Prefer listening over reading? Check out the podcast version of this blog below and enjoy insights on the go!

Cybersecurity companies operate in one of the most competitive and complex markets in B2B. The stakes are high, the technology is sophisticated, and buyers are increasingly skeptical. While demand for cybersecurity solutions continues to grow, many companies struggle to communicate their value clearly and consistently.

Marketing in this space is fundamentally different from other B2B categories. Success depends on more than lead generation or brand awareness. It requires clarity, credibility, and a deep understanding of how security buyers evaluate risk. For many organizations, working with a specialized cybersecurity marketing agency becomes essential to navigating these challenges effectively.

Why Cybersecurity Marketing Is Uniquely Challenging

Cybersecurity marketing sits at the intersection of technical complexity and business risk. Products are often highly specialized, yet buyers range from deeply technical practitioners to executive decision-makers focused on financial and operational impact.

Adding to the challenge, the market is crowded. New vendors emerge constantly, many using similar language and claims. Buyers are inundated with messaging that promises protection, visibility, or resilience, making it difficult for any single brand to stand out.

Trust also plays an outsized role. In cybersecurity, credibility is not optional. Prospective customers must believe that a vendor understands the threat landscape and can protect critical systems. Marketing that feels exaggerated, vague, or overly promotional can quickly undermine confidence.

Challenge 1: Translating Technical Complexity Into Clear Value

One of the most common pitfalls in cybersecurity marketing is an overemphasis on features and technical capabilities. While accuracy matters, deeply technical messaging often fails to resonate with buyers who are focused on outcomes rather than architecture.

Security leaders care about reducing risk, improving response times, and maintaining compliance. Executives want to understand how a solution protects the business, minimizes disruption, and supports long-term resilience. When messaging does not connect technology to these priorities, it creates friction in the buying process.

This challenge is especially pronounced for early-stage and mid-market cybersecurity companies, where product innovation can outpace marketing maturity.

Overcoming Complexity With Strategic Messaging

Effective cybersecurity marketing starts with a disciplined messaging strategy. This means identifying the core problems the product solves and articulating them in language that resonates with different audiences.

A strong messaging framework speaks to both technical and business stakeholders without oversimplifying or diluting accuracy. It prioritizes clarity, relevance, and consistency across channels. Use cases, real-world scenarios, and proof points help ground abstract capabilities in tangible outcomes.

A cybersecurity marketing agency brings structure to this process. With category experience, they know how to balance precision with accessibility, ensuring that complex offerings are understood and remembered.

Challenge 2: Building Trust in a High-Stakes Market

Trust is the foundation of every cybersecurity purchase. Buyers are evaluating vendors not just on functionality, but on reliability, expertise, and long-term viability. Any perception of risk or uncertainty can derail a deal.

For newer companies, establishing credibility is often the biggest hurdle. For established firms, maintaining trust while evolving the brand or expanding into new markets can be equally challenging.

Marketing missteps, such as overpromising results or relying on buzzwords, can quickly erode confidence. In cybersecurity, buyers expect accuracy, transparency, and depth.

Strategies for Establishing Credibility and Authority

Building trust requires consistency over time. Thought leadership plays a critical role, particularly when it demonstrates genuine understanding of the threat landscape and emerging challenges. Content should educate rather than sell, positioning the company as a knowledgeable and reliable partner.

Brand consistency is equally important. From visual identity to tone of voice, every touchpoint should reinforce professionalism and credibility. Customer proof, analyst recognition, and third-party validation help further reduce perceived risk.

A marketing agency for cybersecurity companies understands how to build authority without exaggeration. They focus on long-term brand equity alongside near-term campaign performance.

Challenge 3: Differentiating in a Saturated Cybersecurity Landscape

Differentiation is one of the most persistent challenges in cybersecurity marketing. Many vendors offer overlapping capabilities, and industry language has become increasingly homogenized.

Claims around visibility, protection, and intelligence are common, making it difficult for buyers to discern meaningful differences. Feature-based differentiation often collapses under scrutiny, especially when competitors make similar claims.

Without clear positioning, marketing efforts risk blending into the background, regardless of product quality.

Creating Differentiation Through Brand Strategy

True differentiation comes from strategic positioning, not feature lists. Effective cybersecurity brands define who they serve, what problems they solve best, and why their approach is distinct.

This requires making deliberate choices. Not every buyer is the right buyer, and not every capability needs equal emphasis. Clear positioning helps focus messaging, guide campaign development, and align sales and marketing teams.

A cybersecurity marketing agency brings an external perspective that helps uncover defensible points of differentiation. By aligning brand strategy with business objectives, companies can cut through noise and communicate value more effectively.

Challenge 4: Reaching Multiple Buyers With Conflicting Priorities

Cybersecurity buying decisions rarely rest with a single individual. Security practitioners, IT leaders, CISOs, and executives all influence the process, often with different priorities and concerns.

Marketing must address technical depth without alienating non-technical stakeholders. Content that resonates with security teams may not land with executive buyers, and vice versa. This complexity makes one-size-fits-all messaging ineffective.

Understanding where and how each audience engages is critical to building effective campaigns.

Campaign Strategies That Drive Engagement and Results

Successful cybersecurity campaigns are integrated and intentional. Brand, content, digital, and demand efforts should work together to support long sales cycles and complex decision-making processes.

Measurement frameworks must reflect these realities. While leads and conversions matter, engagement quality and pipeline influence often provide more meaningful insight. Metrics such as account engagement, content performance, and sales alignment help connect marketing activity to revenue outcomes.

A marketing agency for cybersecurity companies brings experience designing campaigns that balance brand building with performance, ensuring that marketing supports growth at every stage.

Why Specialized Cybersecurity Marketing Expertise Matters

Generalist B2B marketing approaches often fall short in cybersecurity. Without category knowledge, agencies can struggle with messaging accuracy, credibility, and buyer expectations.

A specialized cybersecurity marketing agency understands the nuances of the space, from regulatory considerations to evolving threat narratives. This expertise accelerates strategy development and reduces the risk of missteps that can damage trust.

For many cybersecurity companies, partnering with an experienced agency allows internal teams to focus on product innovation while ensuring marketing execution remains disciplined and effective.

Turning Marketing Challenges Into Competitive Advantage

Cybersecurity marketing challenges are significant, but they are not insurmountable. Companies that invest in clarity, credibility, and strategic alignment are better positioned to stand out in crowded markets.

By addressing complexity through strong messaging, building trust through consistent brand execution, and differentiating through clear positioning, cybersecurity companies can transform marketing into a growth driver.

The right agency partnership can make the difference between blending in and leading the conversation. With the right strategy and execution, marketing becomes a competitive advantage rather than a bottleneck.

Ready to turn complex cybersecurity offerings into clear, compelling marketing?

Bluetext partners with cybersecurity companies to clarify positioning, build trust, and create marketing strategies that support real business growth. If you’re looking for a team that understands the cybersecurity landscape and knows how to translate technical depth into impact, let’s talk.

Prefer listening over reading? Check out the podcast version of this blog below and enjoy insights on the go!

A strong brand does more than look good. It clarifies who you are, why you matter, and why the right customers should choose you. In competitive B2B and technology-driven markets, branding often determines whether a company stands out or blends in.

That makes choosing the right branding partner a critical decision. The agency you select will influence how your business is perceived by buyers, investors, employees, and partners for years to come. Yet many organizations underestimate what true alignment looks like and focus too narrowly on visuals or cost.

Whether you are evaluating a DC branding agency for proximity and market familiarity or searching for a specialized B2B branding agency with deep technical experience, the right partner should understand your vision and know how to translate it into a brand that supports growth.

What Brand Alignment Really Means

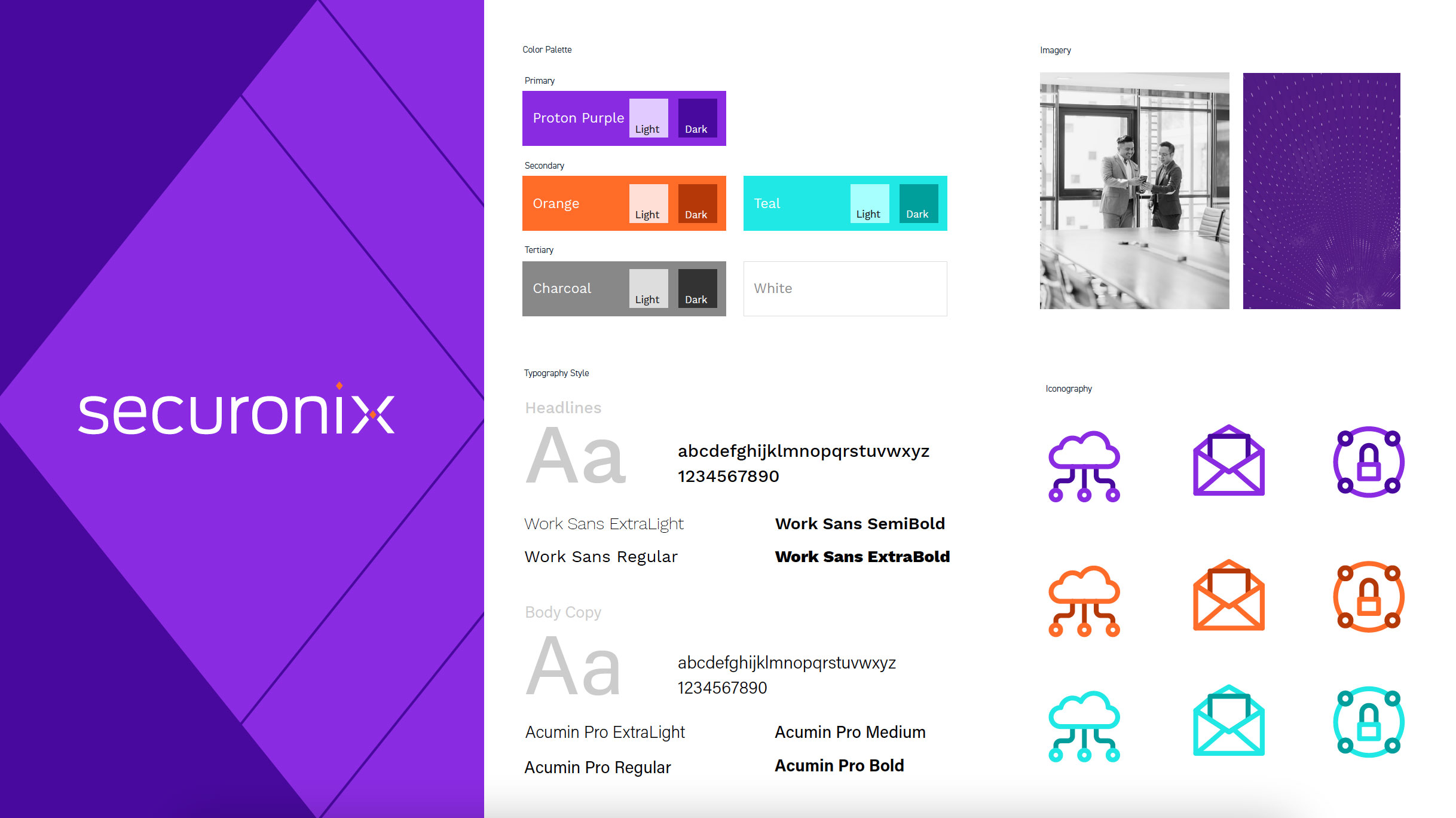

Brand alignment goes far beyond agreeing on a color palette or logo style. True alignment means your branding partner understands your business objectives, your market dynamics, and the challenges your audience faces. It shows up in how strategy informs every creative decision, from messaging and naming to visual identity and digital experience.

An aligned agency will ask thoughtful questions early in the process. They will want to understand where your business is headed, not just where it is today. This includes your growth plans, competitive pressures, and how success should be measured after launch.

When alignment is missing, branding efforts often feel disjointed. Messaging becomes vague, design choices lack purpose, and the brand struggles to support sales and marketing efforts. Alignment ensures the brand works as a strategic asset rather than a surface-level refresh.

Key Traits to Look for in a Branding Partner

Not all agencies approach branding with the same level of rigor. As you evaluate potential partners, there are several traits that consistently distinguish effective branding agencies from transactional vendors.

First, look for strategic depth. A strong branding partner understands that branding exists to support business outcomes, not just aesthetics. They should be able to explain how their work will help you differentiate, communicate value, and scale.

Second, experience matters, particularly in complex markets. A B2B branding agency with experience in technology, cybersecurity, or regulated industries will be better equipped to navigate nuanced messaging, long sales cycles, and multiple stakeholders. Similarly, a tech branding agency should be fluent in translating sophisticated offerings into clear, compelling narratives.

Finally, evaluate how the agency collaborates. Branding is rarely successful when it is done in isolation. The best partners are structured, transparent, and adaptable, with processes that invite stakeholder input while maintaining momentum and focus.

Questions to Ask About Brand Strategy

Before reviewing creative work, it is important to understand how an agency approaches strategy. Brand strategy forms the foundation for everything that follows, and weak strategy often leads to underperforming brands.

Ask how the agency defines positioning and differentiation. They should be able to articulate how your brand will occupy a distinct space in the market and why that position is defensible. You should also ask how they incorporate customer insights, competitive analysis, and internal perspectives into their strategy work.

Another important question is how brand strategy supports revenue. A strong branding partner understands how brand decisions affect sales enablement, demand generation, and buyer confidence. Strategy should not live in a vacuum. It should inform messaging, content, digital experiences, and how your teams communicate consistently.

Evaluating Naming Capabilities

Naming is one of the most high-impact branding decisions a company can make, especially for B2B and technology organizations. A name sets expectations, shapes perception, and influences memorability in crowded markets.

When evaluating an agency’s naming capabilities, ask about their process. A thoughtful naming approach balances creativity with practicality and strategic intent. It should account for brand architecture, future offerings, and market expansion, rather than focusing only on what sounds appealing today.

You should also ask how legal and linguistic considerations are handled. While agencies are not legal counsel, experienced branding partners understand how to screen names effectively and collaborate with legal teams to minimize risk. Naming should feel deliberate and future-ready, not rushed or reactive.

What to Look for in Logo Design and Visual Identity

Visual identity is often the most visible expression of a brand, but it should never exist independently of strategy. A logo and visual system should reinforce positioning, support recognition, and scale across channels and use cases.

As you review an agency’s design work, look for clarity and consistency. Strong visual identities are flexible systems, not one-off designs. They work equally well across digital platforms, presentations, trade show environments, and marketing campaigns.

It is also important to assess whether the agency designs with longevity in mind. Trend-driven visuals may look compelling in the short term but can quickly feel dated. A strong branding partner focuses on creating systems that endure and evolve alongside the business.

Understanding the Agency’s Process and Collaboration Model

Process is often overlooked, yet it is one of the clearest indicators of how successful a branding engagement will be. A defined process provides structure, manages risk, and ensures strategy informs execution at every stage.

Ask how the agency structures discovery, strategy, and creative development. You should understand when and how stakeholders will be involved, how feedback is incorporated, and how decisions are ultimately made. Transparency around timelines and responsibilities helps prevent misalignment and frustration.

Collaboration style matters as well. The best branding partners strike a balance between listening closely and providing confident guidance. They are comfortable challenging assumptions when necessary and can explain the rationale behind their recommendations clearly and constructively.

Why Industry Experience Matters, but Perspective Matters More

Industry experience can be a significant advantage, particularly for organizations operating in complex or regulated markets. A DC branding agency, for example, may bring valuable familiarity with government-adjacent audiences, procurement environments, and credibility requirements.

That said, experience alone is not enough. Agencies that rely too heavily on industry templates may struggle to create truly differentiated brands. The most effective partners combine domain expertise with fresh perspective, applying proven frameworks while avoiding formulaic thinking.

When evaluating agencies, look for evidence that they can adapt their approach to your specific context. Case studies should demonstrate strategic thinking, not just surface-level familiarity with similar industries.

Signs You Have Found the Right Branding Partner

Alignment becomes clear when you pay attention to how an agency engages with your team. The right partner will ask insightful questions that challenge your assumptions and clarify priorities. They will demonstrate a clear understanding of your business and articulate your value proposition in ways that resonate.

You should also feel that the agency is invested in your long-term success, not just the immediate project. Strong branding partners think beyond launch and consider how the brand will be activated, governed, and evolved over time.

Ultimately, trust is a key indicator. When strategy, process, and communication align, collaboration feels productive and focused rather than reactive or transactional.

Choosing a Partner That Grows With You

Branding is not a one-time exercise. It is a long-term investment that shapes how your organization is perceived as it grows and changes. Choosing the right branding partner means finding an agency that understands your vision today and can help you adapt tomorrow.

Whether you are seeking a specialized tech branding agency, an experienced B2B branding agency, or a DC branding agency with regional and regulatory insight, alignment should be the deciding factor. The right partner will help you build a brand that not only stands out, but stands the test of time.

If you are evaluating branding partners and want a strategic perspective grounded in business outcomes, Bluetext helps organizations define, design, and activate brands built for growth. Contact us today to learn more.

Prefer listening over reading? Check out the podcast version of this blog below and enjoy insights on the go!

Breaking into government markets can be challenging, even for highly capable technology companies. While many organizations assume that success in commercial markets will translate naturally to the public sector, B2G marketing operates under a very different set of rules. Procurement complexity, long buying cycles, and heightened scrutiny mean that visibility alone is not enough. Credibility, trust, and mission alignment are essential.

For tech companies looking to expand into federal, state, or local government markets, a clear and disciplined B2G marketing strategy is critical. This guide outlines what makes B2G marketing different, how to approach it strategically, and which tactics consistently drive results.

Why B2G Marketing Is Fundamentally Different

B2G marketing differs from B2B and B2C marketing in both audience mindset and execution. Government buyers are accountable to taxpayers, oversight bodies, and internal stakeholders. As a result, risk aversion plays a central role in decision-making.

Unlike commercial buyers, government audiences are rarely persuaded by aspirational messaging or aggressive calls to action. They prioritize reliability, compliance, and proven outcomes. Marketing efforts must therefore focus on building confidence over time rather than driving immediate conversions. The goal is to become a known, trusted entity before a procurement opportunity formally emerges.

What B2G Marketing Means for Tech Companies

B2G marketing refers to the strategies and tactics used to promote products and services to government agencies and public sector organizations. For technology companies, this includes marketing to federal civilian agencies, the Department of Defense, state and local governments, and quasi-government entities.

Tech companies face additional complexity because their offerings are often highly technical. Successful B2G marketing translates those capabilities into mission-relevant outcomes, such as improved security, modernization, efficiency, or resilience. It also aligns marketing activities with procurement timelines and capture strategies, ensuring that visibility supports long-term revenue goals.

Understanding the Government Buyer Mindset

Government buying decisions are rarely made by a single individual. Instead, they involve committees that may include technical evaluators, contracting officers, program managers, and executive leadership. Each stakeholder evaluates risk differently, which makes consistent, clear messaging essential.

Trust is built through repetition and proof. Buyers look for signals that a company understands their mission, has operated successfully in similar environments, and can deliver without disruption. Certifications, compliance frameworks, and past performance carry significant weight. Marketing that ignores these factors often fails to gain traction, regardless of product quality.

Core Pillars of an Effective B2G Marketing Strategy

A strong B2G marketing strategy rests on several foundational pillars. The first is positioning. Tech companies must clearly articulate how their solutions support agency missions rather than focusing solely on features or innovation.

The second pillar is credibility. This includes showcasing certifications, partnerships, contract vehicles, and relevant experience. Credibility signals reduce perceived risk and help buyers justify engagement internally.

Consistency is another critical factor. Messaging, visual identity, and value propositions should remain aligned across websites, events, content, and sales enablement materials. Finally, alignment between marketing, capture, and business development teams ensures that marketing efforts support real opportunities rather than operating in isolation.

Messaging Frameworks That Resonate With Government Audiences

Effective B2G messaging prioritizes clarity and relevance. Technical depth is important, but only after establishing why the solution matters to the agency’s mission. Messaging should emphasize outcomes such as operational efficiency, improved security posture, or compliance with mandates.

Language should be precise and free of unnecessary hype. Government buyers tend to respond better to plain, direct communication than to buzzwords or exaggerated claims. Proof points, including case studies and third-party validation, strengthen credibility and help differentiate in crowded markets.

B2G Marketing Channels That Drive Visibility

While B2G marketing relies less on high-volume digital tactics, a strong digital foundation is still essential. A website optimized for government audiences should clearly communicate capabilities, compliance readiness, and mission alignment. It should also make it easy for buyers to find relevant information quickly.

Thought leadership plays a significant role in public sector marketing. White papers, webinars, and bylined articles help establish authority while educating buyers. Events and trade shows remain valuable for relationship building, particularly when paired with targeted pre- and post-event outreach.

Public relations and analyst engagement also support credibility. Earned media placements in government-focused publications reinforce legitimacy and increase visibility among decision-makers.

Campaign Execution in a B2G Environment

B2G campaigns require patience and coordination. Rather than short-term promotions, campaigns should support long buying cycles by maintaining consistent presence and reinforcing key messages over time.

Successful campaigns are often tied to specific agencies, mission areas, or contract vehicles. They integrate digital, content, PR, and events to ensure that messaging reaches buyers through multiple touchpoints. Measurement focuses less on immediate lead volume and more on engagement quality, awareness, and influence.

Common B2G Marketing Mistakes Tech Companies Make

One of the most common mistakes in B2G marketing is treating government buyers like commercial customers. Tactics that work in B2B, such as aggressive retargeting or promotional language, often undermine credibility in the public sector.

Another frequent issue is overemphasizing product features without clearly connecting them to mission outcomes. Tech companies may also underestimate the importance of internal alignment, resulting in marketing messages that conflict with capture strategies or proposal narratives.

Finally, many organizations fail to invest in long-term brand building. In government markets, familiarity and trust are often prerequisites for consideration.

The Role of a B2G Marketing Agency

A B2G marketing agency brings specialized expertise that helps tech companies navigate public sector complexity. Agencies understand procurement dynamics, compliance considerations, and government buyer expectations.

Beyond execution, agencies provide strategic guidance that aligns marketing with capture and business development efforts. This reduces wasted effort and accelerates progress in highly competitive markets. For companies entering government markets or expanding into new agencies, agency support can significantly reduce risk.

How Bluetext Supports B2G Marketing for Tech Companies

Bluetext works with technology companies to develop and execute B2G marketing strategies that build credibility and drive long-term growth. Our approach combines positioning, messaging, and integrated campaigns designed specifically for government audiences.

We focus on helping clients articulate mission impact, strengthen visibility, and align marketing with broader public sector objectives. The result is marketing that supports real opportunity development rather than surface-level awareness.

Building Momentum in Government Markets

B2G marketing is not about quick wins. It is about establishing trust, demonstrating value, and showing up consistently over time. For tech companies willing to invest in the right strategy, government markets offer significant opportunities.

If your organization is looking to improve visibility, strengthen messaging, or refine its approach to government buyers, Bluetext can help. A focused, disciplined B2G marketing strategy is often the difference between being eligible and being selected.

Prefer listening over reading? Check out the podcast version of this blog below and enjoy insights on the go!

Not all WordPress sites are created equal. While WordPress powers more than 40 percent of the web, the difference between a high-performing business platform and a fragile, hard-to-manage site often comes down to how it was built and who built it.

For many organizations, WordPress starts as a fast, flexible solution. Over time, however, that same site can become a bottleneck. Pages are slow to load, content updates feel cumbersome, and new initiatives require workarounds instead of progress. At that point, the question is no longer whether WordPress can scale, but whether your current implementation can.

This guide breaks down when it makes sense to hire a WordPress development agency, what an agency actually brings to the table, and how to determine whether it is the right move for your business.

What a WordPress Development Agency Actually Does

A WordPress development agency is not simply a team that installs themes or configures plugins. At its core, a true WordPress development partner focuses on building a scalable, secure, and maintainable content management system that supports business and marketing goals over the long term.

This typically includes custom theme and block development, CMS architecture planning, performance optimization, and security hardening. Agencies also design editorial workflows that make content creation easier for marketing teams rather than more complex. In many cases, they integrate WordPress with CRMs, marketing automation platforms, analytics tools, and third-party systems that support lead generation and reporting.

Most importantly, a WordPress development agency approaches the site as a strategic platform, not a one-time build. The goal is to create a foundation that can evolve as the organization grows.

Signs It Is Time to Hire a WordPress Development Agency

Many organizations wait too long before seeking expert help. By the time an agency is brought in, the site has accumulated technical debt that limits what it can do. Recognizing the warning signs early can save time, money, and frustration.

One of the most common indicators is performance. If pages load slowly, break under traffic spikes, or require constant troubleshooting, the issue often lies in how the site was architected. Another red flag is content management friction. When simple updates require developer support or when marketers avoid using the CMS altogether, the system is no longer serving its purpose.

Security and compliance concerns are also a frequent trigger. As organizations grow, expectations around accessibility, data protection, and governance increase. A WordPress site built without these considerations in mind can quickly become a liability.

Finally, major business moments often expose the limits of an existing site. Rebrands, product launches, acquisitions, or international expansion tend to surface structural problems that cannot be solved with incremental fixes.

Common Business Scenarios That Require Agency-Level Expertise

There are specific situations where hiring a WordPress development agency is not just helpful, but necessary.

Rebrands are a prime example. Updating visuals without rethinking content structure, templates, and CMS logic often results in a site that looks new but functions the same. An agency ensures that messaging, design, and backend architecture evolve together.

Migrations are another high-risk scenario. Moving from a legacy CMS or a poorly built WordPress instance requires careful planning to avoid SEO losses, broken content, and workflow disruptions. Agencies bring repeatable processes that reduce risk during these transitions.

High-growth organizations also benefit from agency support. When traffic increases, campaigns become more complex, and multiple teams contribute content, the CMS must be designed to scale. Without that foundation, growth creates friction instead of momentum.

What You Gain by Working With a WordPress Development Agency

The most immediate benefit of hiring a WordPress development agency is clarity. Instead of reacting to issues as they arise, organizations gain a structured platform that anticipates future needs.

Custom development allows the CMS to reflect how your team actually works. Instead of forcing content into rigid templates, agencies create reusable blocks and flexible layouts that speed up publishing while maintaining brand consistency. This improves efficiency and reduces reliance on developers for everyday updates.

Performance and security improvements are also significant. Clean code, optimized hosting environments, and thoughtful plugin strategies lead to faster load times and fewer vulnerabilities. Over time, this translates to better search visibility, stronger user experiences, and lower maintenance costs.

Perhaps most importantly, a well-built WordPress site reduces long-term technical debt. By investing upfront in the right architecture, organizations avoid the cycle of patchwork fixes that eventually require a full rebuild.

WordPress Agency vs In-House Team: How to Decide

Deciding between an internal team and a WordPress development agency is not always a binary choice. Each approach has advantages depending on the scope of work and business objectives.

In-house teams are often best suited for ongoing content updates and minor enhancements. They bring institutional knowledge and can respond quickly to day-to-day needs. However, they may lack deep expertise in WordPress architecture, performance optimization, or large-scale migrations.

Agencies, on the other hand, excel during moments of transformation. They bring specialized skills, established processes, and cross-industry experience that accelerate complex initiatives. For many organizations, the most effective model is a hybrid one, where an agency builds or modernizes the platform and internal teams manage it going forward.

The key is aligning resources with the level of complexity involved.

How to Evaluate a WordPress Development Agency

Not all WordPress agencies are created equal. Choosing the right partner requires looking beyond visual design and asking the right questions.

Start by understanding how the agency approaches strategy. Do they ask about business goals, audiences, and content workflows before discussing solutions? A strong agency will prioritize these conversations early.

Technical expertise is equally important. Look for experience with custom development, not just theme customization. Ask how they approach scalability, security, and performance, and whether they have worked with organizations similar to yours.

Finally, consider long-term support. A WordPress site is never truly finished. Agencies that offer documentation, training, and ongoing optimization tend to deliver more value over time.

Why Enterprises and B2B Organizations Continue to Choose WordPress

When implemented correctly, WordPress remains one of the most flexible and powerful CMS platforms available. Its open-source foundation allows for deep customization, while its ecosystem supports integration with nearly any modern marketing or analytics tool.

For B2B and enterprise organizations, WordPress offers a balance of control and usability. Marketing teams gain autonomy without sacrificing governance, and technical teams can extend the platform as needs evolve. The result is a system that supports both agility and scale.

The caveat is execution. WordPress succeeds when it is treated as a strategic platform, not a shortcut.

Bluetext’s Approach to WordPress Development

At Bluetext, WordPress development starts with strategy. We focus on building platforms that support long-term growth, simplify content management, and integrate seamlessly with broader marketing ecosystems.

Our approach combines UX, design, and custom development to ensure that WordPress works for both users and internal teams. The result is not just a better website, but a more effective digital foundation for marketing and communications.

Ready to Evaluate Your WordPress Site?

If your current WordPress site feels difficult to manage, slow to evolve, or misaligned with your business goals, it may be time to reassess how it was built. Hiring a WordPress development agency is not about adding complexity. It is about removing the barriers that prevent your site from doing its job.

Bluetext works with organizations to design, build, and optimize WordPress platforms that scale. If you are considering a redesign, migration, or CMS modernization, we are happy to start with a conversation.

Prefer listening over reading? Check out the podcast version of this blog below and enjoy insights on the go!

Communicating effectively in the public sector is both an art and a science. Government agencies operate under complex regulations, serve diverse audiences, and must maintain credibility at every turn. Whether your goal is increasing awareness, influencing policy, or engaging stakeholders, selecting the right government PR firm is critical. A specialized firm understands federal, state, and local audiences and can develop strategies that deliver measurable results.

This guide explores how to choose a government PR firm that aligns with your agency’s objectives, amplifies your voice, and helps achieve meaningful impact.

Understanding Your Agency’s Communication Goals

Before evaluating potential PR firms, it’s essential to define your agency’s communication objectives. Are you looking to raise public awareness, advocate for policy initiatives, strengthen stakeholder relationships, or prepare for crisis situations?

A skilled government PR firm can tailor strategies to fit these goals, whether you’re reaching federal decision-makers, state officials, or local communities. Clear objectives also allow the firm to create focused messaging, select the right channels, and measure outcomes effectively.

Evaluating Experience and Expertise

Experience matters when choosing a government PR firm. The nuances of public sector communications—compliance, legislative awareness, and media sensitivities—require specialized knowledge that general PR firms often lack.

Consider a firm’s track record with similar agencies or campaigns. Do they have experience in your industry, whether it’s defense, healthcare, technology, or public administration? A government PR firm with sector-specific expertise understands audience expectations, regulatory considerations, and how to position your agency credibly.

Key considerations:

- Proven results with federal, state, or local campaigns

- Knowledge of government regulations and processes

- Expertise in creating messaging that resonates across different stakeholder groups

Assessing Strategy and Approach

A PR firm’s approach reveals how well it can meet your agency’s objectives. Ask about their methodology for research, messaging, media outreach, and measurement. A strategic firm will design campaigns grounded in data, targeted to your audiences, and adaptable to changing circumstances.

A capable government PR firm integrates both digital and traditional channels, ensuring consistent messaging across social media, press releases, briefings, and events. They also track campaign performance to provide actionable insights and continuously optimize results.

Tips for evaluation:

- Request sample campaigns or case studies

- Ask how they develop audience personas and messaging frameworks

- Clarify how they measure success and report results

Measuring Results and ROI

Accountability is essential when investing in a government PR firm. Clear metrics help your agency understand the impact of your communications and demonstrate value to leadership and stakeholders.

KPIs can include media coverage, stakeholder engagement, policy influence, and public sentiment. The right PR firm provides transparent reporting, illustrating both qualitative and quantitative outcomes. By measuring results, your agency can refine strategies, allocate resources effectively, and ensure communications achieve their intended impact.

Evaluating Cultural Fit and Collaboration

Successful campaigns depend on more than expertise; they rely on strong collaboration between your agency and the PR firm. Alignment in values, communication style, and work processes ensures smooth execution, especially in high-stakes or time-sensitive situations.

During evaluation, consider:

- How the firm communicates and provides updates

- Their responsiveness and adaptability

- Their willingness to collaborate closely with internal teams

A strong cultural fit fosters trust, improves workflow, and ultimately amplifies your agency’s voice more effectively.

Partner with the Right Government PR Firm

Selecting the right government PR firm requires careful consideration of expertise, strategy, measurable results, and collaboration. By focusing on firms with proven experience, a data-driven approach, and the ability to integrate multiple channels, your agency can amplify its voice, engage stakeholders, and achieve meaningful impact.

Ready to elevate your agency’s communications? Contact Bluetext today to partner with a government PR firm that delivers strategic, measurable results.

Not all marketing strategies work equally well for cybersecurity firms. Unlike traditional B2B businesses, cyber companies face unique challenges—complex solutions, highly technical audiences, and the critical need to establish trust with decision-makers. That’s why partnering with a cyber security marketing agency can make all the difference. From content marketing to LinkedIn campaigns, a specialized agency can help your brand reach the right audience while driving measurable results.

In this article, we’ll explore five proven marketing strategies that cybersecurity companies can leverage to grow their brand, generate leads, and position themselves as thought leaders in the space.

1. Thought Leadership Content Marketing

Content marketing remains one of the most effective ways for cybersecurity companies to build credibility. With high-value resources like white papers, case studies, technical blogs, and industry reports, your company can educate prospects and demonstrate expertise.

A cyber security marketing agency knows how to tailor content for technical audiences without overwhelming them. The right approach balances in-depth analysis with readability, helping your firm become a trusted advisor. By sharing actionable insights and highlighting success stories, your company can engage prospects early in the buying journey.

Tips for implementation:

- Develop educational white papers or research reports addressing industry pain points.

- Regularly publish technical blogs and LinkedIn articles for maximum reach.

- Include CTAs in content to capture leads, such as gated resources or newsletter sign-ups.

When done correctly, content marketing builds trust, positions your brand as an authority, and drives qualified leads to your sales team.

2. LinkedIn and B2B Social Media Campaigns

LinkedIn is the go-to platform for B2B cybersecurity marketing. Decision-makers, executives, and IT leaders spend time here, making it ideal for connecting with your target audience.

A cyber security marketing agency can create highly targeted campaigns that speak directly to your ideal clients. From sponsored content and carousel ads to employee advocacy programs, LinkedIn campaigns amplify reach while maintaining professional credibility.

Key strategies:

- Target posts to decision-makers at companies most likely to benefit from your solutions.

- Use video snippets or carousel ads to showcase product capabilities or client success stories.

- Encourage employees to share branded content to extend organic reach.

Metrics such as engagement rate, lead generation, and conversion tracking help you measure the impact of your campaigns and optimize for better performance over time.

3. Account-Based Marketing (ABM) for High-Value Targets

For cybersecurity companies, not all leads are created equal. Some organizations represent significantly higher revenue potential than others. Account-Based Marketing (ABM) allows you to focus your efforts on high-value targets through personalized campaigns.

An experienced cyber security marketing agency can implement ABM strategies, tailoring messaging, content, and outreach to each account. This approach strengthens relationships, increases engagement, and improves conversion rates, especially for complex solutions that require multiple decision-makers.

ABM tactics to consider:

- Personalized email sequences and content tailored to specific accounts.

- Custom landing pages for target companies.

- Executive webinars or VIP events to showcase expertise and solutions.

By investing in ABM, your company prioritizes quality over quantity, ensuring marketing resources are spent where they will yield the highest return.

4. Search Engine Optimization (SEO) for Cybersecurity Firms

Even in a niche industry like cybersecurity, prospects start their journey with online research. Appearing in search results for relevant queries is critical for generating inbound leads.

SEO for cybersecurity companies requires a strategic approach that combines technical optimization, keyword targeting, and content creation. A cyber security marketing agency can help identify high-value search terms and optimize content to increase visibility and drive organic traffic.

SEO best practices for cybersecurity marketing:

- Use industry-specific keywords, such as “cybersecurity solutions” or “threat intelligence software.”

- Optimize website architecture and page load speeds for user experience.

- Publish authoritative content that addresses customer pain points and questions.

By maintaining a consistent SEO strategy, your company ensures prospects find you when researching solutions, reducing reliance on costly paid campaigns and establishing long-term organic visibility.

5. Strategic Partnerships and Industry Events

Networking and partnerships are often overlooked but highly effective for cybersecurity marketing. Events, conferences, and webinars allow you to connect with potential clients while demonstrating expertise.

A cyber security marketing agency can manage event marketing, sponsorships, and co-marketing opportunities, ensuring your brand receives maximum visibility. Partnerships with complementary vendors also expand your reach and credibility within the industry.

Ways to leverage partnerships and events:

- Host webinars or panel discussions featuring industry experts.

- Sponsor or participate in cybersecurity conferences.

- Collaborate with vendors or industry associations for co-branded campaigns.

Events and partnerships not only generate leads but also strengthen brand awareness and reinforce your company’s position as a trusted authority in cybersecurity.

Transform Your Cybersecurity Marketing with Expertise

Marketing a cybersecurity company requires a strategic and specialized approach. By leveraging thought leadership content, LinkedIn campaigns, ABM, SEO, and industry partnerships, your brand can generate qualified leads, build credibility, and differentiate itself from competitors.

Partnering with a cyber security marketing agency ensures these strategies are implemented effectively, with measurable results that drive business growth. Whether you’re looking to improve content, increase lead generation, or expand your industry presence, a specialized agency brings the expertise and experience your cybersecurity firm needs to succeed.

Ready to elevate your cybersecurity marketing? Contact Bluetext today to start building a strategy that drives results.

Today’s digital audiences are less forgiving than ever. Users expect websites to be intuitive, fast, and easy to navigate, regardless of device or context. When a website fails to meet those expectations, users disengage quickly, often without a second chance.

This is where a UX design agency plays a critical role. Rather than focusing solely on visual appeal, a UX design agency evaluates how users interact with your website, identifies friction points, and designs experiences that support both user needs and business objectives. The result is a website that does more than look good—it works.

What a UX Design Agency Actually Does

A UX design agency brings structure and strategy to the design process. UX is rooted in understanding user behavior, motivations, and expectations, then translating those insights into clear, functional experiences.

Agencies combine research, information architecture, interaction design, and testing to ensure websites are built around real user needs. This strategic approach helps organizations avoid assumptions and design decisions based on internal bias rather than evidence.

By aligning user goals with business priorities, a UX design agency ensures that every design decision supports measurable outcomes.

Improving Website Usability by Removing Friction

One of the most immediate ways a UX design agency transforms a website is by improving usability. Usability issues often show up as confusing navigation, unclear calls to action, or overly complex content structures.

Through user research and testing, agencies identify where users struggle or abandon tasks. Navigation is simplified, information is reorganized, and interactions are refined to guide users toward clear next steps.

When usability improves, engagement increases and drop-off rates decline. Users are able to accomplish their goals faster and with less frustration.

Designing for Accessibility and Inclusivity

Accessibility is no longer optional. A UX design agency approaches accessibility as a fundamental component of good design, not a compliance exercise added at the end of a project.

Designing for accessibility means creating experiences that work for users with varying abilities, devices, and environments. Clear content hierarchy, readable typography, and intuitive interaction patterns benefit all users, not just those with accessibility needs.

By embedding accessibility into UX strategy and design systems, agencies help organizations build websites that are inclusive, compliant, and resilient as standards evolve.

Turning UX Improvements Into Measurable Results

UX design directly influences business performance. A UX design agency connects design decisions to metrics such as conversion rates, engagement, and task completion.

Reducing friction in key moments—such as form submissions, content discovery, or checkout flows—can have an immediate impact on results. UX improvements also support retention by making experiences easier and more satisfying over time.

Rather than treating UX as a one-time redesign, agencies focus on continuous optimization. Ongoing testing and iteration ensure the website continues to perform as user expectations change.

Extending UX Beyond the Website

A website is rarely the only digital touchpoint a user encounters. UX design agencies take a holistic view of the digital ecosystem, ensuring consistency across websites, portals, applications, and platforms.

Design systems play a key role in maintaining this consistency. Shared components, patterns, and guidelines allow organizations to scale UX efficiently without sacrificing quality.

By aligning experiences across channels, a UX design agency helps build trust and familiarity, making interactions feel cohesive rather than fragmented.

When to Engage a UX Design Agency

Organizations often turn to a UX design agency when they see declining engagement, low conversion rates, or user feedback pointing to frustration. Major initiatives such as website redesigns, platform migrations, or digital expansion efforts are also ideal moments to bring in UX expertise.

Engaging a UX design agency early in the process allows UX to inform strategy, structure, and technology decisions. This approach reduces rework and ensures the final experience is aligned from the start.

Treating UX as an ongoing capability rather than a one-off project leads to stronger long-term outcomes.

Transform Your Website Experience With a UX Design Agency

Bluetext partners with organizations to design website experiences that balance usability, accessibility, and performance. Our UX approach combines research, strategy, and design to create digital experiences that support real user needs and business goals.

If your website is not delivering the engagement or results you expect, Bluetext can help. Connect with our team to explore how a UX design agency can transform your website experience.

User expectations have never been higher. In 2026, digital experiences are judged not only on how they look, but on how efficiently they guide users, anticipate needs, and remove friction across every interaction. As technology ecosystems grow more complex and competition intensifies, UX is no longer a downstream design activity. It is a core business capability.

This shift is redefining the role of the modern UX design agency. Agencies are expected to bring strategic insight, data fluency, and deep understanding of user behavior—not just polished interfaces. The most effective UX partners are helping organizations design experiences that scale, adapt, and deliver measurable impact.

Below are the top five UX design trends agencies are actively implementing in 2026 to help brands stay ahead of the curve.

1. AI-Augmented Personalization at Scale

UX design agencies are increasingly leveraging artificial intelligence to move beyond static user journeys. In 2026, personalization is dynamic, contextual, and continuously evolving based on real user behavior.

Rather than designing a single experience for broad audiences, agencies are building UX frameworks for their clients that adapt content, navigation, and interactions in real time. Predictive UX models help anticipate user intent, while machine learning enables experiences to refine themselves over time.

Importantly, leading agencies are pairing AI-driven personalization with transparency and control. Clear user feedback loops, ethical data usage, and explainable design choices are critical to maintaining trust while delivering relevance at scale.

2. UX for Complex Enterprise and B2B Platforms

As enterprise platforms continue to expand in scope and functionality, UX design agencies are focused on simplifying complexity without diluting capability. In 2026, some of the most impactful UX work is happening in B2B, government, and highly regulated environments.

Agencies are designing experiences that support real workflows through role-based interfaces, progressive disclosure, and decision-support patterns. Instead of overwhelming users with every feature at once, UX is structured around context and intent.

This approach requires deep user research and close collaboration with stakeholders. A strong UX design agency understands that usability in enterprise environments is inseparable from operational realities and business objectives.

3. Accessibility-First and Compliance-Driven Design

Accessibility has moved from a best practice to a baseline expectation. In 2026, UX design agencies are embedding accessibility into the foundation of digital experiences rather than treating it as a retroactive requirement.

Designing with accessibility in mind improves usability for all users, not just those with disabilities. Clear navigation, readable typography, logical interaction patterns, and adaptable layouts benefit every audience.

Agencies are also helping organizations navigate evolving compliance standards by integrating accessibility into design systems, component libraries, and governance processes. The result is UX that is inclusive, resilient, and future-ready.

4. UX Integrated Across the Full Digital Ecosystem

UX in 2026 extends far beyond the website. Users interact with brands across portals, applications, dashboards, marketing platforms, and internal tools—and they expect consistency across all of them.

UX design agencies are responding by designing cohesive experience ecosystems. This includes shared interaction patterns, unified design systems, and consistent language across touchpoints.

By aligning UX across marketing, product, and service environments, agencies help organizations reduce friction, strengthen brand trust, and scale experiences more efficiently. UX success is no longer about isolated wins; it is about system-wide cohesion.

5. Data-Informed UX Design and Continuous Optimization

The most effective UX design agencies in 2026 treat UX as a living system. Design decisions are guided by both qualitative insight and quantitative data, enabling teams to validate assumptions and iterate continuously.

User testing, behavioral analytics, and performance metrics inform ongoing refinement. Rather than launching and moving on, agencies help organizations optimize experiences over time as user needs evolve.

This data-informed approach ensures UX remains aligned with business goals while delivering consistent value to users. Optimization is not a phase—it is a mindset.

What This Means When Choosing a UX Design Agency

For organizations evaluating a UX design agency, these trends highlight an important reality: UX success depends on more than visual design expertise. The right agency brings strategic thinking, research rigor, and the ability to scale UX across platforms and teams.

In 2026, a strong UX partner understands how to connect user needs with measurable outcomes. They help organizations design experiences that are intuitive, inclusive, and built to adapt as technology and expectations continue to change.

Partner With a UX Design Agency Built for What’s Next

Bluetext partners with organizations to design UX strategies that drive clarity, engagement, and performance across complex digital ecosystems. Our approach combines research, strategy, and design to create experiences that work for users and the businesses behind them.

If you are looking to future-proof your digital experience strategy, connect with Bluetext to discuss how a UX design agency can support your goals in 2026 and beyond.

Marketing to government agencies is fundamentally different from marketing to commercial buyers. While traditional B2B marketing often emphasizes speed, differentiation, and innovation, B2G Marketing must balance those priorities with compliance, accountability, and risk mitigation. Government buyers are not looking to be impressed; they are looking to be confident.

Winning government contracts requires more than responding to RFPs. It demands a long-term marketing strategy that builds credibility, supports business development, and positions your organization as a trusted partner well before procurement begins. Below are the core B2G Marketing strategies that successful contractors use to stand out and win in an increasingly competitive public sector environment.

Why B2G Marketing Is Not the Same as B2B

At a surface level, B2G Marketing may resemble B2B marketing. In practice, the differences are substantial.

Government purchasing decisions are shaped by formal procurement rules, multiple stakeholders, and long evaluation timelines. Decisions are rarely made by a single buyer and often involve technical evaluators, contracting officers, program leaders, and legal reviewers. Each audience brings a different set of priorities and constraints.

Effective B2G Marketing recognizes these realities. It prioritizes clarity over cleverness, credibility over hype, and consistency over short-term tactics. Organizations that apply consumer or commercial B2B playbooks without adaptation often struggle to gain traction in the public sector.

Understanding the Government Buyer and Procurement Environment

Successful B2G Marketing begins with understanding how government agencies buy.

Federal, state, and local agencies operate within structured procurement frameworks designed to ensure fairness, transparency, and accountability. While processes vary by agency and contract type, they share common characteristics: defined requirements, documented evaluation criteria, and an emphasis on past performance.

Marketing in this environment is not about bypassing procurement rules. It is about supporting them. Strong B2G Marketing helps government buyers understand your capabilities, assess your relevance, and feel confident in your ability to deliver before they ever see a proposal.

Building a Credible and Compliant B2G Brand

In B2G Marketing, brand is less about personality and more about trust.

Government buyers are risk-averse by design. They want to work with organizations that appear stable, experienced, and reliable. Your brand should reinforce those qualities across every touchpoint, from your website to your proposals to your digital campaigns.

This does not mean your brand must be generic. It does mean it should be clear, professional, and aligned with public sector expectations. Consistency, accuracy, and compliance matter far more than novelty. A credible brand reduces perceived risk and supports evaluation decisions, even when technical scores are close.

Messaging That Aligns With Mission, Outcomes, and Accountability

One of the most common B2G Marketing mistakes is reusing commercial messaging without adaptation.

Government agencies are mission-driven. They care about outcomes, efficiency, and public accountability. Effective B2G messaging speaks to those priorities directly, translating your offerings into tangible benefits such as improved service delivery, cost savings, security, or operational resilience.

Rather than leading with features or innovation, strong B2G Marketing emphasizes impact. It shows how your solution supports the agency’s mission, mitigates risk, and delivers measurable value. Clear, direct language consistently outperforms aspirational or sales-heavy positioning in government contexts.

Digital Presence and Content Strategy for Government Buyers

Government buyers conduct significant research long before an RFP is released. Your digital presence often shapes first impressions well in advance of formal engagement.

A strong B2G Marketing website should clearly articulate who you serve, what you do, and where you have succeeded. Case studies, capabilities overviews, and thought leadership help validate experience and expertise. Content should be easy to navigate, accessible, and written for non-marketing audiences.

Thoughtful content strategy supports pre-RFP influence by educating buyers, reinforcing credibility, and aligning your organization with the challenges agencies are trying to solve. In many cases, marketing content becomes a silent partner in the evaluation process.

Integrated Campaigns That Support the Full Contract Lifecycle

B2G Marketing is most effective when it is aligned with business development and capture efforts.

Rather than focusing solely on lead generation, integrated B2G campaigns support awareness, education, and validation throughout the contract lifecycle. Marketing can reinforce capture messaging, support proposal themes, and provide air cover for BD teams engaging with agencies.

This integrated approach ensures that marketing investments directly contribute to pipeline quality and win rates. When marketing and capture operate in silos, opportunities are missed. When they work together, marketing becomes a competitive advantage.

Data, Insights, and Targeting in a Restricted Environment

Targeting government audiences presents unique challenges. Many traditional digital targeting methods are limited or unavailable due to privacy, security, and platform constraints.

Effective B2G Marketing relies on a combination of account-based strategies, intent data, partnerships, and contextual targeting. Success is less about volume and more about precision. Understanding which agencies, programs, and stakeholders matter most allows marketing efforts to be focused and efficient.

Measurement also looks different in B2G. Long sales cycles require patience and a broader definition of success, including engagement, awareness, and support for active pursuits.

Common B2G Marketing Pitfalls to Avoid

Organizations entering B2G Marketing often make the same avoidable mistakes.

Some rely too heavily on proposals and underinvest in brand and digital foundations. Others use overly commercial messaging that does not resonate with government audiences. Many underestimate the time and consistency required to build credibility in the public sector.

Avoiding these pitfalls requires a deliberate, long-term approach. B2G Marketing is not a campaign. It is a sustained effort to build trust, relevance, and recognition over time.

Turning B2G Marketing Into a Competitive Advantage

Winning government contracts requires more than technical expertise. It requires a marketing strategy that supports how government agencies evaluate, select, and partner with vendors.

When executed well, B2G Marketing strengthens brand credibility, supports business development, and improves win rates across the pipeline. It positions your organization not just as a qualified bidder, but as a trusted partner.

Bluetext works with organizations across the public sector to develop B2G Marketing strategies that balance compliance with clarity and credibility with differentiation. If you are evaluating your current approach to government marketing, a strategic assessment is often the best place to start.

Interested in strengthening your B2G Marketing strategy? Contact Bluetext to continue the conversation.

WordPress powers more than 40% of the web, but not all WordPress websites are created equal. The difference between a site that simply looks good and one that actively drives growth often comes down to who built it. A top-tier WordPress Development Agency does far more than install themes and configure plugins. It brings strategic thinking, technical rigor, and long-term partnership to the table.

As organizations rely more heavily on their websites to support marketing, sales, and customer experience, choosing the right WordPress Development Agency has become a critical business decision. Below are the key features that separate the best agencies from the rest and what you should expect when working with a true WordPress partner.

Strategic Discovery and Business-Driven Development

A strong WordPress Development Agency does not begin with design comps or code. It begins with discovery.

This phase focuses on understanding your business objectives, audience needs, internal workflows, and technical constraints. The agency should ask pointed questions about growth goals, content strategy, integrations, analytics, and long-term scalability. The outcome is a clear technical and architectural roadmap, not just a project plan.

When development is driven by strategy, WordPress becomes a flexible platform that supports measurable outcomes rather than a static marketing asset.

Custom WordPress Development Built for Scale

One of the clearest indicators of a high-quality WordPress Development Agency is its approach to customization. Rather than relying heavily on prebuilt themes or bloated page builders, top agencies favor custom WordPress development tailored to your specific needs.

This typically includes:

- Custom blocks or components using modern WordPress frameworks

- Flexible content models that empower marketing teams

- Clean, maintainable code designed for long-term use

Custom development ensures your website can evolve as your organization grows, without requiring constant rework or workarounds. It also reduces reliance on third-party dependencies that can create performance and security issues over time.

Responsive Design with Performance in Mind

Responsive design is no longer a differentiator; it is a baseline requirement. What separates a strong WordPress Development Agency is how deeply performance is integrated into the design and build process.

Top agencies take a mobile-first approach and design with real-world usage in mind. They account for load times, image optimization, and layout shifts long before launch. Performance metrics such as Core Web Vitals are treated as design and development considerations, not post-launch fixes.

The result is a website that feels fast, intuitive, and polished across devices, supporting both user experience and search visibility.

Thoughtful Plugin Strategy and System Integrations

Plugins are one of WordPress’s greatest strengths, but also one of its biggest risks when misused. A capable WordPress Development Agency applies a disciplined plugin strategy rather than defaulting to whatever is fastest to install.

This means:

- Evaluating plugins for security, performance, and long-term support

- Avoiding overlapping functionality and unnecessary dependencies

- Building custom functionality when plugins introduce risk or complexity

In addition, leading agencies are experienced in integrating WordPress with enterprise systems such as CRMs, marketing automation platforms, analytics tools, and digital asset managers. These integrations are handled deliberately, ensuring data flows cleanly and reliably across systems.

Security, Compliance, and Ongoing Stability

Security is a non-negotiable feature of modern WordPress development. A professional WordPress Development Agency builds security into every layer of the site, from code standards to hosting recommendations.

This includes secure authentication, role-based permissions, regular updates, monitoring, and backup strategies. For organizations in regulated or high-risk environments, agencies should also be comfortable addressing compliance considerations and internal governance requirements.

A secure WordPress site is not achieved through a single plugin. It is the result of sound engineering, proactive maintenance, and clear operational processes.

SEO-Ready Architecture and Editorial Flexibility

Search visibility starts with how a website is built. A knowledgeable WordPress Development Agency understands that SEO is both a technical and structural discipline.

Best practices include clean URL structures, logical content hierarchies, schema markup, and fast page performance. Just as important is editorial flexibility. Marketing teams should be able to create, update, and optimize content without relying on developers for every change.

When WordPress is architected correctly, it becomes a powerful platform for content marketing, SEO, and ongoing optimization rather than a bottleneck.

Rigorous Quality Assurance and Launch Processes

Before launch, a top WordPress Development Agency invests significant effort in testing and validation. This goes well beyond basic browser checks.

Quality assurance should include:

- Cross-browser and cross-device testing

- Accessibility and usability validation

- Performance benchmarking

- Content and data integrity checks

Launch itself should follow a structured deployment process designed to minimize downtime and risk. Agencies that treat launch casually often introduce issues that could have been avoided with proper planning.

Post-Launch Support and Long-Term Partnership

A reliable WordPress Development Agency understands that launch is the beginning of a relationship, not the end of a project. Ongoing support is critical to maintaining performance, security, and relevance over time.

Post-launch services often include maintenance, enhancements, analytics reviews, and optimization roadmaps. Rather than reacting to issues, the best agencies work proactively to identify opportunities for improvement and growth.

This long-term mindset is what transforms WordPress from a one-time build into a strategic digital platform.

Choosing the Right WordPress Development Agency

Selecting a WordPress Development Agency is ultimately about trust, experience, and alignment. The right partner brings technical excellence, strategic thinking, and a clear understanding of how websites support broader business goals.

At Bluetext, WordPress development is approached as part of a larger digital ecosystem, where design, technology, and strategy work together to drive results. If you are evaluating your current WordPress site or planning a new build, a strategic assessment is often the best place to start.

Interested in exploring what a stronger WordPress foundation could look like for your organization? Contact Bluetext to start the conversation.