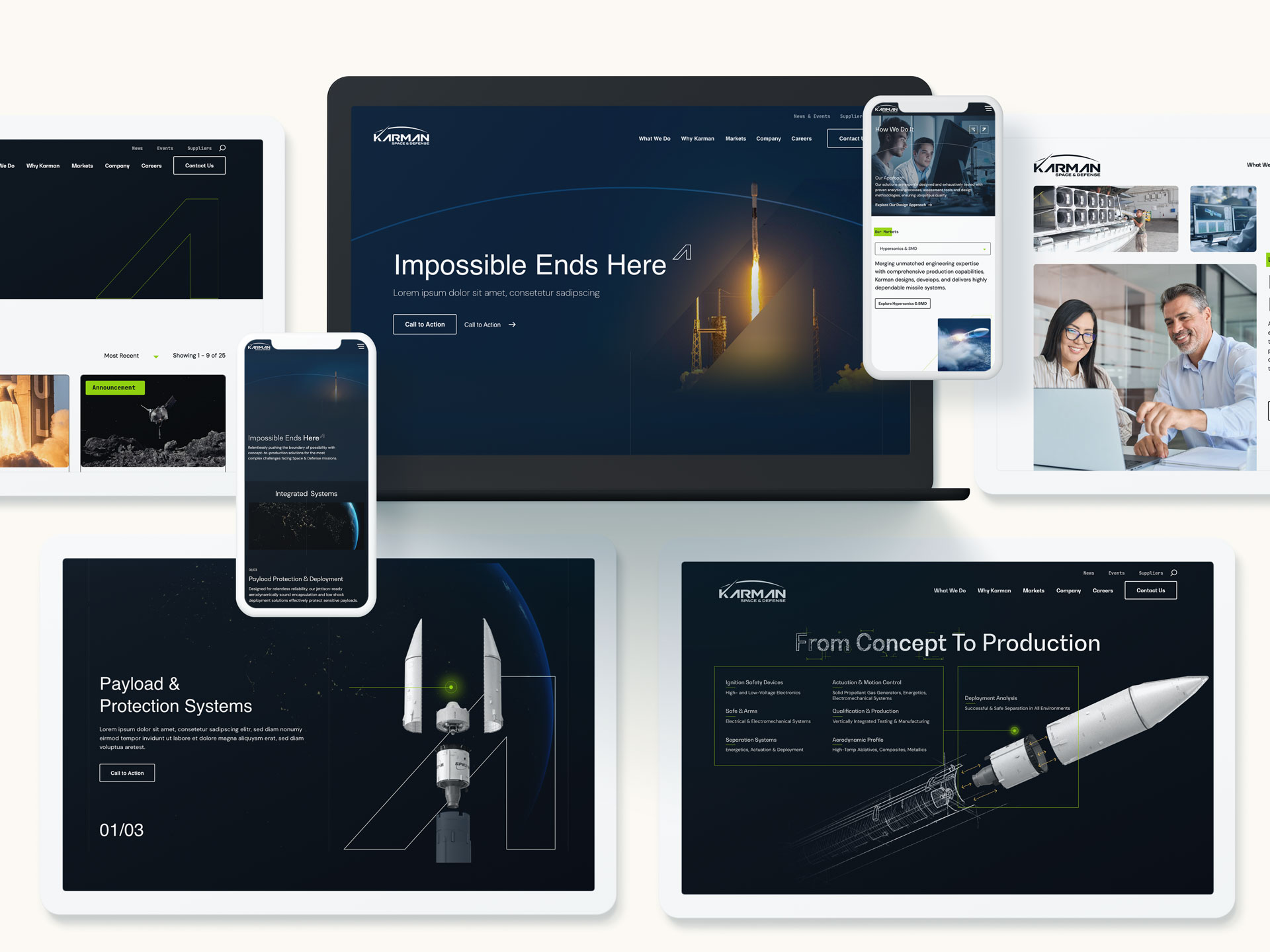

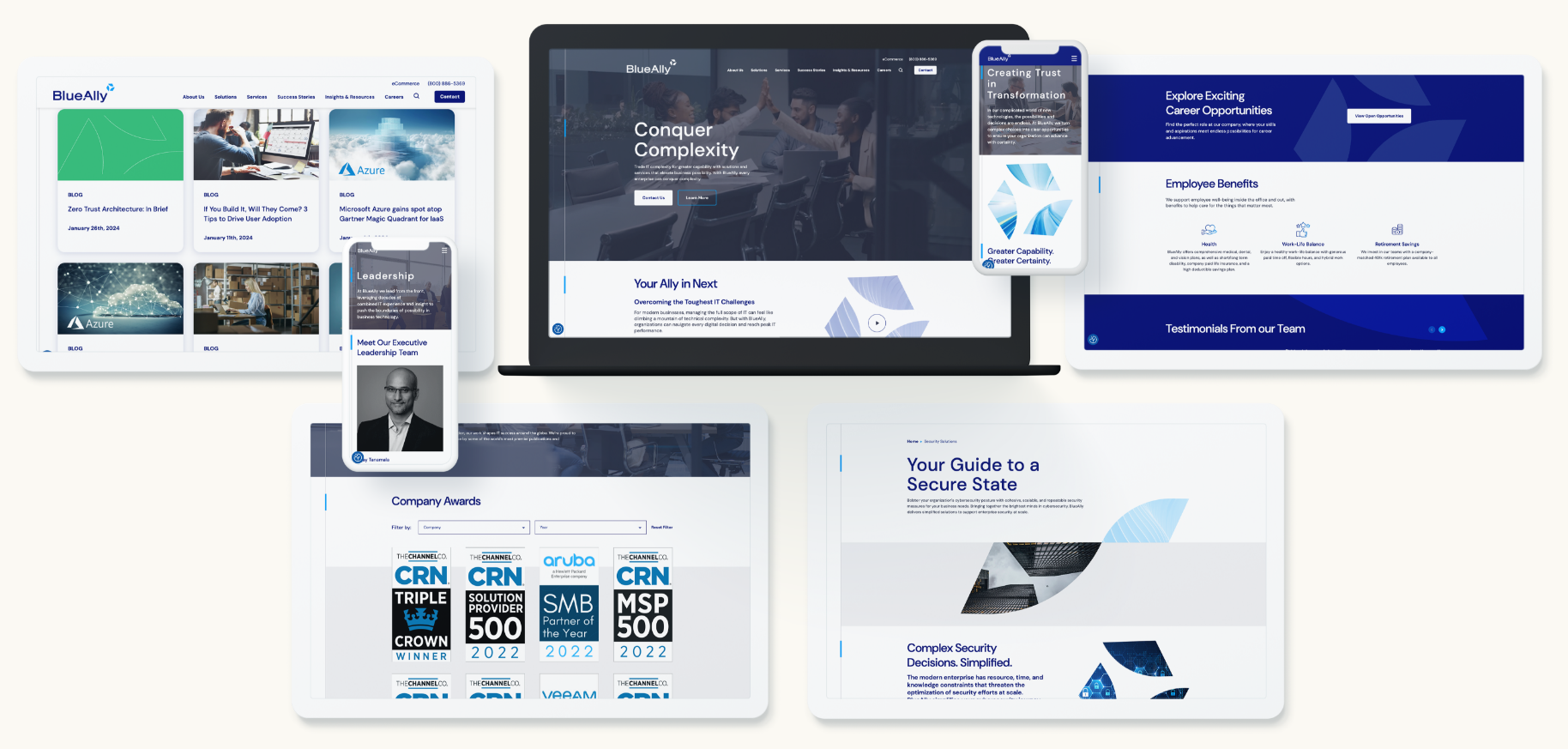

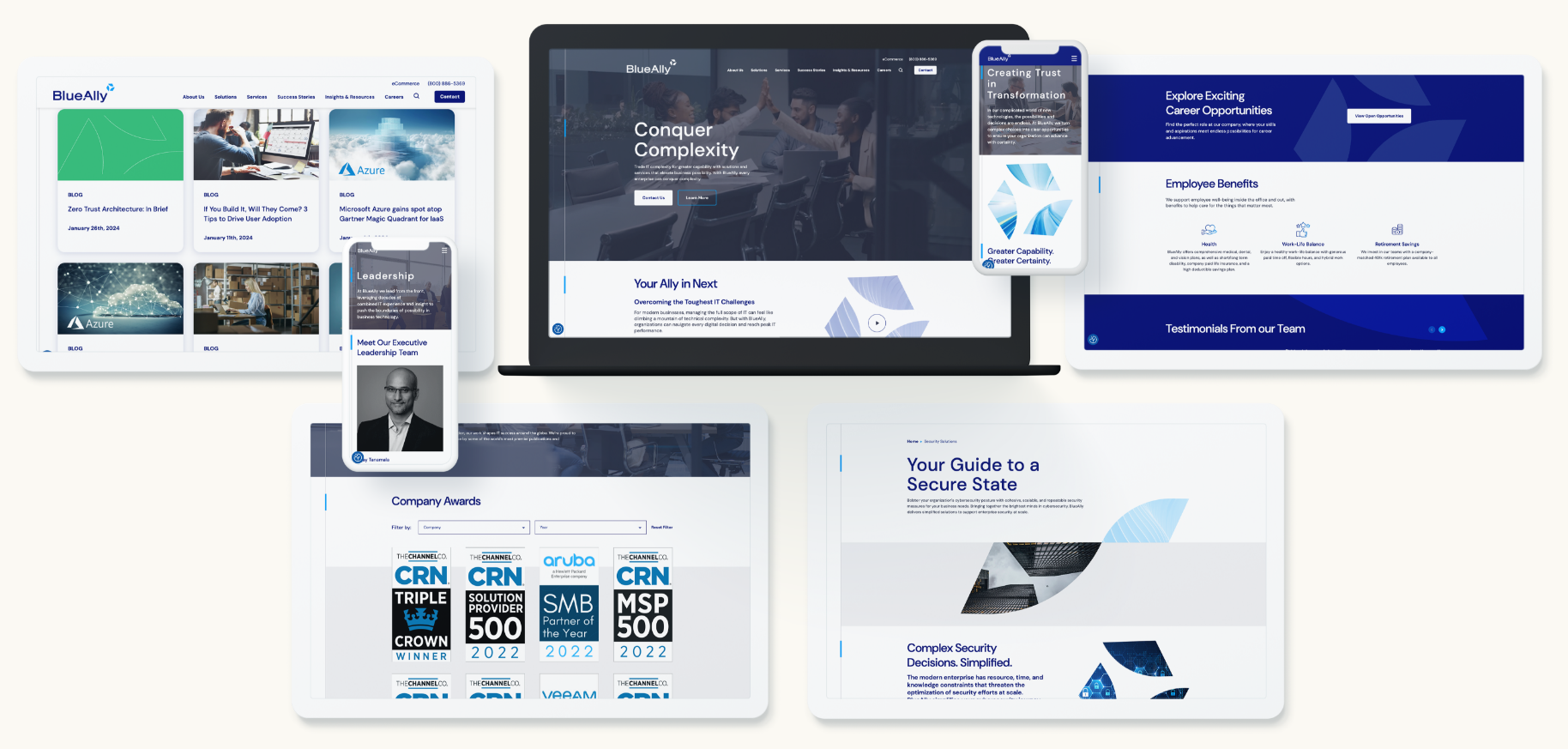

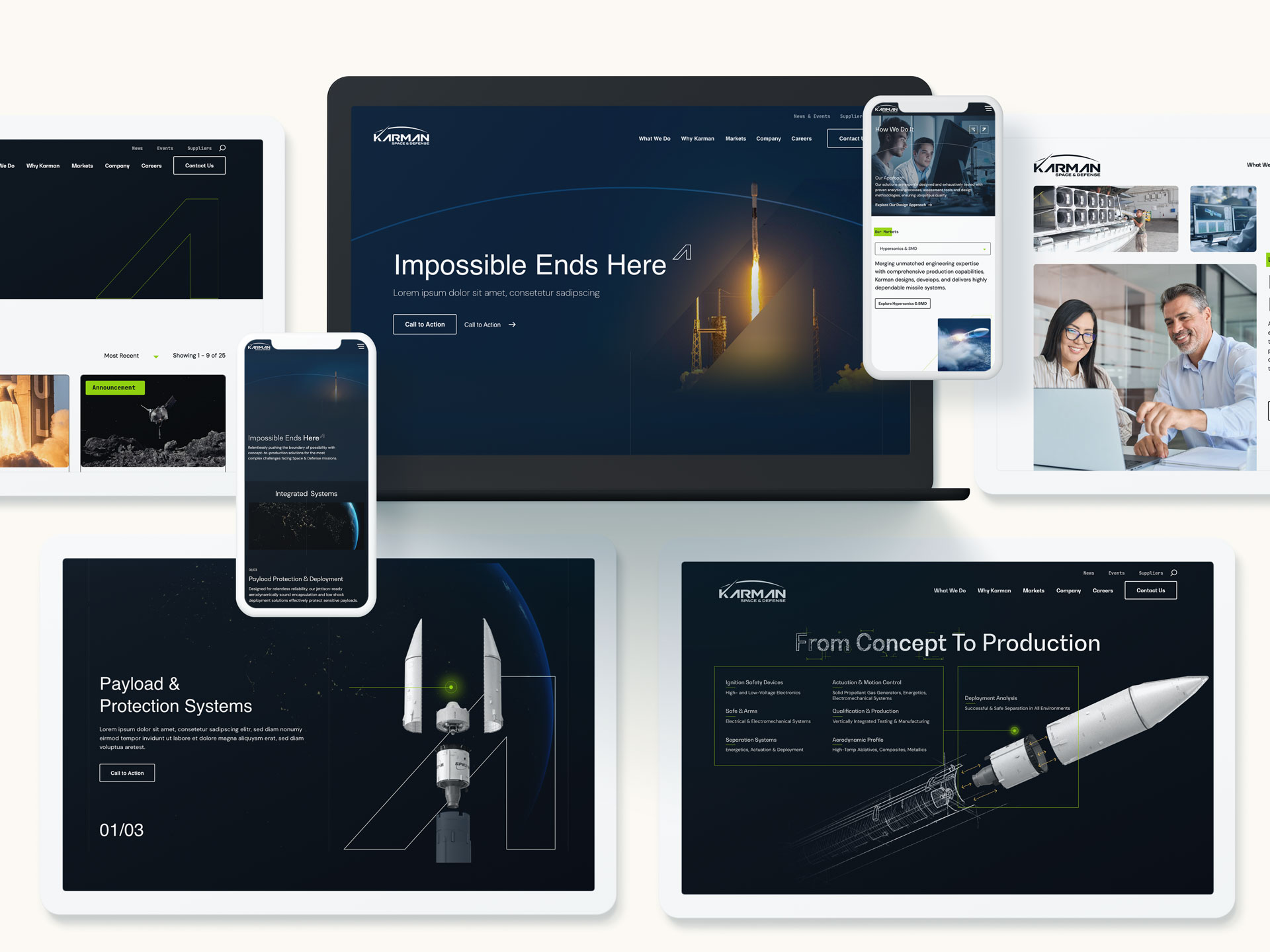

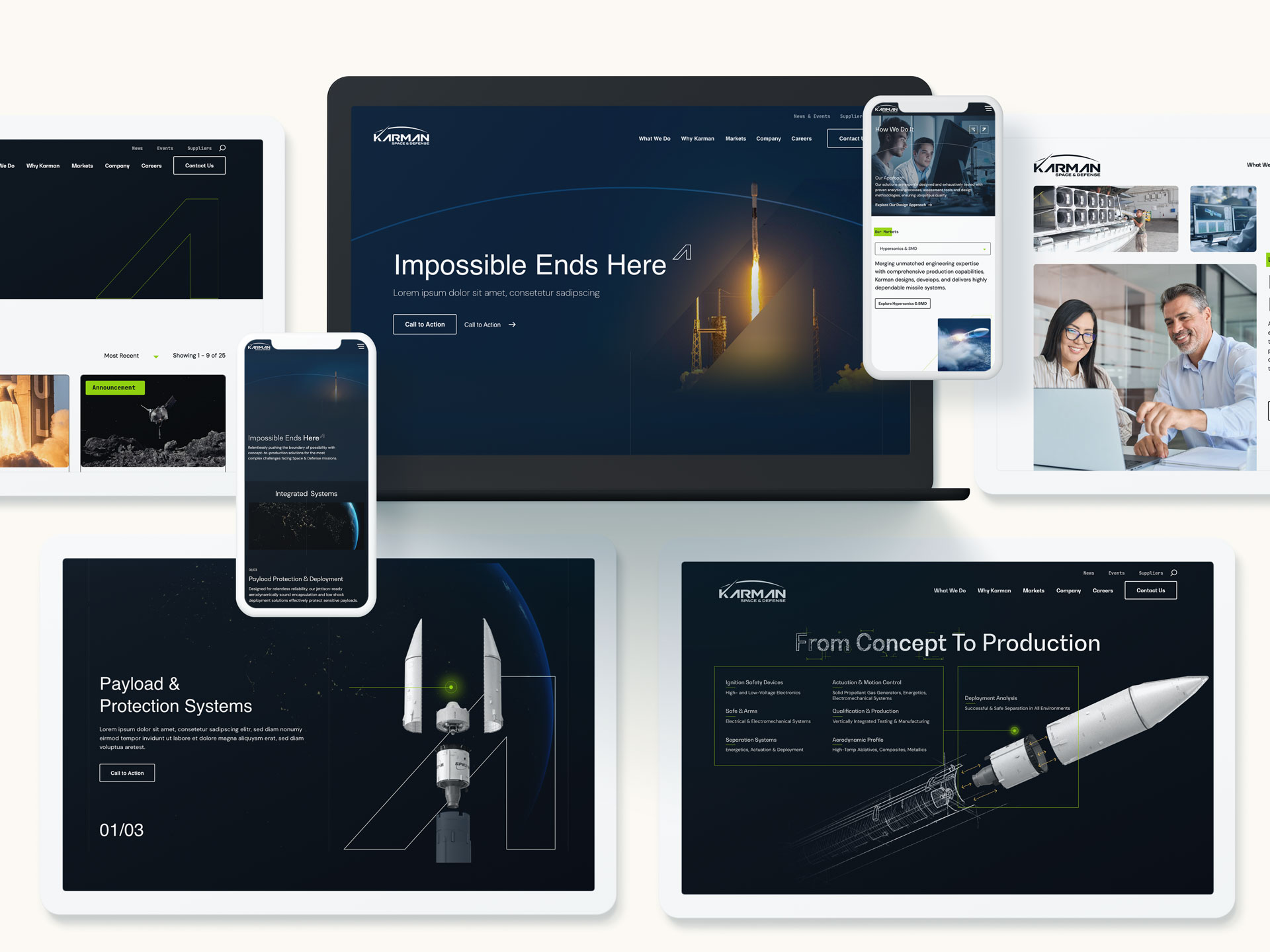

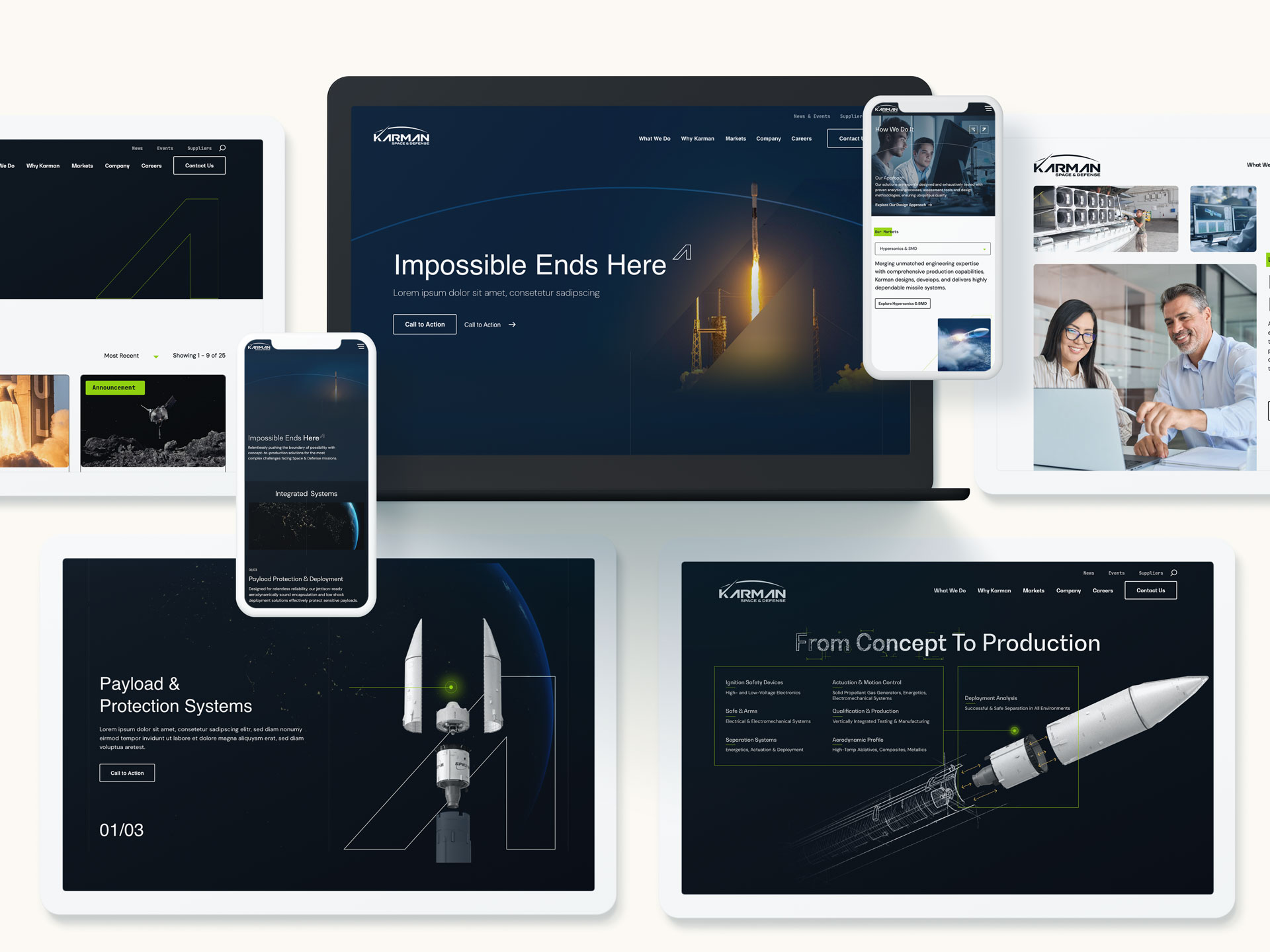

A core Bluetext sweet spot is empowering government contractors and IT providers to re-shape an existing brand or re-brand to target government stakeholders and investors (PE firms, etc.). Whether that need is fueled by an acquisition, merger or pre-IPO planning, brand storytelling that pops raises enterprise value.

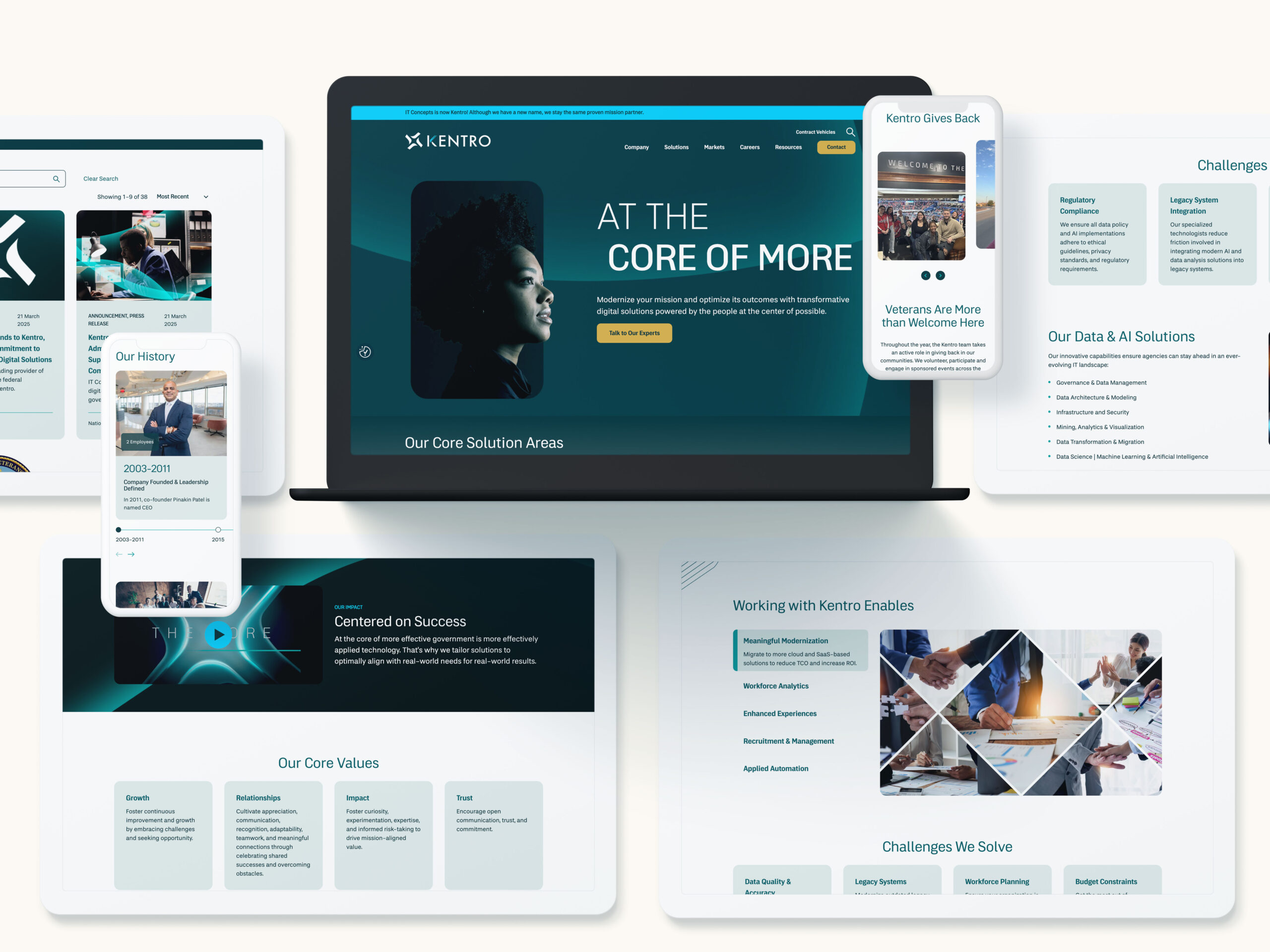

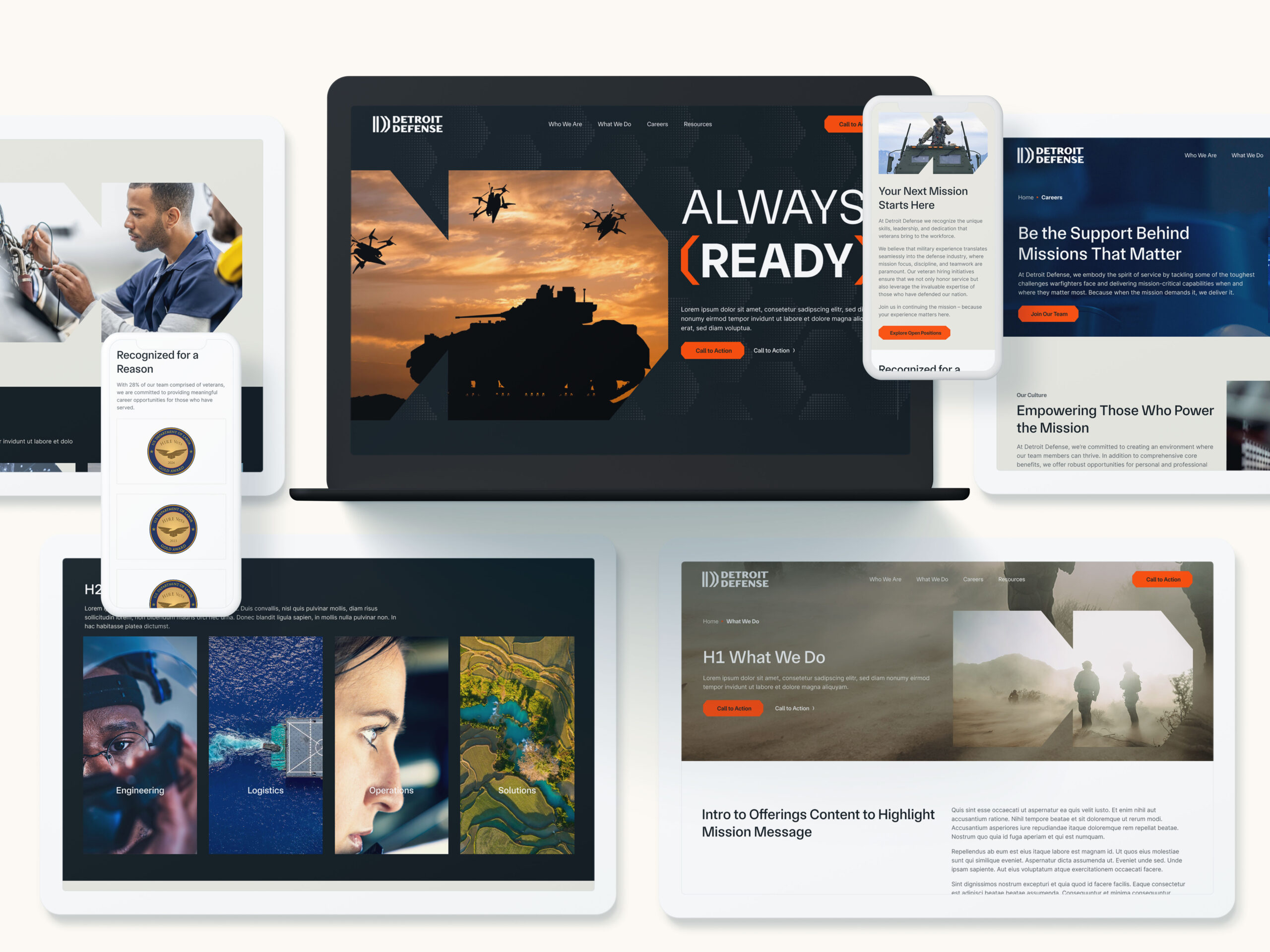

It’s why 82 of our clients have been acquired in the 24 months following a Bluetext engagement (see all the acquisitions here). We know how to build enterprise value across the B2G marketing stack – from branding, logo design, messaging & positioning, website design & development and naming to public relations, thought leadership, SEO, paid campaigns and social media.

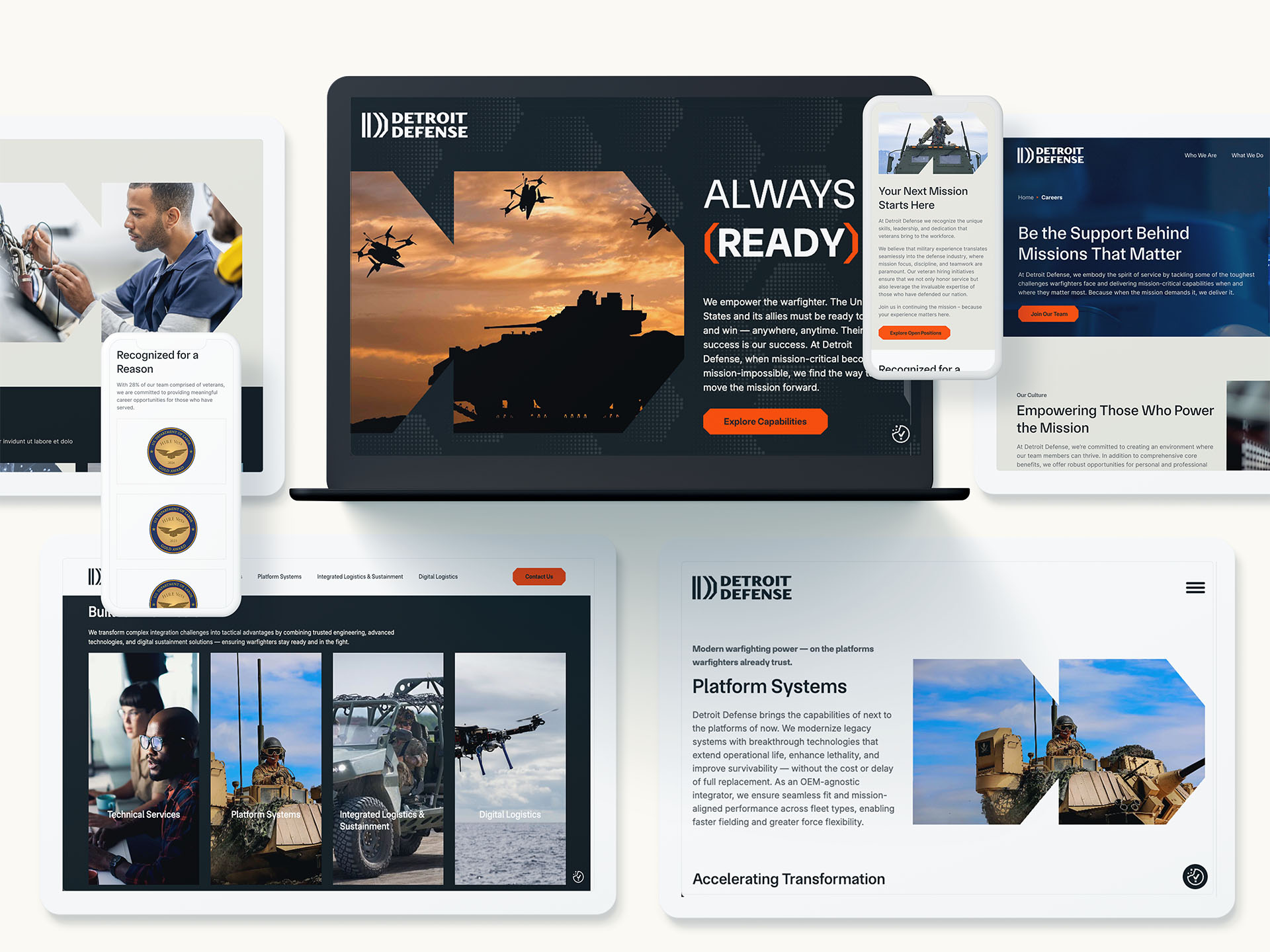

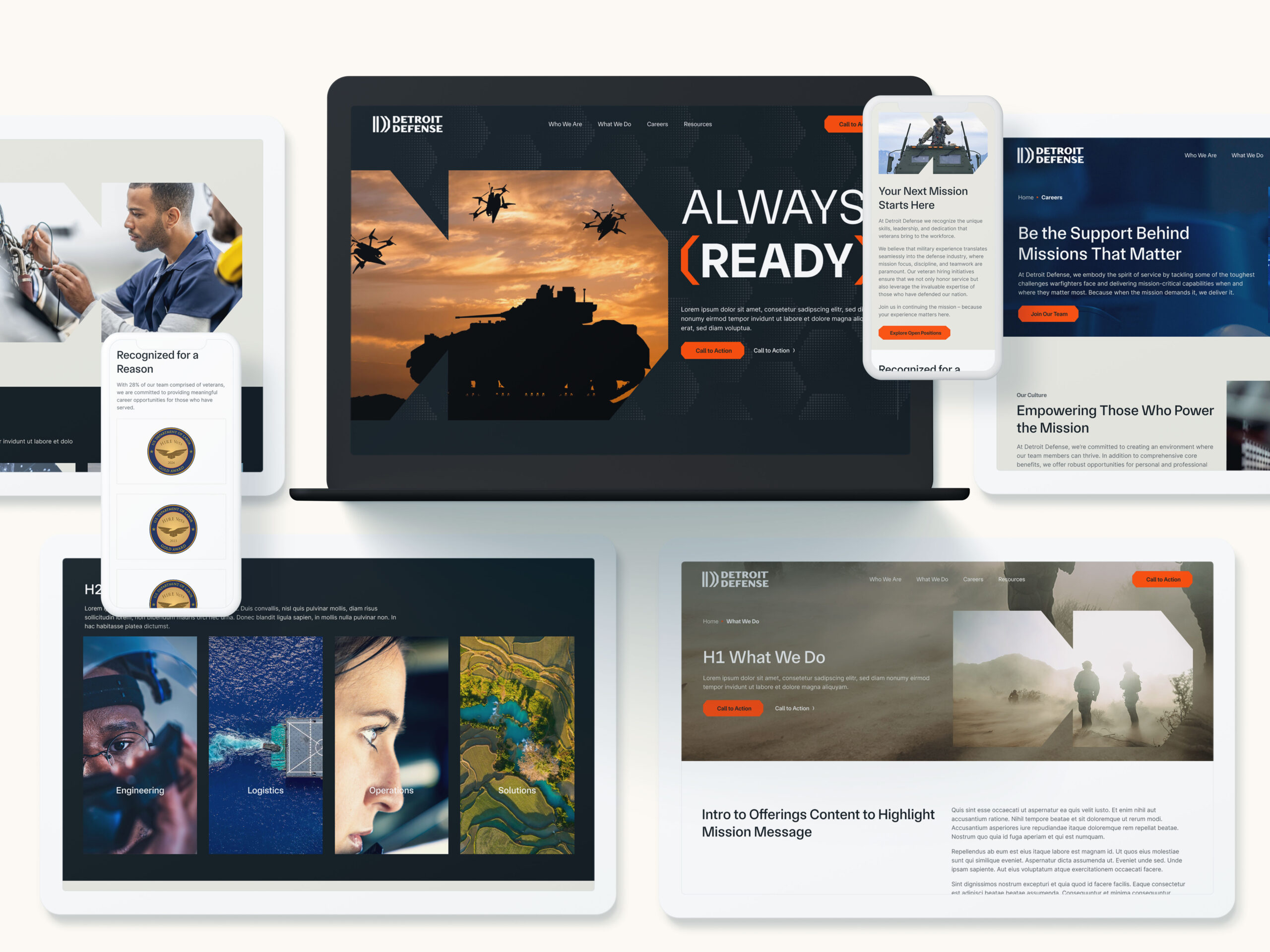

One recent project involved Ricardo Defense, which needed to transition into a fully U.S.-owned company and reintroduce itself to government and commercial partners. It turned to Bluetext to lead a comprehensive rebranding effort. The result: Detroit Defense—a new name and identity that reflects the company’s proud roots in Michigan’s defense innovation corridor and its strategic focus on U.S. national security.

At the FedPulse event, GovExec CEO Tim Hartman underscored how critical 2025 will be for B2G marketers, suggesting the next several months may well determine your public sector business trajectory for the next several years. You have to get it right. Click here to find out why Bluetext is the right B2G marketing partner to meet this moment, or contact us today to start the conversation.

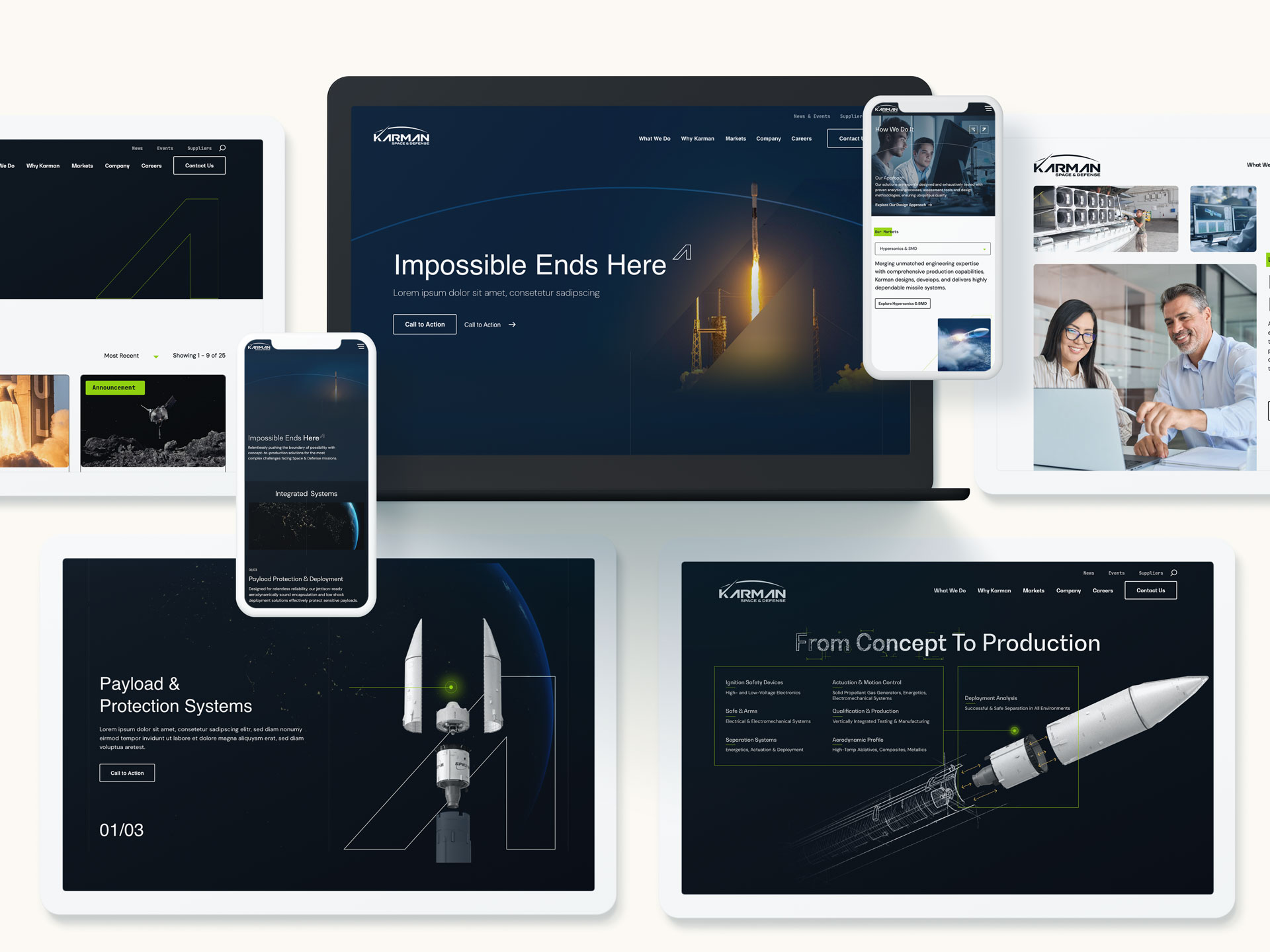

Government contractors face a unique digital challenge: create an experience that checks every compliance box while still connecting with users. It’s a balancing act that requires more than just meeting federal standards—it demands thoughtful, human-centered design that engages stakeholders, builds trust, and supports mission delivery.

At Bluetext, we’ve worked with leading B2G organizations to tackle this challenge head-on. Here’s what it takes to align your UX with both federal requirements and user expectations.

The UX Landscape for Government Contractors

Unlike private sector sites that prioritize conversion funnels or sleek brand storytelling, digital platforms for government contractors must often serve multiple masters. They need to be:

- Compliant with strict accessibility and data security standards

- Clear and intuitive for a wide range of users, from contracting officers to program managers

- Aligned with the mission and values of the agencies they serve

Too often, this results in dense, overly technical websites that users find difficult to navigate. But poor UX doesn’t just frustrate visitors—it can undermine credibility, reduce engagement, and even impact contract wins. Great UX isn’t a luxury in the B2G space—it’s a differentiator.

Accessibility and Compliance: The Non-Negotiables

Section 508 compliance is the baseline for any government-facing digital experience. Alongside WCAG 2.1 guidelines, these standards ensure that websites are usable by people with disabilities, including those using screen readers, keyboard navigation, or alternative input devices.

But compliance doesn’t have to be a creativity killer. In fact, designing with accessibility in mind often leads to cleaner layouts, better content structure, and more usable interfaces for everyone.

Tools like Axe, WAVE, and Lighthouse can help identify issues early in the design process. Even more important is building accessibility into your workflow from day one—writing semantic HTML, designing for contrast and readability, and testing with real users when possible.

Compliance isn’t a one-time box to check. It’s an ongoing commitment that—when done right—enhances the overall experience.

Engagement Without Compromise

Just because your site has to follow the rules doesn’t mean it has to be boring. In fact, engaging design is often about doing more with less.

Here are a few UX principles that shine in the government space:

- Clarity over cleverness: Use plain language, intuitive labels, and clear visual hierarchy.

- Consistency builds trust: Standardize layouts, navigation, and interaction patterns to reduce friction.

- Guide the user journey: Employ subtle animations, progress indicators, and calls to action to keep users oriented and informed.

Small touches—like clean iconography, digestible content blocks, or a smart search function—can go a long way in making your digital experience more intuitive and user-friendly.

Building UX into the Proposal Process

UX shouldn’t be an afterthought—or an add-on once the development process is underway. Forward-thinking government contractors are baking user experience into their RFP responses, showing prospective clients how they’ll create usable, accessible solutions from the start.

This approach demonstrates not only technical know-how, but a genuine understanding of the agency’s end users and mission. By collaborating across design, development, content, and compliance teams early, contractors can avoid costly rework and deliver smarter, faster solutions.

Future Trends in Gov UX

The bar is rising for digital experiences—even in the public sector. Government buyers and stakeholders increasingly expect:

- Mobile-first functionality that works seamlessly across devices

- AI-enhanced interfaces for smarter content delivery and navigation

- Modular, design system-driven platforms that allow for scalable updates and consistency

- Human-centered cybersecurity, where secure doesn’t mean confusing

As these expectations evolve, the ability to deliver UX that’s both compliant and compelling will become a critical differentiator.

Partnering with Experts for Results

Designing UX for the government audience requires more than a basic understanding of Section 508. It requires an agency partner that understands the nuances of federal requirements, the strategic goals of B2G marketing, and the creative potential of great design.

At Bluetext, we specialize in creating digital experiences that meet the highest standards for accessibility and engagement—whether you’re responding to an RFP, redesigning a contractor portal, or launching a campaign microsite.

Is your digital presence working as hard as your proposal team? Contact Bluetext to build a UX that’s as smart, secure, and strategic as your business.

Marketing to government audiences is a different game. Unlike commercial buyers, government decision-makers operate within a framework of strict procurement rules, risk mitigation priorities, and mission-driven goals. That means the messages that work in B2B or B2C settings often fall flat in B2G (business-to-government) environments.

To break through the noise and build credibility with government stakeholders, your marketing message needs to be sharp, structured, and strategically aligned with the public sector’s unique expectations. Here’s how to tailor your messaging to resonate with decision-makers in government.

What Makes Government Audiences Unique?

Government buyers are not just influenced by brand awareness or product features—they’re tasked with serving the public interest, meeting compliance standards, and ensuring taxpayer dollars are spent wisely. These decision-makers are typically risk-averse, procurement-focused, and guided by regulations.

It’s also important to understand that the government buying process involves multiple stakeholders:

- Technical experts who evaluate product feasibility.

- Program managers who care about mission alignment.

- Contracting officers who focus on price, compliance, and past performance.

Crafting messages that speak to each of these groups—without overcomplicating or overwhelming—is key.

Principles of Effective B2G Messaging

Government audiences respond best to messages that are clear, credible, and connected to their mission. Here are some essential principles to follow:

- Mission First: Frame your offering in terms of how it supports the agency’s objectives or improves public outcomes.

- Proof Over Promotion: Back every claim with data, use cases, or credentials. Flashy slogans don’t hold weight—facts do.

- Trust and Compliance: Emphasize security standards, certifications (like FedRAMP or CMMC), and contract history to reduce perceived risk.

- Simplicity is Strength: Avoid industry jargon or buzzwords. Speak plainly, directly, and with authority.

Tailoring Your Message for the Government Buying Cycle

The government decision-making process is long and layered. Your messaging should adapt to each phase of the journey:

- Awareness: At this stage, government stakeholders are seeking information—not sales pitches. Educational content like white papers, webinars, or industry briefings can help establish your credibility.

- Consideration: Here, decision-makers want to understand how your solution stacks up. Highlight differentiators, technical capabilities, and mission relevance with tailored solution briefs or case studies.

- Decision: Now it’s about procurement. Make it easy for buyers to justify your solution—share past performance, articulate ROI, and demonstrate compliance. Clear pricing structures and acquisition paths matter.

Best Practices for Connecting with Government Audiences

To ensure your messaging lands with impact, keep these best practices in mind:

- Use Plain Language: Government audiences appreciate direct, jargon-free communication that gets to the point quickly.

- Tailor Content Formats: Capability statements, compliance checklists, and executive summaries are more effective than flashy brand decks.

- Address Agency Pain Points: Customize your messaging to reflect the specific challenges, mandates, or priorities of the agency you’re targeting.

- Be Consistent Across Channels: Whether it’s a website, digital ad, or RFI response, your brand message should reinforce trust and reliability every step of the way.

Positioning for Long-Term Success

Winning a government contract often takes time, persistence, and strategic alignment. The right messaging can open doors, but it’s consistency and clarity that keep them open. Government buyers want to work with partners who understand their world—who speak their language, anticipate their needs, and deliver on their promises.

At Bluetext, we specialize in helping brands craft B2G messaging that resonates with government audiences—combining strategic insight, content precision, and compliance know-how.

Ready to refine your message for government audiences? Bluetext helps B2G brands connect with decision-makers through precision messaging, content strategy, and campaign execution. Let’s start the conversation.

Winning federal contracts is a highly competitive process that requires more than just a strong proposal. In today’s digital-first landscape, government contractors must leverage modern marketing strategies to stand out, build credibility, and engage key decision-makers. A well-executed digital marketing strategy can be the difference between securing a contract and being overlooked. This blog explores how government contractors can use digital marketing to gain an edge in the federal procurement space.

Why Digital Marketing is Essential for Federal Contractors

Traditional networking and referrals remain valuable, but government buyers increasingly conduct research online before making procurement decisions. Without a strong digital presence, contractors risk missing out on critical opportunities. Digital marketing helps federal contractors:

- Increase Visibility: A robust online presence ensures agencies can find and evaluate your company.

- Build Credibility: A well-maintained website and thought leadership content establish trust.

- Engage Decision-Makers: Targeted digital campaigns help influence key stakeholders at the right time.

Optimizing Your Website for Government Buyers

Your website is often the first impression a government agency has of your company. To make it effective:

- Ensure Compliance: Include required disclaimers, certifications, and security measures.

- Clarify Capabilities: Highlight core competencies, past performance, and contract vehicles.

- Simplify Navigation: Make it easy for government buyers to find relevant information quickly.

SEO and Content Marketing for Thought Leadership

Search engine optimization (SEO) is critical for ranking in searches relevant to government contracting. Consider these strategies:

- Target Industry Keywords: Optimize for terms like “government contract consulting” or “federal procurement solutions.”

- Publish Informative Content: Create blog posts on regulatory updates, procurement tips, and case studies.

- Leverage Backlinks: Partner with industry sites and publications to improve authority.

Leveraging LinkedIn & Targeted Advertising for Outreach

LinkedIn is a powerful tool for engaging government buyers and influencers. Contractors should:

- Develop a Strong LinkedIn Presence: Share relevant content and updates.

- Engage in LinkedIn Groups: Participate in government contracting discussions.

- Run Targeted Ads: Use LinkedIn and other platforms for account-based marketing (ABM) to reach key decision-makers.

Final Thoughts

Winning federal contracts requires more than technical expertise; it demands a strategic marketing approach. By leveraging digital tools, optimizing your online presence, and engaging government buyers where they research, you can increase your chances of success in the GovCon space.

Need help crafting a government marketing strategy that drives results? Contact Bluetext today to elevate your brand and secure more federal contracts.

Navigating DOGE’s Impact on B2G Marketing

As government marketing continues to evolve, the Department of Government Engagement (DOGE) has introduced new guidelines that significantly impact how contractors engage with federal agencies. These changes mean that B2G brands must reassess their marketing strategies to ensure compliance while maintaining their competitive edge. Striking the right balance between regulatory adherence and compelling storytelling is crucial.

At Bluetext, we help government contractors navigate complex marketing challenges. This post explores actionable strategies to refine messaging, optimize outreach, and maintain credibility in the new era of DOGE compliance.

Understanding DOGE’s New Regulations

The recent DOGE guidelines are designed to enhance transparency and ethical marketing practices among government contractors. Key changes include:

- Stricter content regulations: Messaging must align with federal priorities and avoid misleading claims.

- Refined engagement protocols: Restrictions on direct outreach and solicitation require brands to be more strategic in their communications.

- Increased oversight of digital marketing efforts: Social media, paid advertising, and content marketing must adhere to compliance frameworks.

Failure to comply can lead to reputational damage and potential disqualification from federal contracts. Understanding these shifts is the first step toward adapting your marketing approach effectively.

Refining Your Value Proposition for a B2G Audience

A strong value proposition is essential to resonate with federal decision-makers. To align with DOGE’s standards, B2G brands should:

- Emphasize mission alignment: Clearly articulate how your solutions support government objectives.

- Prioritize data-backed claims: Use case studies and measurable outcomes to reinforce credibility.

- Maintain clarity and transparency: Avoid vague statements and ensure messaging is direct and compliance-friendly.

Optimizing Outreach Channels for Compliance and Impact

With new restrictions on direct marketing tactics, B2G brands must leverage alternative engagement strategies, such as:

- Educational content marketing: Thought leadership pieces, white papers, and webinars can position your brand as an industry authority.

- Strategic LinkedIn engagement: Building relationships through professional networking rather than direct solicitation.

- Account-based marketing (ABM): Targeted campaigns tailored to specific government agencies for higher relevance and engagement.

Leveraging Digital Tools for Compliance and Efficiency

Marketing automation and analytics platforms play a crucial role in maintaining compliance while optimizing effectiveness. Consider:

- CRM systems to track engagements: Ensure outreach efforts adhere to regulatory requirements.

- AI-driven content monitoring: Detect potential compliance risks before publishing marketing materials.

- Data-driven audience insights: Tailor campaigns to align with government procurement cycles and priorities.

Future-Proofing Your B2G Marketing Strategy

As regulations evolve, staying ahead of changes is key to long-term success. B2G brands should:

- Regularly audit marketing materials for compliance.

- Invest in team training to stay informed on regulatory updates.

- Establish crisis communication plans to handle potential compliance breaches proactively.

Partner with Bluetext for DOGE-Compliant Marketing

Navigating DOGE’s regulations while maintaining an effective marketing strategy requires expertise. At Bluetext, we specialize in helping B2G brands craft compelling, compliant marketing strategies that drive engagement and growth. Contact us today to ensure your marketing efforts align with federal regulations while maximizing impact.

The Department of Defense’s Operational Guidance for Enterprises (DOGE) is transforming procurement and compliance standards for businesses working with the government. As these regulations evolve, B2G companies must rethink their marketing strategies to ensure compliance while maintaining a competitive edge. Aligning marketing efforts with DOGE isn’t just about meeting new requirements—it presents an opportunity to differentiate and strengthen brand positioning. This blog explores key marketing pivots that can help B2G companies adapt successfully.

Understanding DOGE: Key Compliance and Procurement Changes

DOGE introduces updated compliance and procurement processes that impact how B2G companies communicate their value propositions. Some key aspects of DOGE include:

- Enhanced cybersecurity requirements that necessitate clear messaging around data protection and operational security.

- Stronger vetting and certification processes for vendors, influencing how businesses position themselves as trusted partners.

- Greater emphasis on supply chain transparency, which must be reflected in marketing materials and brand storytelling.

Strategic Marketing Adjustments for DOGE Compliance

To remain competitive and compliant, B2G companies should make the following strategic adjustments:

1. Develop Transparent and Compliant Messaging

Regulatory language and security commitments should be embedded in all marketing materials. Clearly communicate compliance with DOGE standards to build credibility and trust.

2. Leverage Digital Channels for Education and Engagement

Use websites, webinars, and thought leadership content to educate government stakeholders about your compliance posture and value proposition.

3. Align Content Marketing with Evolving Procurement Processes

Ensure that whitepapers, case studies, and digital content showcase adherence to DOGE guidelines. Highlighting past performance in compliant contracts can set your company apart.

Strengthening Brand Positioning Through Compliance Alignment

Rather than viewing compliance as a burden, companies can use DOGE alignment as a competitive advantage:

- Thought leadership: Share insights on compliance trends via blogs and LinkedIn articles.

- Trust-building: Create case studies that illustrate successful implementation of DOGE-compliant processes.

- Strategic partnerships: Collaborate with industry leaders and certification bodies to reinforce credibility.

Actionable Steps for B2G Marketers

To stay ahead of compliance shifts, B2G companies should:

- Conduct a marketing audit to ensure all messaging aligns with DOGE regulations.

- Update website content and digital assets to reflect security and compliance commitments.

- Strengthen government-facing outreach efforts with transparent and targeted engagement strategies.

Final Thoughts

DOGE compliance isn’t just a regulatory necessity—it’s a chance to refine and strengthen your brand’s positioning. By proactively adjusting marketing strategies, B2G companies can enhance trust, credibility, and competitiveness in the evolving procurement landscape.

Need to refine your B2G marketing strategy to align with evolving compliance standards? Contact Bluetext today to ensure your brand messaging and digital presence stay ahead of regulatory changes.

As a new administration takes shape, brands must be prepared to navigate shifts in policy, regulation, and public sentiment that could directly impact their marketing strategies. From evolving government priorities to changes in procurement and compliance, staying agile is crucial for maintaining relevance and positioning for success. Here’s how businesses can adapt to a shifting political landscape.

1. Understand Policy Changes and Their Impact

New administrations often bring shifts in regulations, economic priorities, and industry-specific policies. Brands must stay informed about these changes, particularly those affecting taxation, environmental policies, labor laws, and procurement processes. By monitoring legislative updates and industry insights, businesses can proactively adjust their marketing messaging and strategies to align with new regulations.

2. Reassess Audience Sentiment

Public sentiment can shift dramatically with political change. Brands should conduct audience research and sentiment analysis to gauge how consumer attitudes evolve in response to new policies. Tailoring messaging to reflect changing priorities, such as sustainability, inclusivity, or economic resilience, can strengthen brand positioning and engagement.

3. Align Messaging with Evolving Priorities

Government policies can influence public priorities, affecting how brands communicate. For example, if an administration prioritizes renewable energy, businesses in related industries may benefit from emphasizing sustainability in their marketing. Companies should align messaging with relevant topics while maintaining authenticity and avoiding overt political endorsements.

4. Adjust Digital Advertising Strategies

Changes in regulations around data privacy and digital advertising policies can impact marketing campaigns. Brands should stay compliant with evolving rules, such as restrictions on targeted ads or data collection, and explore alternative strategies like contextual advertising and first-party data utilization to maintain effective audience reach.

5. Strengthen Government and B2G Marketing Efforts

For businesses selling to the government, shifts in procurement strategies and budget allocations can present new opportunities and challenges. Companies should refine their B2G marketing strategies by closely tracking procurement trends, engaging with key decision-makers, and optimizing their value propositions to align with evolving government needs.

6. Prepare for Crisis Management and Reputation Resilience

A polarized political environment can increase the risk of brand controversies. Companies should develop crisis communication strategies to handle potential backlash, maintain transparency, and uphold brand values. Proactively managing reputation through clear communication and stakeholder engagement can help brands navigate political turbulence effectively.

Navigating Change with Confidence

Adapting to a shifting political landscape requires brands to be informed, flexible, and proactive. By understanding policy changes, reassessing audience sentiment, refining messaging, and staying compliant with new regulations, businesses can navigate uncertainty while maintaining a strong market presence. Need expert guidance? Contact Bluetext today to ensure your marketing strategy remains resilient in a changing environment.

Winning government cybersecurity contracts is no small feat. With the rise of cyber threats targeting national security, public infrastructure, and sensitive data, government agencies are actively seeking private-sector partners to bolster their defenses. However, for cybersecurity firms targeting business-to-government (B2G) opportunities, standing out in a crowded field requires more than just cutting-edge technology—it demands a strategic approach to marketing. This guide explores the essentials of marketing for cybersecurity firms aiming to secure government contracts, with a focus on compliance, communication, and effective messaging.

Understanding the Regulatory Landscape

Compliance is the foundation of marketing for government cybersecurity contracts. Federal, state, and local agencies operate within strict regulatory frameworks, including standards like:

- NIST Cybersecurity Framework: A cornerstone for ensuring secure systems and processes.

- FedRAMP Certification: For firms offering cloud services to government agencies.

- DFARS Compliance: Relevant for working with the Department of Defense.

Your marketing materials and messaging must demonstrate your firm’s ability to meet these requirements. Incorporate proof of certifications, audits, and adherence to these standards into your website, collateral, and presentations. Without a clear focus on compliance, your firm may fail to even qualify for consideration. Additionally, staying up-to-date with evolving regulations is crucial. As standards and requirements shift to address new threats, your firm’s ability to adapt and demonstrate continued compliance can give you a competitive edge. Regularly review updates to government policies and incorporate those changes into your marketing narrative to showcase your proactive approach.

Building Credibility Through Communication

Government agencies are highly risk-averse, especially when it comes to cybersecurity. Establishing trust is key, and the way you communicate can make or break your credibility. Case studies and testimonials play a critical role in this process. Showcase success stories where your cybersecurity solutions have effectively mitigated risks or safeguarded assets. Be specific about measurable results, such as the percentage reduction in breaches or downtime avoided. Thought leadership content is another valuable tool. Publish blogs, whitepapers, and webinars on topics like emerging cyber threats or best practices for securing government systems. Positioning your firm as an industry authority builds trust with decision-makers and reinforces your expertise. Tailored outreach is equally essential. Avoid generic pitches. Research the specific needs and challenges of the agency you’re targeting and craft customized proposals. Personalization signals your genuine understanding of their mission and pain points, which can significantly improve your chances of securing contracts. Consistency across your communication channels ensures your message resonates and reinforces your firm’s expertise. Whether through email campaigns, presentations, or in-person meetings, maintaining a cohesive narrative builds confidence in your capabilities.

Crafting Resonant Messaging

Government buyers prioritize solutions that align with their mission and address their pain points. To craft effective messaging, emphasize security and resilience. Highlight how your solutions proactively mitigate risks and enhance operational resilience. Speak their language by using terminology familiar to government stakeholders, such as references to “mission-critical systems” or “continuity of operations.” Address cost-efficiency, as budget constraints are a reality for many government agencies. Demonstrate the value and return on investment your firm can provide. Showcase agility by emphasizing how your solutions adapt to emerging challenges. With cyber threats evolving rapidly, government agencies need partners who can keep pace. Your messaging should balance technical depth with accessibility, ensuring both technical evaluators and non-technical decision-makers understand your value. Consider creating audience-specific materials to cater to different stakeholders within the procurement process, from IT specialists to program managers and budget officers. By aligning your messaging with their diverse priorities, you can better articulate your value proposition.

Leveraging Digital Channels for B2G Marketing

Digital marketing is just as important in the B2G space as in commercial markets. Leverage these strategies to amplify your reach: LinkedIn campaigns can target federal and state government decision-makers with sponsored content showcasing your expertise. Search engine optimization (SEO) is critical; optimize your website for keywords like “government cybersecurity solutions” and “FedRAMP-certified services.” Account-based marketing (ABM) focuses on individual agencies, tailoring ads and email campaigns to their unique requirements. Remember to keep your digital assets—from landing pages to downloadable content—compliant with accessibility standards like WCAG, which many government buyers expect. Beyond these tactics, consider investing in webinars and virtual events that cater specifically to government audiences. These platforms allow you to demonstrate your expertise, interact directly with decision-makers, and address their questions in real-time. Additionally, monitor analytics from your digital campaigns to continuously refine your approach, ensuring maximum impact and engagement.

A Strategic Approach to Success

Securing government cybersecurity contracts requires a well-rounded marketing strategy that prioritizes compliance, builds trust, and delivers resonant messaging. By understanding the regulatory landscape, communicating effectively, and leveraging digital channels, your firm can stand out as a reliable partner in protecting the nation’s cyber infrastructure. The competition for these contracts is fierce, but with a clear strategy that emphasizes your strengths and aligns with the unique needs of government agencies, your firm can position itself as a trusted partner in the fight against cyber threats. Ready to position your cybersecurity firm for B2G success? Contact Bluetext today to learn how we can help you navigate the complexities of marketing to government agencies.