Why getting B2G branding right in today’s contracting climate may dictate success or failure for years to come.

The beat of federal marketers has been a tad arrhythmic the past few months, as we seek to digest dramatic shifts in agency budgets, procurement and contracting, as well as reduced manpower. The old adage “nobody ever gets fired for buying IBM” has evolved in the current contracting climate to “explain why you bought IBM in the first place.”

And while the public face of DOGE may be moving on, its mandate endures through the Trump administration FYI 2026 budget proposal – which calls for expanding DOGE staffing by roughly two-thirds and more than doubling its budget. There are also few signs that hyper analysis of contracts with top revenue industry partners will ease. After targeting the top 10 consulting firms for contract cuts, GSA is now requesting justifications for services and pricing structures from 10 leading tech Value Added Resellers (VARs). Already this year, more than 11,000 contracts across 60 agencies have been nixed, totaling $33 billion.

All of these narratives were swirling on June 6th at FedPulse 2025: Turning Brand & Market Data into Competitive Advantage.

FedPulse is GovExec’s new brand and market intelligence platform designed to empower public sector marketers, business development, and sales leaders with real-time data and insights to drive smarter strategies and win market share.

Through a series of panels, CXOs, public sector unit leads and marketing executives from Intel, Dell, Carahsoft, SolarWinds, and GDIT discussed this tectonic shift in workforce dynamics – driven by an unprecedented shift in the public sector / administration “decision maker class” when it comes to contracting, procurement, and go-to-market strategies. The discussions were buoyed by new FedPulse data on Fed IT brand perception and what B2G marketing strategies resonate with agency customers AD (After DOGE) vs. BD (Before DOGE).

Props to GovExec for structuring one of the more insightful government marketing events I’ve attended when it comes to valuable market intelligence and panelists who were not just dispensing cookie-cutter insights and commentary, but instead offering blunt assessments on what it will take to succeed in the current environment.

Below are some data-driven takeaways from the event that public sector marketers and executives can consider as they navigate the contract landscape in 2025:

1. B2G Brands Must Re-Introduce Themselves To Decision Makers

FedPulse data shared by GovExec at the event affirms what government marketers already knew to be anecdotally true: Significant turnover amongst agency decision makers to those with fewer years of public sector experience and exposure to B2G brands. 44% of those surveyed have 10 years of experience or less as a government employee, down from 34% last year. This helps explain a four percentage point drop in those surveyed being “very familiar” with some of the top B2G brands included in FedPulse.

What does this mean for government marketers? As panelist Oliver Nutt, Vice President, Marketing and External Communications (U.S.) at GDIT shared, it becomes critical to re-introduce your brand to these new decision makers. They may know the name, but not fully grasp what you do and what you enable. Agencies are under massive pressure and they need to be able to communicate outcomes delivered, not just services you provide.

This is particularly urgent for these top consulting and services providers whose contracts are now under the microscope. Firms are being bucketed into general categories, and saying you do everything may not be the best path to preserve existing contracts and win new ones. Prioritization and differentiation must be communicated through clear branding, messaging, go-to-market and PR strategies.

Some prioritization opportunities are already emerging. During his 1×1 interview at the event, Craig Abod, President and Founder, Carahsoft, spoke of a “re-invigorated CMMC,” as DoD elevates security requirements for contractors and subcontractors – requirements such as CMMC compliance that may find their way into more contracts sooner rather than later.

2. Brands Must Re-Think How They Educate

Every B2G brand is now fully aware that decisions are being heavily driven by your ability to deliver operational efficiencies and cost reduction. These are now longer differentiator messages, but table stakes.

Abod outlined the stakes in even starker terms: Decision makers need to understand what would happen if the agency didn’t use your product or service. It’s not just re-introducing the brand, but you need to re-sell every deal. Because the question being asked isn’t “why should we buy your product/service” but “why did the agency buy it in the first place.”

How B2G brands must educate has changed. As referenced, agencies are buying outcomes so that impacts market messaging. Nutt added in later panel comments that it may not resonate to brand yourself as “the AI company” or “the digital transformation company.” If you are talking about digital transformation, connect it to specific use cases such as logistics to justify why these technologies matter.

For marketers, content assets such as case studies to show a track record of outcomes remain highly relevant, but it’s not an AI case study, or DT case study. The storytelling has to be outcome based with supporting data and compelling visuals.

The bottom line, as panelist Greg Clifton, General Manager – Defense & National Security Group, Intel added, is that you can’t assume agency decision makers know what you do. Educate yes, but there is a need to re-invent how you talk to customers. We make chips, great, but what emerging applications does this enable?

3. Non-Traditional Events & Networking Will Drive Deals

Relying exclusively on traditional marketing and branding channels will not get it done. This reality is a byproduct of where the new class of decision makers is consuming information and building relationships. Agency and industry events still hold value, but at the event GovExec CEO Tim Hartman discusses the fact that this is a relationship-driven Administration. B2G brands will need to engage in more advocacy and political events, and across all channels communicate how your solutions enable the agency – and political – mission.

4. Industry Collaboration

We spoke of a new contingent of agency decision makers; they are younger and many hail from silicon valley. Their worldview on technology development, adoption and implementation is driving a changing acquisition strategy. They don’t just want to acquire products and innovate piecemeal. More holistically, they want to build new technology stacks.

The Administration / DOGE message to vendors and contractors is clear, as Clifton detailed in his panel: You own a piece of our IT environment, but it is not in our best interests to try and go vendor by vendor in a siloed fashion. Instead, get together with other relevant vendors up and down the stack and give us an integrated strategy.

5. Your B2G Brand Must Stand Out, Not Fit In

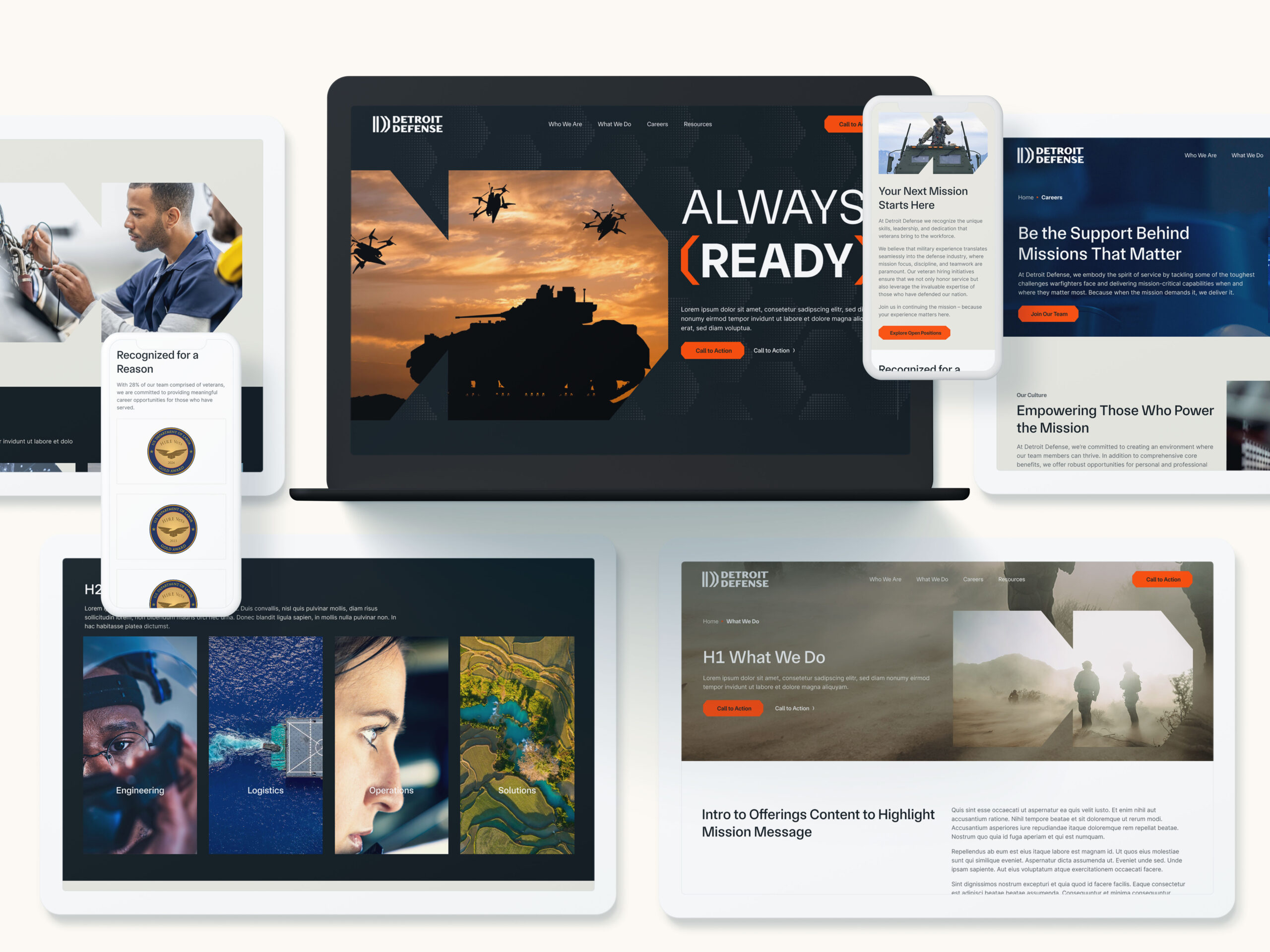

A core Bluetext sweet spot is empowering government contractors and IT providers to re-shape an existing brand or re-brand to target government stakeholders and investors (PE firms, etc.). Whether that need is fueled by an acquisition, merger or pre-IPO planning, brand storytelling that pops raises enterprise value.

It’s why 82 of our clients have been acquired in the 24 months following a Bluetext engagement (see all the acquisitions here). We know how to build enterprise value across the B2G marketing stack – from branding, logo design, messaging & positioning, website design & development and naming to public relations, thought leadership, SEO, paid campaigns and social media.

One recent project involved Ricardo Defense, which needed to transition into a fully U.S.-owned company and reintroduce itself to government and commercial partners. It turned to Bluetext to lead a comprehensive rebranding effort. The result: Detroit Defense—a new name and identity that reflects the company’s proud roots in Michigan’s defense innovation corridor and its strategic focus on U.S. national security.

At the FedPulse event, GovExec CEO Tim Hartman underscored how critical 2025 will be for B2G marketers, suggesting the next several months may well determine your public sector business trajectory for the next several years. You have to get it right. Click here to find out why Bluetext is the right B2G marketing partner to meet this moment, or contact us today to start the conversation.